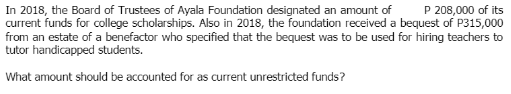

In 2018, the Board of Trustees of Ayala Foundation designated an amount of current funds for college scholarships. Also in 2018, the foundation received a bequest of P315,000 from an estate of a benefactor who specified that the bequest was to be used for hiring teachers to tutor handicapped students. P 208,000 of its What amount should be accounted for as current unrestricted funds?

In 2018, the Board of Trustees of Ayala Foundation designated an amount of current funds for college scholarships. Also in 2018, the foundation received a bequest of P315,000 from an estate of a benefactor who specified that the bequest was to be used for hiring teachers to tutor handicapped students. P 208,000 of its What amount should be accounted for as current unrestricted funds?

Chapter15: Exempt Entities

Section: Chapter Questions

Problem 11DQ

Related questions

Question

Transcribed Image Text:In 2018, the Board of Trustees of Ayala Foundation designated an amount of

current funds for college scholarships. Also in 2018, the foundation received a bequest of P315,000

P 208,000 of its

from an estate of a benefactor who specified that the bequest was to be used for hiring teachers to

tutor handicapped students.

What amount should be accounted for as current unrestricted funds?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT