In 2018, the Laguna Inc entered into a contract to construct a road for 5th Avenue for $14,000,000. The road was completed in 2018. Information related to the contract is as follows: Laguna uses the completed contract method of accounting for long-term construction contracts. Calculate the amount of gross profit to be recognized in each of the three years. Prepare all necessary journal entries for each of the years (credit various accounts for construction costs incurred). Prepare a partial balance sheet for 2016 and 2017 showing any items related to the contract.

In 2018, the Laguna Inc entered into a contract to construct a road for 5th Avenue for $14,000,000. The road was completed in 2018. Information related to the contract is as follows: Laguna uses the completed contract method of accounting for long-term construction contracts. Calculate the amount of gross profit to be recognized in each of the three years. Prepare all necessary journal entries for each of the years (credit various accounts for construction costs incurred). Prepare a partial balance sheet for 2016 and 2017 showing any items related to the contract.

Accounting (Text Only)

26th Edition

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter22: Budgeting

Section: Chapter Questions

Problem 22.22EX: Capital expenditures budget On January 1, 2016, the controller of Omicron Inc. is planning capital...

Related questions

Question

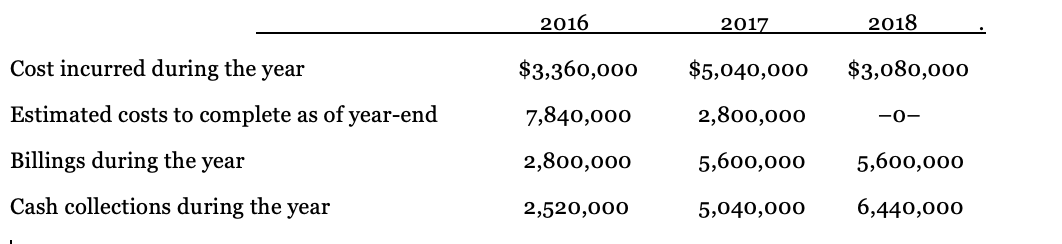

In 2018, the Laguna Inc entered into a contract to construct a road for 5th Avenue for $14,000,000. The road was completed in 2018. Information related to the contract is as follows:

Laguna uses the completed contract method of accounting for long-term construction contracts.

- Calculate the amount of gross profit to be recognized in each of the three years.

- Prepare all necessary

journal entries for each of the years (credit various accounts for construction costs incurred). - Prepare a partial

balance sheet for 2016 and 2017 showing any items related to the contract.

Transcribed Image Text:2016

2017

2018

Cost incurred during the year

$3,360,000

$5,040,000

$3,080,000

Estimated costs to complete as of year-end

7,840,000

2,800,000

-0-

Billings during the year

2,800,000

5,600,000

5,600,000

Cash collections during the

year

2,520,000

5,040,000

6,440,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning