Ignoring tax and the time-value of money between days 1 and 20, and assuming the details given are the only factors having an impact on the share prices of Company Y and Z, determine the day 2, day 4, and day 12 share prices of Company P and Company Q if the market is: 1. Semi-Strong Efficient. 2. Strong Form Efficient.

Ignoring tax and the time-value of money between days 1 and 20, and assuming the details given are the only factors having an impact on the share prices of Company Y and Z, determine the day 2, day 4, and day 12 share prices of Company P and Company Q if the market is: 1. Semi-Strong Efficient. 2. Strong Form Efficient.

Chapter20: Financing With Derivatives

Section: Chapter Questions

Problem 12P

Related questions

Question

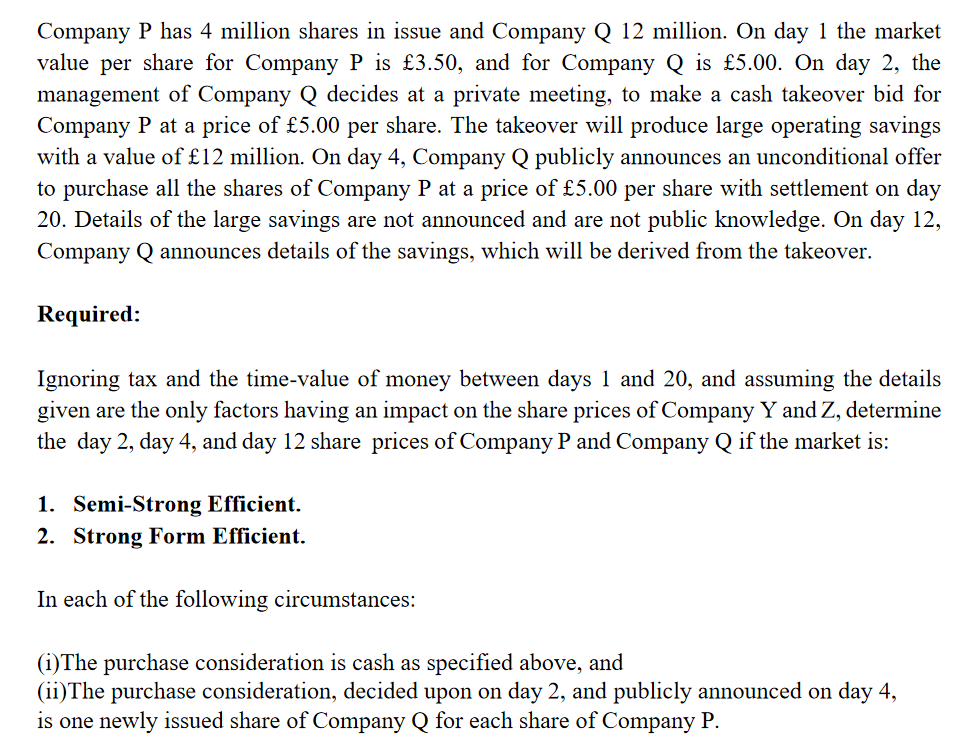

Transcribed Image Text:Company P has 4 million shares in issue and Company Q 12 million. On day 1 the market

value per share for Company P is £3.50, and for Company Q is £5.00. On day 2, the

management of Company Q decides at a private meeting, to make a cash takeover bid for

Company P at a price of £5.00 per share. The takeover will produce large operating savings

with a value of £12 million. On day 4, Company Q publicly announces an unconditional offer

to purchase all the shares of Company P at a price of £5.00 per share with settlement on day

20. Details of the large savings are not announced and are not public knowledge. On day 12,

Company Q announces details of the savings, which will be derived from the takeover.

Required:

Ignoring tax and the time-value of money between days 1 and 20, and assuming the details

given are the only factors having an impact on the share prices of Company Y and Z, determine

the day 2, day 4, and day 12 share prices of Company P and Company Q if the market is:

1. Semi-Strong Efficient.

2. Strong Form Efficient.

In each of the following circumstances:

(i) The purchase consideration is cash as specified above, and

(ii) The purchase consideration, decided upon on day 2, and publicly announced on day 4,

is one newly issued share of Company Q for each share of Company P.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning