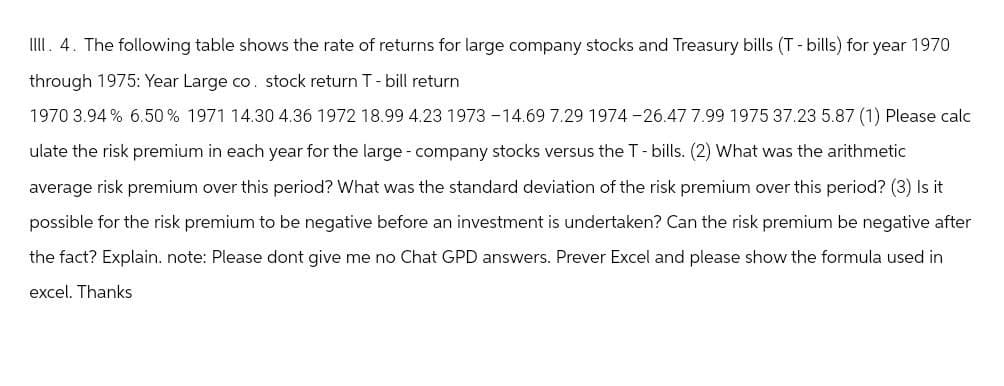

IIII. 4. The following table shows the rate of returns for large company stocks and Treasury bills (T - bills) for year 1970 through 1975: Year Large co. stock return T - bill return 1970 3.94 % 6.50% 1971 14.30 4.36 1972 18.99 4.23 1973 -14.69 7.29 1974-26.47 7.99 1975 37.23 5.87 (1) Please calc ulate the risk premium in each year for the large - company stocks versus the T-bills. (2) What was the arithmetic average risk premium over this period? What was the standard deviation of the risk premium over this period? (3) Is it possible for the risk premium to be negative before an investment is undertaken? Can the risk premium be negative after the fact? Explain. note: Please dont give me no Chat GPD answers. Prever Excel and please show the formula used in excel. Thanks

IIII. 4. The following table shows the rate of returns for large company stocks and Treasury bills (T - bills) for year 1970 through 1975: Year Large co. stock return T - bill return 1970 3.94 % 6.50% 1971 14.30 4.36 1972 18.99 4.23 1973 -14.69 7.29 1974-26.47 7.99 1975 37.23 5.87 (1) Please calc ulate the risk premium in each year for the large - company stocks versus the T-bills. (2) What was the arithmetic average risk premium over this period? What was the standard deviation of the risk premium over this period? (3) Is it possible for the risk premium to be negative before an investment is undertaken? Can the risk premium be negative after the fact? Explain. note: Please dont give me no Chat GPD answers. Prever Excel and please show the formula used in excel. Thanks

Chapter2: The Domestic And International Financial Marketplace

Section: Chapter Questions

Problem 1P

Related questions

Question

Transcribed Image Text:IIII. 4. The following table shows the rate of returns for large company stocks and Treasury bills (T - bills) for year 1970

through 1975: Year Large co. stock return T - bill return

1970 3.94 % 6.50% 1971 14.30 4.36 1972 18.99 4.23 1973 -14.69 7.29 1974-26.47 7.99 1975 37.23 5.87 (1) Please calc

ulate the risk premium in each year for the large - company stocks versus the T-bills. (2) What was the arithmetic

average risk premium over this period? What was the standard deviation of the risk premium over this period? (3) Is it

possible for the risk premium to be negative before an investment is undertaken? Can the risk premium be negative after

the fact? Explain. note: Please dont give me no Chat GPD answers. Prever Excel and please show the formula used in

excel. Thanks

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning