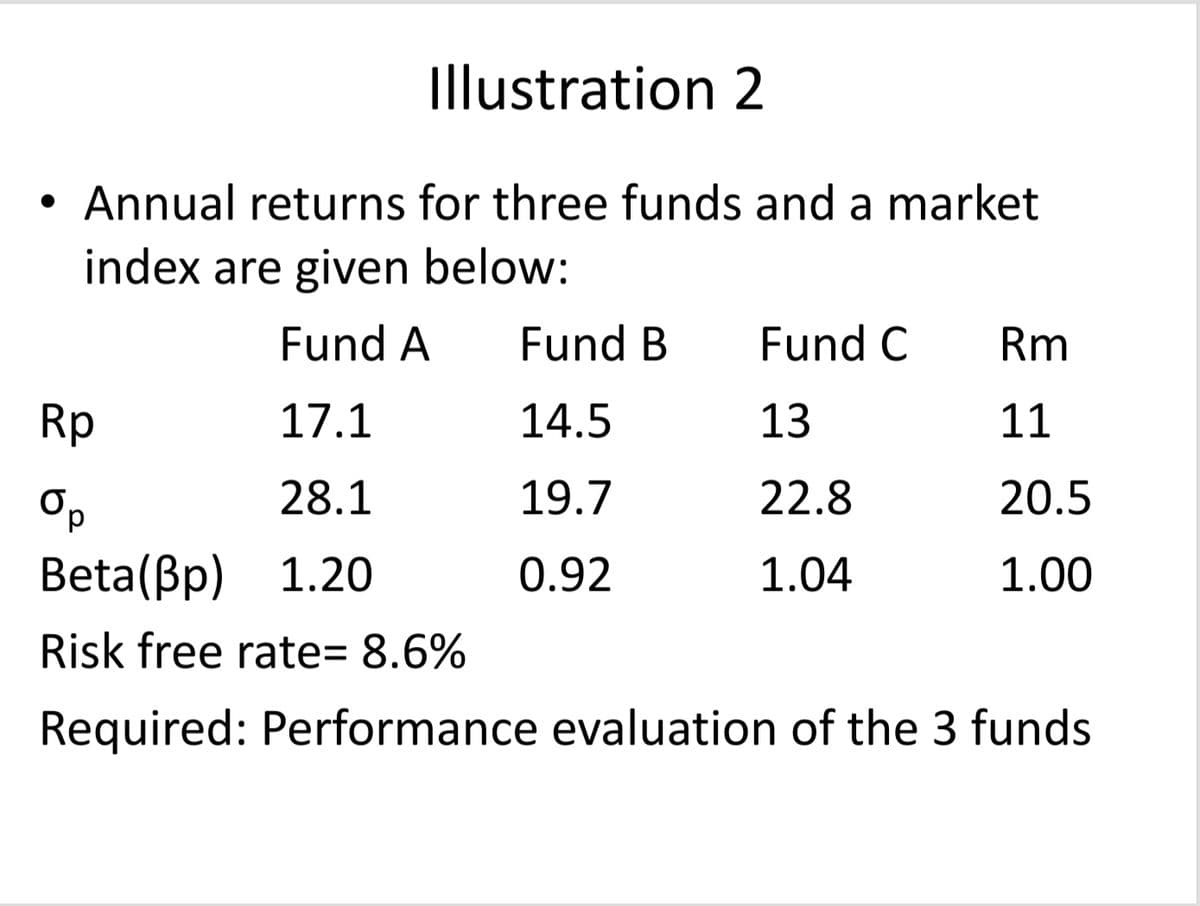

Illustration 2 • Annual returns for three funds and a market index are given below: Rp Op Fund A Fund B 17.1 14.5 28.1 19.7 Beta(Bp) 1.20 0.92 Risk free rate= 8.6% Required: Performance evaluation of the 3 funds Fund C 13 22.8 1.04 Rm 11 20.5 1.00

Q: Consider historical data showing that the average annual rate of return on the S&P 500 portfolio…

A: A portfolio that has been perfectly balanced between risk and return is said to be optimum. The best…

Q: a)Find the nominal rate per annum convertible monthly that pays an interest of £200 on an initial…

A: The effective annual interest rate (EAR) is the interest rate that accounts for the effect of…

Q: 27. Gateway Communications is considering a project with an initial fixed asset cost of $2.46…

A: Net Present Value - It is the difference between the present value of cash outflow and present value…

Q: Kappa Company is fully equity financed and has a cost of capital (WACC) = 11% per annum and is…

A: Here, Project Name Beta Expected return (%) Risk-free rate of return Expected market return WACC…

Q: Warren Corporation will pay a $3.60 per share dividend next year. The company pledges to increase…

A: Dividend discount model with constant growth rate in perpetuity When the growth rate of dividends is…

Q: The common stock of Textile Inc. pays a quarterly dividend of $0.40 a share. The company has…

A: Value of stock is the present value of dividend that are going to be received in the future and…

Q: Next, consider the case of Windsor Flooring Company: The management at Windsor Flooring has…

A: A collection float is when a check is received but has not been reflected in the bank statement. A…

Q: 2.11 Heddy is considering working on a project that will cost her $20 000 today. It will pay her $10…

A: Data given: Cash outflow today=$20000 Cash inflow at the end of each of the next 12 months=$10000…

Q: Kate and her brother Rustin own a piece of property in Dallas as tenants in common valued at…

A: It is a case where the bank has to recover its loan payment from the person who has defaulted. Here…

Q: Currently, the term structure is as follows: One-year bonds yield 9%, two-year bonds yield 10%,…

A: Yield on one-year bond = 9% Yield on two-year bond = 10% Yield on three-year bond = 11% Coupon rate…

Q: DeltaCo has a payout ratio of 0.6 and it reinvests the remainder of earnings in new projects. If…

A: Payout ratio = 0.60 Earnings per share = $7.18 Expected return = 15% Required rate of return = 10.8%

Q: Based on the quarter ended March 2023 financial results on investor.siriusxm.com, as per attached…

A: Introduction: Sirius XM is a leading American broadcasting company. It provides satellite radio and…

Q: bserve a stock price of $18.75. You expect a dividend growth rate of 5%, and the most recent…

A: Required rate of return of the stock is the sum of the capital gains and dividend yield of the…

Q: The following assumptions are made for each Investigation: • The original mortgage is $300,000…

A: Present value is Determined by discounted value of the future cash flows at the present date. Future…

Q: Which would increase a firm’s return on equity? A. Issuance of 12% bonds and investing the proceeds…

A: Return on equity (ROE) is a financial measurement that measures company's profitability by the…

Q: Last year, a stockholder purchased 25 shares of Zycodec at its lowest price of the year. What is the…

A: The investor purchase the share at lower price and sell this year's at higher price in order to…

Q: Barker Company calculated the NPV of a project and found it to be $63,900. The project's life was…

A: The NPV of the Project is $63,900. The estimated life of the project is 8 years. The annual…

Q: ABC stock is currently trading at 100. In the next period, the price will either go up by 10% or…

A: Option delta is the measure of the sensitivity of the option value vis a vis the change in share…

Q: A Company has decided to finance $50 million by issuing 10-year bonds that pay a 10% coupon…

A: Bonds refer to the financial instrument issued by the government against allocating funds for…

Q: tale News Corporation has been growing at a rate of 10% per year, and you expect this growth rate in…

A: With current dividend (D), constant growth rate (g) and discount rate (r), the value is calculated…

Q: A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a…

A: An optimal portfolio refers to a portfolio of investments that offers the highest expected return…

Q: You owe $2,000 on a credit card that charges 20% interest. You have $2,200 in your savings account…

A: The interest earned on the savings account is the cash inflow while the interest paid on credit card…

Q: Which of the following is an example of a capital expenditure? Select all that apply A- New…

A: Capital Expenditure is that expenses which is incurred by the company on long term assets such as…

Q: Which of the following describes delta? The ratio of the option price to the stock price None of…

A: The simplest form of delta hedging entails an investor purchasing or disposing of options, and then…

Q: A 15-year bond with a face value of $1,000 currently sells for $850. Which of the following…

A: A bond's yearly interest rate, calculated as a percentage of the face value and paid from the…

Q: Orange Inc's next two annual dividends be $6.05 and $5.55, with the first occurring exactly one year…

A: To calculate the fair price of Orange Inc. stock, we can use the dividend discount model (DDM). The…

Q: Describe the following assets and categorise them into real or financial assets giving reasons for…

A: The financial assets a type of acids that are held by traders and investors and these assets help…

Q: Based on the chart above, which portfolio is “better” based on Markowitz approach to portfolio…

A: Markowitz theory states that the investors should try to make portfolio which maximizes its return…

Q: A telephone company purchased a microwave radio equipment for P 6M. Freight and installation charges…

A: As per the given information: Microwave radio equipment purchased for - P6MFreight and installation…

Q: What is the alpha of a portfolio with a beta of 2, an actual return of 22%, market- return of 12%,…

A: The risk free rate, market return and beta of a portfolio is given. And, the required return is…

Q: Consider the two mutually exclusive projects described in the table below. (Note: Each part of the…

A: The difference between the current value of cash inflows and outflow of cash over a period of time…

Q: One year from today, Rockwall stock will pay its next dividend of $5.72. After this first dividend,…

A: When the company receives profits and distributes them among the shareholders. That share of profit…

Q: Greg borrows $881,000 to buy a house. His mortgage requireds 22 years of monthly payments, with the…

A: The scenario requires identifying the amount required to be paid after the 36th monthly payment. It…

Q: Jeffersons are considering selling their current residence, buying a small home near Avery’s parents…

A: Mortgage loans are very common when buying homes and these secured loans against home as collateral…

Q: Part 1 Under the current (leveraged) capital structure, how much does Lando receive in dividends…

A: Please note that under the guidelines only up to 3 sub-questions can be answered. Kindly repost the…

Q: We are considering an investment opportunity with the following projected cashflow Year CF Plan A…

A: Net present value refers to the method of capital budgeting used for estimating the difference…

Q: portfolio

A: a) To construct a portfolio that satisfies the first two conditions of Redington’s immunization…

Q: In the context of the Pastor-Stambaugh multifactor model (PSM), the relevant risk factors are the…

A: Risk factors in both the Pastor-Stambaugh and Fama-French models include: Market Risk (MKT): This…

Q: Everjust, Inc., stock has an expected return of 16 percent. The risk-free rate is 3 percent and the…

A: Stock beta is measure the risk which is involved in earning the return from the stock in relation to…

Q: The Rodriguez Company is considering an average-risk investment in a mineral water spring project…

A: Introduction to the NPV Net present value is the capital budgeting techniques for decision making…

Q: The value in pounds of a fund at time t = 0 is V0 = 50, 000. After one year (at t = 1) it has…

A: The time-weighted rate of return is the geometric mean of return for each period.

Q: The price of a European call option on a non-dividend-paying stock with a strike price of $50 is $6.…

A: 1. According to put - call parity, C + Present value of K = S + P where, C = call premium K =…

Q: Carter Communications does not currently pay a dividend. You expect the company to begin paying a…

A: Price of stock can be determined using the dividend discounting model(DDM) of constant growth.

Q: Find the interest Thomas has started working, and he will be putting $100 aside, at the end of every…

A: When the lender lends a loan to the borrower, he charges a rate of interest on the borrowed amount.…

Q: Graham Potato Company has projected sales of $10,200 in September, $13,500 in October, $20.200 in…

A: Cash budget is used to estimate cash inflows (cash receipts) and cash outflows (cash payments) of a…

Q: Jason makes six EOY deposits of $2,000 each in savings account paying 5% compounded annually. If the…

A: Annually deposit = d = $2000 Interest rate = r = 5%

Q: In keeping with the increasingly popular merchandising theme of customization an entrepreneurial…

A: Internal rate of return is a capital budgeting techniques which help in decision making on the basis…

Q: Current stock price for XYZ Interest rate Dividend rate Option PUT PUT PUT PUT CALL CALL CALL CALL…

A: Both call-and-put options provide leverage and flexibility to investors and traders, allowing them…

Q: Using the data in the following table, and the fact that the correlation of A and B is 0.56,…

A: In the given case, we have given the return of each stock of different number of years. And, the…

Q: Provide an example of Decentralised Finance (Defi) and critically examine the effect of Defi on…

A: Decentralised Finance (DeFi), which challenges conventional banking structures and ushers in a new…

Step by step

Solved in 3 steps

- The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 14% 28.5% 1.7 S&P 500 17.6% 19.4% 1 Risk-free 4.8% Calculate the Treynor measure of performance for Fund A. Convert percentages to decimal places before calculating your answer. ENTER your answer using FOUR DECIMAL places. Example: 0.1234The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 14% 24% 1.21 S&P 500 17.4% 19.4% 1 Risk-free 5.1% Calculate the Treynor measure of performance for the S&P 500. Convert percentages to decimal places before calculating your answer. ENTER your answer using FOUR DECIMAL places.Example: 1.2345The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 22.9% 24% 1.4 S&P 500 15.7% 19% 1 Risk-free 3.5% Calculate the Jensen's alpha measure of performance for Fund A only. ENTER your answer using THREE DECIMAL places.Use the correct sign if the answer is negative! Example: -1.234

- The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate each year: Fund Return Benchmark Return Risk-free rate Year 1 22% 19% 2% Year 2 23% 20% 2% Year 3 25% 22% 2% Year 4 28% 23% 2% Year 5 28% 22% 2% Year 6 29% 22% 2% Year 7 20% 18% 2% Year 8 18% 16% 2% Year 9 15% 13% 2% Year 10 13% 12% 2% Required: a. What is the Sharpe ratio for the fund and the benchmark? b. What is the Treynor ratio for the fund and the benchmark? c. What is the fund tracking error? d. What is the beta for the fund? e. What is Jensen’s alpha for the fund?The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 12.5% 25.4% 1.27 S&P 500 14% 6% 1 Risk-free 1.2% Calculate the Sharpe measure of performance for Fund A.The average return, standard deviation, and beta for Fund A is given below along with data for the S&P 500 Index. Fund Average Return Standard Deviation Beta A 25.7% 29% 1.3 S&P 500 17.9% 20% 1 Risk-free 3.8% Calculate the M2 measure of performance for Fund A. Use the correct sign if the answer is negative! Example: -1.23

- The following data is reported for a fund and an appropriate benchmark as well as the risk-free rate each year: Fund Return Benchmark Return Risk-free rate Year 1 22% 19% 2% Year 2 23% 20% 2% Year 3 25% 22% 2% Year 4 28% 23% 2% Year 5 28% 22% 2% Year 6 29% 22% 2% Year 7 20% 18% 2% Year 8 18% 16% 2% Year 9 15% 13% 2% Year 10 13% 12% 2% Do not round intermidete calucations Required: a. What is the Sharpe ratio for the fund and the benchmark? b. What is the Treynor ratio for the fund and the benchmark? c. What is the fund tracking error? d. What is the beta for the fund? e. What is Jensen’s alpha for the fund?A closed-end fund starts the year with a net asset value of OMR10. By year end, NAV equals OMR10.10. At the beginning of the year, the fund was selling at a 3% premium to NAV. By the end of the year, the fund is selling at a 6% discount to NAV. The fund paid year end distributions of income and capital gains of OMR2.50. What is the rate of return to an investor in the fund during the year?A closed-end fund starts the year with a net asset value of $31. By year-end, NAV equals $33.00. At the beginning of the year, the fund is selling at a 3% premium to NAV. By the end of the year, the fund is selling at a 8% discount to NAV. The fund paid year-end distributions of income and capital gains of $3.40. Required: a. What is the rate of return to an investor in the fund during the year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would have been the rate of return to an investor who held the same securities as the fund manager during the year? (Round your answer to 2 decimal places.)

- In the above $110K allocation problem, you decided to allocate 30% weight in A, 50% weight in B, 20% weight in C, and you want to find its AVG return. Which of the following is the appropriate method to find the mean (AVG) return on the $100K fund invested? a. Weighted Average (WAVG ) b. Simple Average c. Geometric Average d. Arithmetic AverageFund Beta Deviation (%) Return (%) Rf (%) XXX 1.07 5.13 19 6 YYY 1.02 4.28 17 6 ZZZ 0.86 3.52 12 6 Market 1 3.8 13 6 Compute the Sharpe Measure for the XXX fund. Compute the Treynor Ratio for the ZZZ fund. Compute the Jensen Measure for the YYY fund.You need to know the profitability of an investment fund where the amount to invest is $ 17,000, the amount of initial participation value is 3.1235 and at the end of the period is 4.456, what is the profitability of the fund?