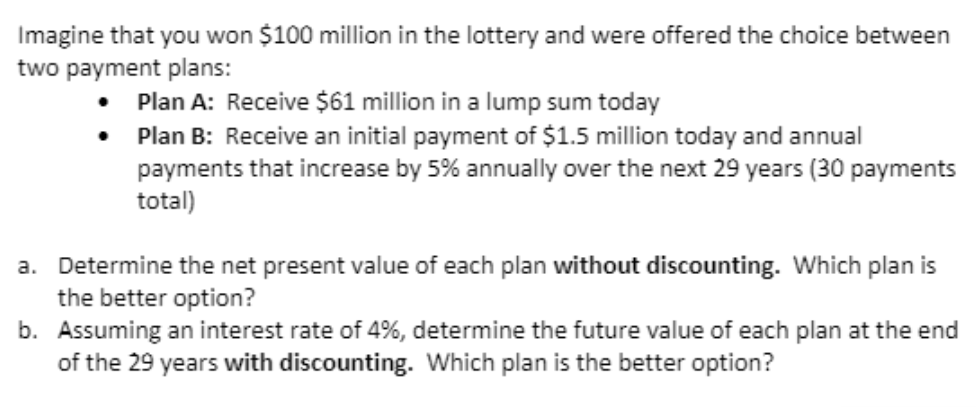

Imagine that you won $100 million in the lottery and were offered the choice between two payment plans: • Plan A: Receive $61 million in a lump sum today • Plan B: Receive an initial payment of $1.5 million today and annual payments that increase by 5% annually over the next 29 years (30 payments total) a. Determine the net present value of each plan without discounting. Which plan is the better option? b. Assuming an interest rate of 4%, determine the future value of each plan at the end of the 29 years with discounting. Which plan is the better option?

RPlan A : Total won Cash flows = $100

Less : Opportunity cost = ($39)

-------

Net present value $61

-------

Note : Here, higher amount of NPV or Opportunity cost will be considered for the best choice of amount of cash flows

Plan B : Initial payments of cash flows = $ 1.5

Annually increases payments = $ 45.675

($1.5 + 5%) x 29 years

-----------

Total cash flows $ 47.175

----------

Total Won cash flows =$100

less: Opportunity cost = ($52.825)

----------

Net present value = $47.175

----------

Conclusion : As per above calculations present value for plan A is higher than B, so Plan A is a best option

Trending now

This is a popular solution!

Step by step

Solved in 2 steps