ii. operue Land in Spain (with P1M unpaid mortgage) P2,000,000; Land in Batangas, Philippines 500,000; Franchise in Switzerland 100,000; Receivable from debtor in Philippines 70,000; Receivable from debtor in Switzerland 100,000; Bank deposits in Switzerland 80,000; Shares of stocks of ABS-CBN (listed), Philippines 75,000; Shares of stocks of RPH, foreign corporation 80% of the business in the Philippines 125,000; Other personal properties 300,000; Zonal value of the land in Batangas 750,000. i. If the decedent is a non-resident citizen, his gross estate is iv. ut estate tax matters. If the decedent is a non-resident alien without reciprocity, his gross estate is If the decedent is a non-resident alien with reciprocity, his gross estate is Assuming the ABS-CBN shares are not listed, and there are 1,000 shares at the time of death, ABC-CBN's outstanding shares were 10,000 shares. Its retained earnings were P2,000,000, par value per share was P50. The gross estate should show the said shares at

ii. operue Land in Spain (with P1M unpaid mortgage) P2,000,000; Land in Batangas, Philippines 500,000; Franchise in Switzerland 100,000; Receivable from debtor in Philippines 70,000; Receivable from debtor in Switzerland 100,000; Bank deposits in Switzerland 80,000; Shares of stocks of ABS-CBN (listed), Philippines 75,000; Shares of stocks of RPH, foreign corporation 80% of the business in the Philippines 125,000; Other personal properties 300,000; Zonal value of the land in Batangas 750,000. i. If the decedent is a non-resident citizen, his gross estate is iv. ut estate tax matters. If the decedent is a non-resident alien without reciprocity, his gross estate is If the decedent is a non-resident alien with reciprocity, his gross estate is Assuming the ABS-CBN shares are not listed, and there are 1,000 shares at the time of death, ABC-CBN's outstanding shares were 10,000 shares. Its retained earnings were P2,000,000, par value per share was P50. The gross estate should show the said shares at

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 30P

Related questions

Question

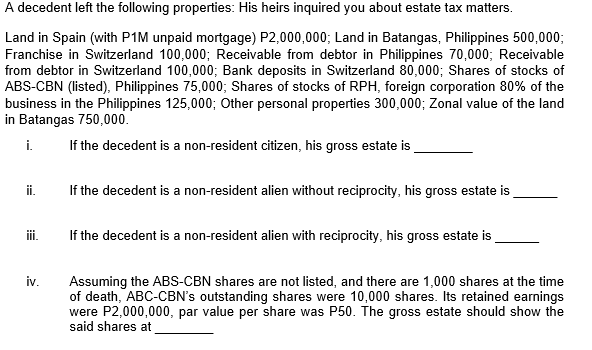

Transcribed Image Text:A decedent left the following properties: His heirs inquired you about estate tax matters.

Land in Spain (with P1M unpaid mortgage) P2,000,000; Land in Batangas, Philippines 500,000;

Franchise in Switzerland 100,000; Receivable from debtor in Philippines 70,000; Receivable

from debtor in Switzerland 100,000; Bank deposits in Switzerland 80,000; Shares of stocks of

ABS-CBN (listed), Philippines 75,000; Shares of stocks of RPH, foreign corporation 80% of the

business in the Philippines 125,000; Other personal properties 300,000; Zonal value of the land

in Batangas 750,000.

i.

If the decedent is a non-resident citizen, his gross estate is

i.

If the decedent is a non-resident alien without reciprocity, his gross estate is

ii.

If the decedent is a non-resident alien with reciprocity, his gross estate is

iv.

Assuming the ABs-CBN shares are not listed, and there are 1,000 shares at the time

of death, ABC-CBN's outstanding shares were 10,000 shares. Its retained earnings

were P2,000,000, par value per share was P50. The gross estate should show the

said shares at

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you