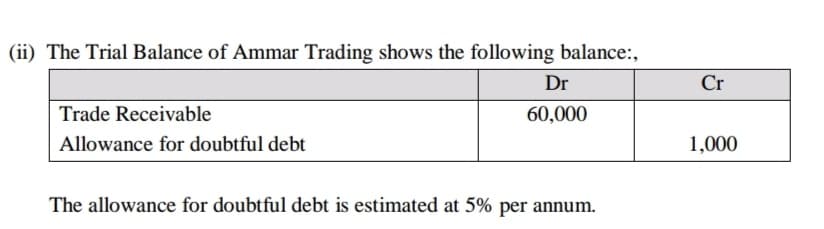

(ii) The Trial Balance of Ammar Trading shows the following balance:, Dr Cr Trade Receivable 60,000 Allowance for doubtful debt 1,000 The allowance for doubtful debt is estimated at 5% per annum.

Q: ARG Inc. has an overdraft limit of $3.2 million and pays interest on its overdraft at a rate of 6…

A: Times interest earned ratio is a solvency ratio that evaluates a company’s ability to repay its…

Q: PLKO Co. factored P160,000 accounts receivable to NCD Financing Corp on a with recourse basis on…

A: Factoring is the facility wherein the company sells its account receivable to third party called…

Q: Lucas Co. provides for bad debt expense at the rate of 1% of sales on account. The allowance for…

A: Bad debt expenses are those expenses which cannot be collectible from the debtor. Allowance for…

Q: utomotive Excellence Inc. borrowed $16,000.00 on May 11 with an interest raté of 8.7% per annum. On…

A: We need to compute loan balance as on October 6.

Q: A company had the following accounts and balances on December 31, 2020: Accounts Receivable $ 6,000…

A: Current Liabilities of a company consist of Short - term financial obligations that are due…

Q: Brothers Corporation borrows P70,000.00, annual interest rate of 19% is deducted in advance. What is…

A: Gross borrowing = P 70,000 Interest advance deduction = 19%

Q: 1. In December 2027. Taguan Bank reported a net income of P900,000, net of trading loss of P50,000.…

A: You have asked three questions under a single answerable question kindly resubmit remaining two…

Q: 1. Agogo Trading has the following account balances as at 30 June 2019. RM Account Receivable…

A: Bad debts means when the chances of recovery of account receivable is NIL and account receivable has…

Q: terprise ABC has contracted a credit for the amount of 300 000 zlotys. The credit is to be 5 equal…

A: In this we need to calculate the effective cost of credit.

Q: The debt is amortized by the periodic payment shown Compute (a) the number of payments required to…

A: A loan is an agreement where one party receives an amount in exchange for paying it back later in…

Q: Abc Investment Ltd., plans to borrow Ghc100,000 for a 90 day period from Lloyds Finance Company. Abc…

A: Given The amount borrowed is Ghc 100,000. The interest for 90 days is Ghc 5,000

Q: 1. Agogo Trading has the following account balances as at 30 June(2019. RM Account Receivable…

A: The following computations are done for Agogo Trading to assess the balance of provision for…

Q: Pogo Stick Co can issue debt yielding 10 percent. The company is paying at a 40 percent tax rate.…

A: A company pays interest cost when it issues debt. The cost of debt is measured by the YTM of the…

Q: The debt is amortized by the periodic payment shown. Compute (a) the number of payments required to…

A: A type of loan in which the borrower has to make a schedule for the periodic payment regarding both…

Q: 1. Agogo Trading has the following account balances as at 30 June 2019. RM Account Receivable…

A: Journal Entries are primary record maintained by an entity for the occurrence or non-occurrence of…

Q: A debt of P3,500 is to be amortized by 6 equal semiannual payments with interest at 6%compounded…

A: Debt amount (D) = P 3500 n = 6 payments r = 6% per annum = 3% semiannually Let the periodic payment…

Q: Ameera Enterprise had a balance on its allowance for doubtful debts of RM26,250 as at 31 December…

A: Opening Balance for doubtful debts= RM 26,250 Closing Balance for doubtful debts =RM 550,000×5%…

Q: Omega Chemicals Ltd. took a $440,000 two-year note receivable from a customer in connection with a…

A: Price of the bond = c × F × (1 − (1 + r)-t)/r+F(1 + r)t C=Interest Rate F= Face Value r=Market…

Q: Bank CO approved a loan application of Client ME on January 1, 20A for P3,500,000. Client ME is…

A: Direct origination costs are initially added to the carrying amount of the loan and are subsequently…

Q: Don Ltd bought a $100 000 commercial bill in the secondary market with 100 days to maturity. It was…

A: A commercial bill is an unsecured debt issued by a corporation. The question says that, The value of…

Q: The trial balance of Beta Limited as at 31st December, 2019 is as follows: Debit Credit GH¢…

A: Given: The Beta limited based on 31st December, 2019 that includes the trial balance sheet as…

Q: The trial balance of Beta Limited as at 31st December, 2019 is as follows: Debit Credit GH¢…

A: Statement of profit and loss and other comprehensive income is as follows: Result:

Q: If the company accepted a Notes Receivable on Oct 1, X1 for $60,000 at 8%, due in one year, what is…

A: Maturity value is the total amount including the interest on the Notes Receivable till it's maturity…

Q: 1. Bank CO approved a loan application of Client ME on January 1, 20A for P3,500,000. Client ME is…

A: Operating income (EBIT) is another word for income from operations (IFO). The profit created by a…

Q: Please do not use excel format in computation A debt of P25,000 was repaid in ten equal quarterly…

A: Debt is the value which is borrowed from other sources like banks for the period and this amount is…

Q: The Sample Company discounts a $100,000 note receivable on 15 Máy 20x2. The following facts are…

A: Maturity value can be calculated as sum of principal and interest. Further, the discount amount can…

Q: (a) UniText started a business buying and selling tertiary textbook on 1 January 2018. At the end of…

A: This question deals with the preparation for allowance for bad debt account, bad debt account, and…

Q: On October 1, Dalton Corp. borrows $100,000 fromNational Bank, signing a six-month note payable for…

A: Interest amount: Interest charged on the borrowed principal amount. Interest is charged…

Q: The debt is amortized by the periodic payment shown. Compute (a) the number of payments required to…

A: Loan Amortization: The process of amortizing a fixed-rate loan into equal installments is known as…

Q: Ameera Enterprise had a balance on its allowance for doubtful debts of RM26,250 as at 31 December…

A: Estimated allowance for doubtful debts = Net Accounts Receivable x Estimated uncollectible % =…

Q: Agogo Trading has the following account balances as at 30 June 2019. RM Account Receivable 200,000…

A: Provision for doubtful debts account is maintained so as to write off the bad debts that occurs in…

Q: The debt is amortized by the periodic payment shown. Compute (a) the number of payments required to…

A: According to the time value of money concept, an amount of money has two different purchasing power…

Q: Lang Warehouses borrowed $157,000 from a bank and signed a note requiring 2 annual payments of…

A: The question is based on the concept of Financial Accounting. Annuity refers to the series of equal…

Q: A debt of 4,400 with interest at 2.5% payable semi-annualy or .0125, will be discharged by payments…

A: Given information: Amount of debt : 4,400 Interest rate : 1.25% Periods : 7 Payments : 600

Q: a. Abc Investment Ltd., plans to borrow Ghc100,000 for a 90-day period from Lloyds Finance Company.…

A: Answer a: Information Provided: Amount borrowed = 100,000 Interest = 5,000 Days = 90

Q: The debt is amortized by the periodic payment shown. Compute (a) the number of payments required to…

A: The term debt represents a loan amount borrowed by someone at a financial interest rate from another…

Q: Pearl has trade receivables at the year-end amounting to RM150,000. An irecoverable debt of RM3,500…

A: Solution: balance of allowance account at year end is computed by multiplying the ending trade…

2) Outline the extracts of Trade Receivable at

Step by step

Solved in 2 steps with 2 images

- 3. The following balances have been taken from the unadjusted trial balance of a tradingorganization for the year ended Dec. 31, 2020:Sales (All on credit) Rs. 650,000Sales Return and Allowance (All from credit sales) 20,000Sales Discount 10,000Accounts Receivable 430,000Allowance for bad debt (Cr.) 2000Required:Record and close bad debt expense for the year ended Dec. 31, 2020 under each of the followingassumptions separately:a. Allowance for bad debt was estimated @ 10% of accounts receivable.b. Bad debt expense was estimated @ 1.5% of net credit sales.Ameera Enterprise had a balance on its allowance for doubtful debts of RM26,250 as at 31 December 2019. Allowance for doubtful debts was estimated at 5% on account receivable. On 31 December 2020, the balance of its net accounts receivable was RM550,000. Calculate the amount of doubtful debts to be shown in the statement of profit or loss for the year ending 31 December 2020 A.RM25,000 B.RM1,250 C.RM2,500 D.RM27,5001. Agogo Trading has the following account balances as at 30 June 2019.RMAccount Receivable 200,000Provision for doubtful debt 6,000On 30 June 2019, the following adjustment have to be made:i. Debts of RM500 are to be written off as badii. One of the entities with accounts receivable whose debts had previously been written off as bad sent a cheque for RM1,000 in full settlement of the amount owed iii. Provision for doubtful debts is 2% of the outstanding accounts receivables Required:For the year ending 30 June 2019 show the:a) Provision for doubtful debts accountb) Statement of Profit or Loss (extract)c) Statement of Financial Position (extract) 2. The following is a summary of account receivable and related accounts for threeyears for Tommy Enterprise the financial year ends 30 April each year.Year ended 30 AprilAccount receivable as at 30 April (before writing off bad debts)RMBad debts written offRMProvision for doubtful debt2017 70,000 Nil 2%2018 61,000 1,000 2%2019 83,000…

- D borrowed from XYZ Bank P2,000,000.00 payableat the end of 5 years. Before maturity, anextraordinary deflation supervened causing the valueof the debt to rise to P5,000,000.00 on the date ofmaturity. On due date, B must pay XYZ Bank:a. P2,000,000.00b. P5,000,000.00c. P800,000.00d. P20,000,000.0037-a At the end of the operating period, a rediscount of 7.500 TL has been calculated for the debt securities. Accordingly, which of the following accounts is correct to use in the posting to be made at the end of the period ? a) 321 Debt Securities Hs. Credited 7.500 TL B) 647 Rediscount Interest Income Hs. Creditor 7.500 TL NS) 657 Rediscount Interest Expenses Hs. Borrower 7.500 TL D) 647 Rediscount Interest Income Hs. Borrower 7.500 TL TO) 321 Debt Securities Hs. Borrower 7.500 TLThe allowance for doubtful debts account has a debit balance at the start of the year of $1,000. At the end of the year, debts of $770 inclusive GST are written off and the allowance for doubtful debts is to be adjusted for 5% of the net credit sales of $60,000 exclusive GST. The new amount of the allowance for doubtful debts that is deducted from accounts receivable in the balance sheet is $__________. Group

- Tines Commerce computes bad debt based on the allowance method. They determine their current years balance estimation to be a credit of $45,000. The previous period had a credit balance in Allowance for Doubtful Accounts of $12,000. What should be the reported figure in the adjusting entry for the current period? A. $12,000 B. $45,000 C. $33,000 D. $57,000Balloons Plus computes bad debt based on the allowance method. They determine their current years balance estimation to be a credit of $84,000. The previous period had a credit balance in Allowance for Doubtful Accounts of $26,000. What should be the reported figure in the adjusting entry for the current period? A. $84,000 B. $58,000 C. $26,000 D. $110,000Jars Plus recorded $861,430 in credit sales for the year and $488,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.6% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method.