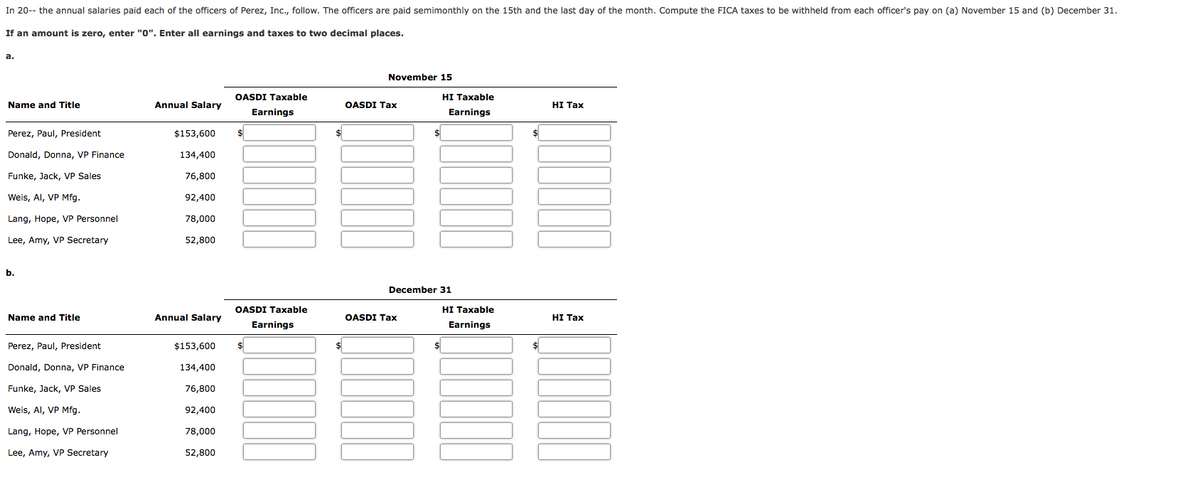

In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. If an amount is zero, enter "o". Enter all earnings and taxes to two decimal places.

In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. If an amount is zero, enter "o". Enter all earnings and taxes to two decimal places.

Century 21 Accounting Multicolumn Journal

11th Edition

ISBN:9781337679503

Author:Gilbertson

Publisher:Gilbertson

Chapter13: Accounting For Payroll And Payroll Taxes

Section: Chapter Questions

Problem 4AP

Related questions

Question

Transcribed Image Text:In 20-- the annual salaries paid each of the officers of Perez, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31.

If an amount is zero, enter "0". Enter all earnings and taxes to two decimal places.

a.

November 15

OASDI Taxable

HI Taxable

Name and Title

Annual Salary

OASDI Tax

HI Тах

Earnings

Earnings

Perez, Paul, President

$153,600

$

%24

Donald, Donna, VP Finance

134,400

Funke, Jack, VP Sales

76,800

Weis, Al, VP Mfg.

92,400

Lang, Hope, VP Personnel

78,000

Lee, Amy, VP Secretary

52,800

b.

December 31

OASDI Taxable

HI Таxable

Name and Title

Annual Salary

OASDI Tax

HI Tax

Earnings

Earnings

Perez, Paul, President

$153,600

Donald, Donna, VP Finance

134,400

Funke, Jack, VP Sales

76,800

Weis, Al, VP Mfg.

92,400

Lang, Hope, VP Personnel

78,000

Lee, Amy, VP Secretary

52,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,