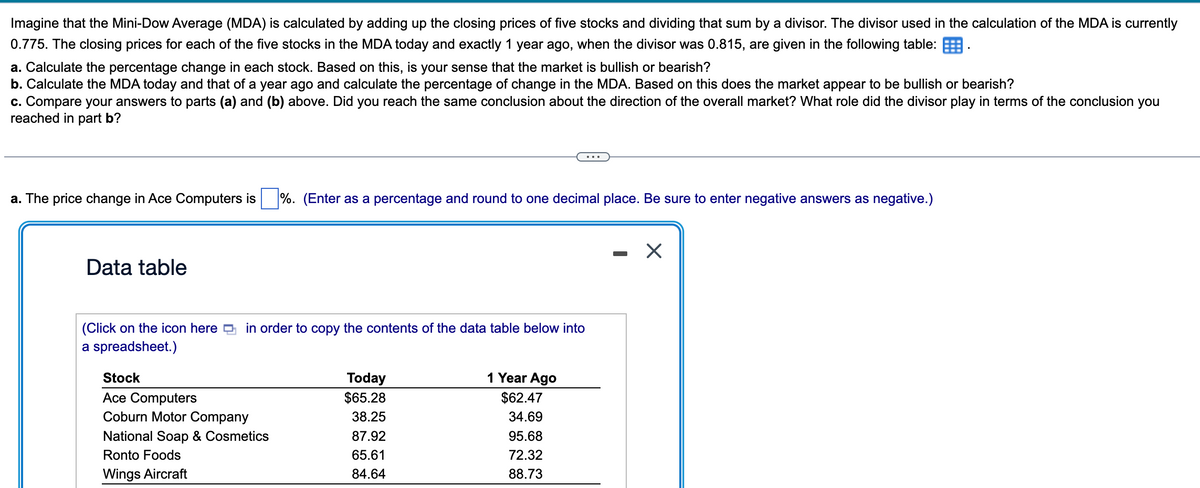

Imagine that the Mini-Dow Average (MDA) is calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently 0.775. The closing prices for each of the five stocks in the MDA today and exactly 1 year ago, when the divisor was 0.815, are given in the following table: . a. Calculate the percentage change in each stock. Based on this, is your sense that the market is bullish or bearish? b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA. Based on this does the market appear to be bullish or bearish? c. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you reached in part b? a. The price change in Ace Computers is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Stock Ace Computers Coburn Motor Company National Soap & Cosmetics Ronto Foods Wings Aircraft Today $65.28 38.25 87.92 65.61 84.64 C 1 Year Ago $62.47 34.69 95.68 72.32 88.73 - X

Imagine that the Mini-Dow Average (MDA) is calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently 0.775. The closing prices for each of the five stocks in the MDA today and exactly 1 year ago, when the divisor was 0.815, are given in the following table: . a. Calculate the percentage change in each stock. Based on this, is your sense that the market is bullish or bearish? b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA. Based on this does the market appear to be bullish or bearish? c. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you reached in part b? a. The price change in Ace Computers is %. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Stock Ace Computers Coburn Motor Company National Soap & Cosmetics Ronto Foods Wings Aircraft Today $65.28 38.25 87.92 65.61 84.64 C 1 Year Ago $62.47 34.69 95.68 72.32 88.73 - X

Essentials of Business Analytics (MindTap Course List)

2nd Edition

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Chapter7: Linear Regression

Section: Chapter Questions

Problem 7P: The Dow Jones Industrial Average (DJIA) and the Standard Poors 500 (SP 500) indexes are used as...

Related questions

Question

100%

CH 3 HW Q2 practice

Answer all questions please, thank you

Transcribed Image Text:Imagine that the Mini-Dow Average (MDA) is calculated by adding up the closing prices of five stocks and dividing that sum by a divisor. The divisor used in the calculation of the MDA is currently

0.775. The closing prices for each of the five stocks in the MDA today and exactly 1 year ago, when the divisor was 0.815, are given in the following table:

a. Calculate the percentage change in each stock. Based on this, is your sense that the market is bullish or bearish?

b. Calculate the MDA today and that of a year ago and calculate the percentage of change in the MDA. Based on this does the market appear to be bullish or bearish?

c. Compare your answers to parts (a) and (b) above. Did you reach the same conclusion about the direction of the overall market? What role did the divisor play in terms of the conclusion you

reached in part b?

a. The price change in Ace Computers is%. (Enter as a percentage and round to one decimal place. Be sure to enter negative answers as negative.)

Data table

(Click on the icon here in order to copy the contents of the data table below into

a spreadsheet.)

Stock

Ace Computers

Coburn Motor Company

National Soap & Cosmetics

Ronto Foods

Wings Aircraft

Today

$65.28

38.25

87.92

65.61

84.64

1 Year Ago

$62.47

34.69

95.68

72.32

88.73

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials Of Business Analytics

Statistics

ISBN:

9781285187273

Author:

Camm, Jeff.

Publisher:

Cengage Learning,