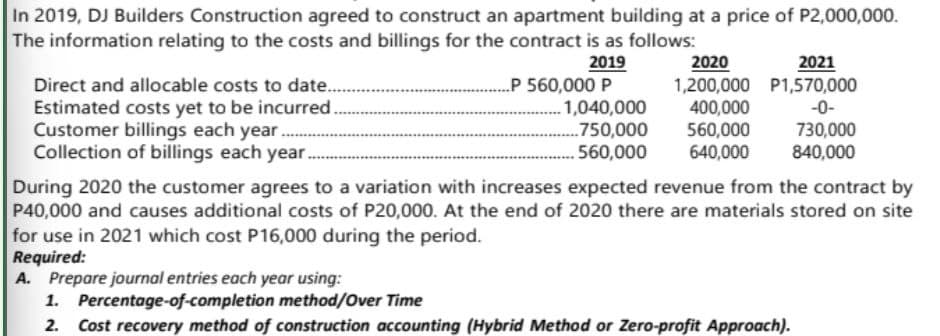

In 2019, DJ Builders Construction agreed to construct an apartment building at a price of P2,000,000. The information relating to the costs and billings for the contract is as follows: 2019 Direct and allocable costs to date.. Estimated costs yet to be incurred. Customer billings each year......... Collection of billings each year. ...P 560,000 P 1,040,000 ..750,000 .560,000 2020 1,200,000 400,000 560,000 640,000 2021 P1,570,000 -0- 730,000 840,000 During 2020 the customer agrees to a variation with increases expected revenue from the contract by P40,000 and causes additional costs of P20,000. At the end of 2020 there are materials stored on site for use in 2021 which cost P16,000 during the period. Required: A. Prepare journal entries each year using: 1. Percentage-of-completion method/Over Time 2. Cost recovery method of construction accounting (Hybrid Method or Zero-profit Approach).

In 2019, DJ Builders Construction agreed to construct an apartment building at a price of P2,000,000. The information relating to the costs and billings for the contract is as follows: 2019 Direct and allocable costs to date.. Estimated costs yet to be incurred. Customer billings each year......... Collection of billings each year. ...P 560,000 P 1,040,000 ..750,000 .560,000 2020 1,200,000 400,000 560,000 640,000 2021 P1,570,000 -0- 730,000 840,000 During 2020 the customer agrees to a variation with increases expected revenue from the contract by P40,000 and causes additional costs of P20,000. At the end of 2020 there are materials stored on site for use in 2021 which cost P16,000 during the period. Required: A. Prepare journal entries each year using: 1. Percentage-of-completion method/Over Time 2. Cost recovery method of construction accounting (Hybrid Method or Zero-profit Approach).

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 6P

Related questions

Question

Transcribed Image Text:In 2019, DJ Builders Construction agreed to construct an apartment building at a price of P2,000,000.

The information relating to the costs and billings for the contract is as follows:

2019

Direct and allocable costs to date..

Estimated costs yet to be incurred.

Customer billings each year.........

Collection of billings each year.

...P 560,000 P

1,040,000

..750,000

.560,000

2020

1,200,000

400,000

560,000

640,000

2021

P1,570,000

-0-

730,000

840,000

During 2020 the customer agrees to a variation with increases expected revenue from the contract by

P40,000 and causes additional costs of P20,000. At the end of 2020 there are materials stored on site

for use in 2021 which cost P16,000 during the period.

Required:

A. Prepare journal entries each year using:

1. Percentage-of-completion method/Over Time

2. Cost recovery method of construction accounting (Hybrid Method or Zero-profit Approach).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT