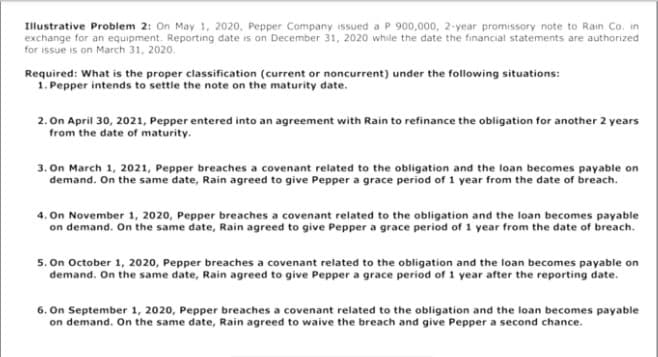

Illustrative Problem 2: On May 1, 2020, Pepper Company issued a P 900,000, 2-year promissory note to Rain Co. in exchange for an equipment. Reporting date is on December 31, 2020 while the date the financial statements are authorized for issue is on March 31, 2020. Required: What is the proper classification (current or noncurrent) under the following situations: 1. Pepper intends to settle the note on the maturity date. 2. On April 30, 2021, Pepper entered into an agreement with Rain to refinance the obligation for another 2 years from the date of maturity. 3. On March 1, 2021, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year from the date of breach. 4. On November 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year from the date of breach. 5. On October 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year after the reporting date. 6. On September 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to waive the breach and give Pepper a second chance.

Illustrative Problem 2: On May 1, 2020, Pepper Company issued a P 900,000, 2-year promissory note to Rain Co. in exchange for an equipment. Reporting date is on December 31, 2020 while the date the financial statements are authorized for issue is on March 31, 2020. Required: What is the proper classification (current or noncurrent) under the following situations: 1. Pepper intends to settle the note on the maturity date. 2. On April 30, 2021, Pepper entered into an agreement with Rain to refinance the obligation for another 2 years from the date of maturity. 3. On March 1, 2021, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year from the date of breach. 4. On November 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year from the date of breach. 5. On October 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year after the reporting date. 6. On September 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on demand. On the same date, Rain agreed to waive the breach and give Pepper a second chance.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 13C

Related questions

Question

Transcribed Image Text:Illustrative Problem 2: On May 1, 2020, Pepper Company issued a P 900,000, 2-year promissory note to Rain Co. in

exchange for an equipment. Reporting date is on December 31, 2020 while the date the financial statements are authorized

for issue is on March 31, 2020.

Required: What is the proper classification (current or noncurrent) under the following situations:

1. Pepper intends to settle the note on the maturity date.

2. On April 30, 2021, Pepper entered into an agreement with Rain to refinance the obligation for another 2 years

from the date of maturity.

3. On March 1, 2021, Pepper breaches a covenant related to the obligation and the loan becomes payable on

demand. On the same date, Rain agreed to give Pepper a grace period of 1 year from the date of breach.

4. On November 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable

on demand. On the same date, Rain agreed to give Pepper a grace period of 1 year from the date of breach.

5. On October 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable on

demand. On the same date, Rain agreed to give Pepper a grace period of 1 year after the reporting date.

6. On September 1, 2020, Pepper breaches a covenant related to the obligation and the loan becomes payable

on demand. On the same date, Rain agreed to waive the breach and give Pepper a second chance.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning