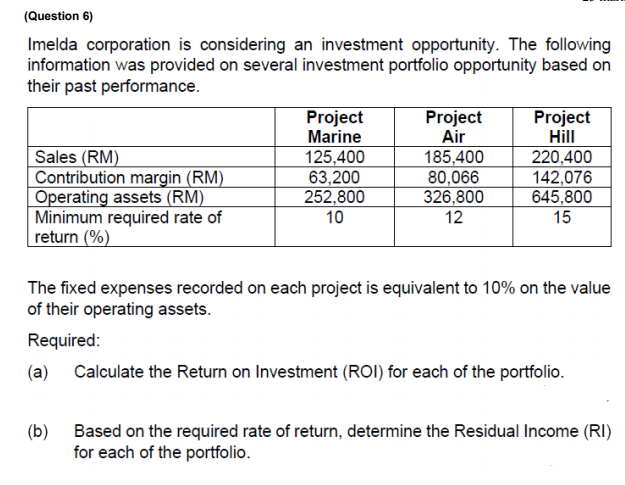

Imelda corporation is considering an investment opportunity. The following information was provided on several investment portfolio opportunity based on their past performance. Project Air 185,400 80,066 326,800 Project Marine Sales (RM) Contribution margin (RM) Operating assets (RM) Minimum required rate of return (%) Project Hill 220,400 142,076 645,800 125,400 63,200 252,800 10 12 15 The fixed expenses recorded on each project is equivalent to 10% on the value of their operating assets. Required: (a) Calculate the Return on Investment (ROI) for each of the portfolio. (b) Based on the required rate of return, determine the Residual Income (RI) for each of the portfolio.

Imelda corporation is considering an investment opportunity. The following information was provided on several investment portfolio opportunity based on their past performance. Project Air 185,400 80,066 326,800 Project Marine Sales (RM) Contribution margin (RM) Operating assets (RM) Minimum required rate of return (%) Project Hill 220,400 142,076 645,800 125,400 63,200 252,800 10 12 15 The fixed expenses recorded on each project is equivalent to 10% on the value of their operating assets. Required: (a) Calculate the Return on Investment (ROI) for each of the portfolio. (b) Based on the required rate of return, determine the Residual Income (RI) for each of the portfolio.

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter26: Capital Investment Analysis

Section: Chapter Questions

Problem 3PA

Related questions

Question

Transcribed Image Text:(Question 6)

Imelda corporation is considering an investment opportunity. The following

information was provided on several investment portfolio opportunity based on

their past performance.

Project

Marine

125,400

63,200

252,800

10

Project

Air

185,400

80,066

326,800

Project

Hill

Sales (RM)

Contribution margin (RM)

Operating assets (RM)

Minimum required rate of

return (%)

220,400

142,076

645,800

15

12

The fixed expenses recorded on each project is equivalent to 10% on the value

of their operating assets.

Required:

(a) Calculate the Return on Investment (ROI) for each of the portfolio.

(b) Based on the required rate of return, determine the Residual Income (RI)

for each of the portfolio.

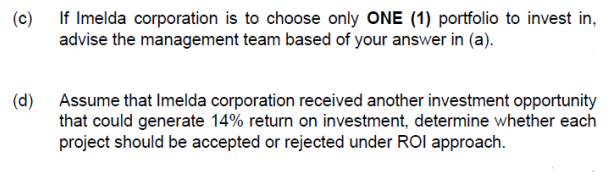

Transcribed Image Text:(c)

If Imelda corporation is to choose only ONE (1) portfolio to invest in,

advise the management team based of your answer in (a).

(d)

Assume that Imelda corporation received another investment opportunity

that could generate 14% return on investment, determine whether each

project should be accepted or rejected under ROI approach.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning