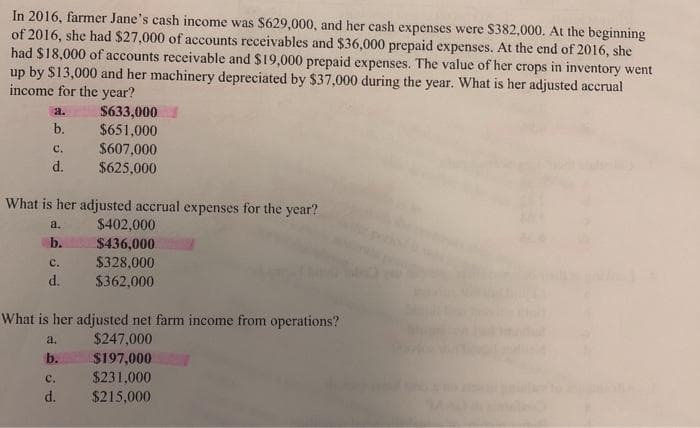

In 2016, farmer Jane's cash income was $629,000, and her cash expenses were $382,000. At the beginning of 2016, she had $27,000 of accounts receivables and $36,000 prepaid expenses. At the end of 2016, she had $18,000 of accounts receivable and $19,000 prepaid expenses. The value of her crops in inventory went up by $13,000 and her machinery depreciated by $37,000 during the year. What is her adjusted accrual income for the year? $633,000 $651,000 a. b. с. $607,000 d. $625,000 What is her adjusted accrual expenses for the year? $402,000 a. b. $436,000 $328,000 $362,000 с. d. What is her adjusted net farm income from operations? $247,000 $197,000 $231,000 $215,000 a. b. с. d.

In 2016, farmer Jane's cash income was $629,000, and her cash expenses were $382,000. At the beginning of 2016, she had $27,000 of accounts receivables and $36,000 prepaid expenses. At the end of 2016, she had $18,000 of accounts receivable and $19,000 prepaid expenses. The value of her crops in inventory went up by $13,000 and her machinery depreciated by $37,000 during the year. What is her adjusted accrual income for the year? $633,000 $651,000 a. b. с. $607,000 d. $625,000 What is her adjusted accrual expenses for the year? $402,000 a. b. $436,000 $328,000 $362,000 с. d. What is her adjusted net farm income from operations? $247,000 $197,000 $231,000 $215,000 a. b. с. d.

Chapter4: Gross Income: Concepts And Inclusions

Section: Chapter Questions

Problem 55P

Related questions

Question

Transcribed Image Text:In 2016, farmer Jane's cash income was $629,000, and her cash expenses were $382,000. At the beginning

of 2016, she had $27,000 of accounts receivables and $36,000 prepaid expenses. At the end of 2016, she

had $18,000 of accounts receivable and $19,000 prepaid expenses. The value of her crops in inventory went

up by $13,000 and her machinery depreciated by $37,000 during the year. What is her adjusted accrual

income for the year?

$633,000

$651,000

$607,000

a.

b.

с.

d.

$625,000

What is her adjusted accrual expenses for the year?

a.

$402,000

b.

$436,000

$328,000

$362,000

c.

d.

What is her adjusted net farm income from operations?

a.

$247,000

b.

$197,000

с.

$231,000

d.

$215,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning