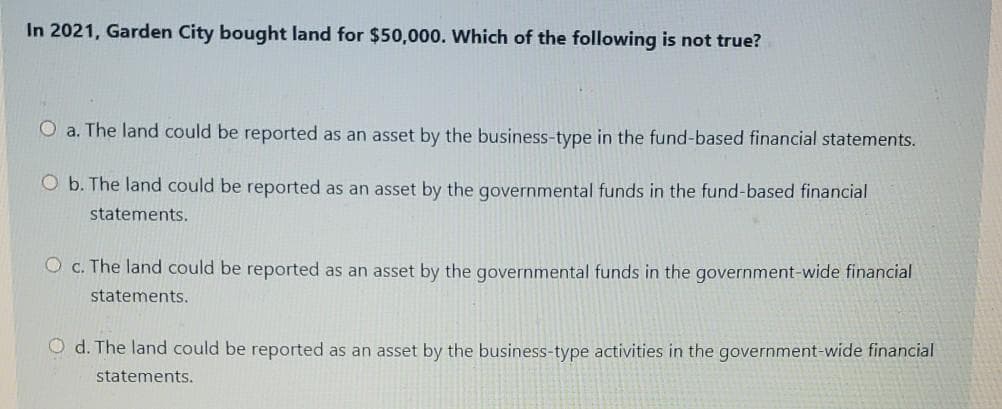

In 2021, Garden City bought land for $50,000. Which of the following is not true? O a. The land could be reported as an asset by the business-type in the fund-based financial statements. O b. The land could be reported as an asset by the governmental funds in the fund-based financial statements. O c. The land could be reported as an asset by the governmental funds in the government-wide financial statements. O d. The land could be reported as an asset by the business-type activities in the government-wide financial statements.

Q: Capital projects funds account for construction expenditures, not for the assets that are being…

A: Statement of Revenue Expenditure & Changes in Fund Balance is a statement which shows the flow…

Q: A city receives a copy of its original charter from the year 1799 as a gift from a citizen. The…

A: Government-wide financial statements are the overall financial statement encompassing the whole…

Q: The amount that should report as expenditure in its general funds is a. RO 5 million b. RO 30…

A: The general fund is the fund that records all the general incomes and expenditures. It deals with…

Q: Al Shahri community, located in the City of Duqm, voted to form a local improvement district to fund…

A: A journal entry is the act of recording of transactions of both economic and non-economic in nature.

Q: Prepare journal entries for a local government to record the following transactions, first for fund…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: The City of Soheil maintains its books so as to prepare fund accounting statements and prepares…

A: Capital outlay generally described as spending on capital assets to manage, improve, purchase, or…

Q: Ibri city was awarded two state grants during the fiscal year 2019 RO 2 million and RO 1 million…

A: Grants means the amount received without any sale of product or providing any services.

Q: The City of Fresh Springs created a Swimming Pool (Enterprise) Fund in 2020. (Hint: this means the…

A: Net position is prepared by the fund enterprises to evaluate their value of resources owned based on…

Q: olice cars at a total cost of $200,000. The vehicles are expected to have a useful life of four…

A:

Q: A city transfers cash of $90,000 from its general fund to start construction on a police station.…

A: Particulars Debit credit Cash 1800000 Bonds payable 1800000 ( being to record Bonds…

Q: Al Shahri community, located in the City of Duqm, voted to form a local improvement district to fund…

A: Given, Interest Rate = 4.5%

Q: The following General Fund information is available for the preparation of the financial statements…

A: The General Fund Statement of Revenue: It is a statement prepared for government fund-related…

Q: The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of…

A:

Q: A city constructs curbing in a new neighborhood and finances it as a special assessment. Under what…

A: Governmental accounting's constant goal is control and accountability. It provides evaluating…

Q: Assume that the City of Coyote has already produced its financlal statements for December 51,2017,…

A: A government wide financial statement shows all the details of the grants and utilization of various…

Q: The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of…

A: If the following three conditions are fulfilled then the recording of sculpture as a capital asset…

Q: A city constructs a special assessment project (a sidewalk) for which it is secondarily liable. The…

A: Expenses: Expenses are costs incurred for the operations of a business. The costs incurred for…

Q: Prepare journal entries for a local government to record the following transactions, first for fund…

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of…

A:

Q: Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the…

A: Financial statements includes mainly three important statements of the company like the income…

Q: From the following information you are required to prepare Statement of revenues, expenditure and…

A: Revenue Management- Revenue management is a technology that allows businesses to optimize their…

Q: 1.Which of the following transactions or events will not be reported in a governmental fund's…

A: Operating Statement includes the revenues and expenditure of a business related to day to day…

Q: Cash of $90,000 is transferred from a city’s general fund to start construction on a police station.…

A: Journal: Journal is the method of recording monetary business transactions in chronological order.…

Q: The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of…

A: Given information is: The City of Wilson receives a large sculpture valued at $240,000 as a gift to…

Q: The following transactions relate to the general fund of the city of Lost Angels for the year ending…

A: Journal entry: It is the first step of recording transactions of a company. Before this, no other…

Q: Indicate (i) how each of the following transactions impacts the fund balance of the general fund,…

A:

Q: Assume that the City of Coyote has produced its financial statements for December 31, 2020, and the…

A: Net position in the balance sheet (or statement of net position) of a local and state government is…

Q: The police department of the city of Elizabeth acquires a new police car during the current year. In…

A: Revenue: It is the amount earned by a company or governmental organization on the delivery of goods…

Q: A landfill is scheduled to be filled to capacity gradually over a 10-year period. However, at the…

A: Post closure and closure cost on measurement of economic resources and accrual accounting basis…

Q: This topic is about government grants. Choose the letter of correct answer. On Sept. 1, 2021,…

A: Grants means the amount received without any sale of product or providing any services. Government…

Q: The following transactions relate to the General Fund of the city of Lost Angels for the year ending…

A: Working note: Compute the amount of total revenue earned:

Q: The following transactions relate to the general fund of the city of Lost Angels for the year ending…

A:

Q: The City of Kastle purchased a vehicle for the parks department. If the operations of the parks…

A: As the asset is finance by general revenue hence it is part of general fund. Governmental activities…

Q: For each of the following events or transactions, identity the fund that will be affected. A city…

A: The monetary sources of the government of a nation which are used to finance the activities or…

Q: Assume that the City of Coyote has already produced Its financlal statements for December 31, 2017,…

A: A government wide financial statement shows all the details of the grants and utilization of various…

Q: Financing for the renovation of Mink City’s municipal park, begun and completed during 2019, came…

A: Given information: Grant from state government = $400,000Proceeds from general obligation bond =…

Q: uction of a county health center. The land had cost the resident $2.5 million. The county sold the…

A: A journal entry is used to record day-to-day transactions of the business by debiting and crediting…

Q: The following transactions relate to the general fund of the city of Lost Angels for the year ending…

A:

Q: Hi, I am in advanced accounting and doing a balance sheet for state and local government. Can you…

A: Capital funds are maintained by governmental bodies to finance the capital projects needs.

Q: Nizwa city was awarded two state grants during the fiscal year 2019 RO 4 million and RO 2 million…

A: Special Revenue Fund : In government accounting, there are different types of funds with…

Q: a. The city believes that the landfill was included appropriately in all previous years as one of…

A: Part a: A land filled at the end of year 3 = 25% A land filled at the end of year 4 = 35% Amount to…

Q: A government buys equipment for its police department at a cost of $54,000. Which of the following…

A: Definition: Assets: These are the resources owned and controlled by business and used to produce…

Q: The City of Grinders Switch Maintains its books in a manner that facilitates the preparation of fund…

A: Solution - S no Particulars Amount DR Amount CR 1 Land-----------------------------------DR $…

Q: A city issues a 60-day tax anticipation note to fund operations until taxes have been collected.…

A: The correct answer is 2. i.e. A liability should be reported in the government-wide financial…

Q: In response to a petition signed by the property owners of Riverdale Subdivision, the city of…

A: Journal entry: Journal entry is the book of original entry where first transactions are recorded in…

Q: According to PAS 20 Accounting for Government Grants and Disclosure of Government Assistance, which…

A: A government grant is a benefit that is provided by the government to the company, it may be in…

Q: Assume that the Cty of Coyote has already produced fts financlal statements for December 31, 2017…

A: A government wide financial statement shows all the details of the grants and utilization of various…

Q: A city receives a copy of its original charter from the year 1799 as a gift from a citizen. The…

A: 1. Determine the following statement is true or false: Answer: True: Explanation: This statement is…

Step by step

Solved in 2 steps

- During the current year, a government buys land for $80,000. Which of the following is not true? Choose the correct.a. The land could be reported as an asset by the business-type activities in the government-wide financial statements.b. The land could be reported as an asset by the governmental activities in the government-wide financial statements.c. The land could be reported as an asset by the proprietary funds in the fund financial statements.d. The land could be reported as an asset by the governmental funds in the fund financial statements.Fund A transfers $20,000 to Fund B. For each of the following, indicate whether the statement is true or false and, if false, explain why. If Fund A is the general fund and Fund B is an enterprise fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements. If Fund A is the general fund and Fund B is a debt service fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements. If Fund A is the general fund and Fund B is an enterprise fund, a $20,000 reduction will be reported on the statement of revenues, expenditures, and other changes in fund balance for the governmental funds within the fund financial statements. If Fund A is the general fund and Fund B is a special revenue fund (which is not considered a major fund), no changes will be shown on the statement of revenues, expenditures, and other changes in fund balance within the fund financial statements.…Fund A transfers $20,000 to Fund B. For each of the following, indicate whether the statement is true or false and, if false, explain why.a. If Fund A is the general fund and Fund B is an enterprise fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.b. If Fund A is the general fund and Fund B is a debt service fund, nothing will be shown for this transfer on the statement of activities within the government-wide financial statements.c. If Fund A is the general fund and Fund B is an enterprise fund, a $20,000 reduction will be reported on the statement of revenues, expenditures, and other changes in fund balance for the governmental funds within the fund financial statements.d. If Fund A is the general fund and Fund B is a special revenue fund (which is not considered a major fund), no changes will be shown on the statement of revenues, expenditures, and other changes in fund balance within the fund financial…

- The City of Wilson receives a large sculpture valued at $240,000 as a gift to be placed in front of the municipal building. Which of the following is true for reporting the gift within the government-wide financial statements?a. A capital asset of $240,000 must be reported.b. No capital asset will be reported.c. If conditions are met, recording the sculpture as a capital asset is optional.d. The sculpture will be recorded but only for the amount paid by the city.A government buys equipment for its police department at a cost of $54,000. Which of the following is not true?a. Equipment will increase by $54,000 in the government-wide financial statements.b. Depreciation in connection with this equipment will be reported in the fund financial statements.c. The equipment will not appear within the reported assets in the fund financial statements.d. An expenditure for $54,000 will be reported in the fund financial statements.The governing board of a private not-for-profit entity votes to set $400,000 in cash aside in an investment fund so that this money and future interest will be available in five years, when a new building is scheduled for construction. Which of the following is not true? Multiple Choice The investments are reported on the statement of financial position as net assets without donor restrictions. The acquisition of the investments is not reported on the statement of activities. Board-designated funds will appear in the net asset section of the statement of financial position as net assets with donor restrictions. Income earned by these investments appears on the statement of activities under net assets without donor restrictions.

- The police department of the city of Elizabeth acquires a new police car during the current year. In reporting the balance sheet for the governmental funds within the fund-based financial statements, what reporting ismade of this police car?a. It is reported as a police car at its cost.b. It is reported as a police car at cost less accumulated depreciation.c. It is reported as equipment at fair value.d. It is not reported.The City of St. John operates an investment trust fund for neighboring governments, including St. John County and the independent school district. Assume the investment trust fund began the year 2020 with investments in US government securities totaling $1,300,000, no liabilities, and Restricted Net Position of $1,300,000. The county and school district deposited $3,600,000 in the investment pool. The investment trust fund invested $1,400,000 in corporate bonds and $2,200,000 in US government securities. Interest received by the investment trust fund totaled $40,000 for the year. At year-end, the fair value of the corporate bonds had increased by $8,000. The earnings of the fund (there are no expenses) are allocated among the accounts of the participating governments. Throughout the year, the participating governments withdrew $3,430,000 of funds from the investment trust fund. Assume that an equal amount of short-term investments were converted to cash as they matured. Required:b.…The City of St. John operates an investment trust fund for neighboring governments, including St. John County and the independent school district. Assume the investment trust fund began the year 2024 with investments in U.S. government securities totaling $1,324,000, no liabilities, and Restricted Net Position of $1,324,000. The County and school district deposited $3,155,000 in the investment pool. The investment trust fund invested $726,000 in corporate bonds and $2,429,000 in U.S. government securities. Interest received by the investment trust fund totaled $128,000 for the year. At year-end, the fair value of the corporate bonds had increased by $1,600. The earnings of the fund (there are no expenses) are allocated among the accounts of the participating governments. Throughout the year, the participating governments withdrew $3,251,000 of funds from the investment trust fund. Assume that an equal amount of short-term investments were converted to cash as they matured. Required:…

- Indicate (i) how each of the following transactions impacts the fund balance of the general fund, and its classifications, for fund financial statements and (ii) what impact each transaction has on the net position balance of the Government Activities on the government-wide financial statements.a. Issue a five-year bond for $6 million to finance general operations.b. Pay cash of $149,000 for a truck to be used by the police department.c. The fire department pays $17,000 to a government motor pool that services the vehicles of only the police and fire departments. Work was done on several department vehicles. d. Levy property taxes of $75,000 for the current year that will not be collected until four months into the subsequent year.e. Receive a grant for $7,000 that must be returned unless the money is spent according to the stipulations of the conveyance. That is expected to happen in the future.f. Businesses make sales of $20 million during the current year. The…The City of Bagranoff holds $90,000 in cash that will be used to make a bond payment when the debt comes due early next year. The assistant treasurer had made that decision. However, just before the end of the current year, the city council formally approved using this money in this way. The city council has been designated as the highest level of decision-making authority for this government. What impact does the council’s action have on the reporting of fund financial statements? Fund balance—unassigned goes down and fund balance—restricted goes up. Fund balance—assigned goes down and fund balance—committed goes up. Fund balance—unassigned goes down and fund balance—assigned goes up. Fund balance—assigned goes down and fund balance—restricted goes up.For each of the following, indicate whether the statement is true or false and include a brief explanation for your answer.a. A pension trust fund appears in the government-wide financial statements but not in the fund financial statements.b. Permanent funds are included as one of the governmental funds.c. A fire department placed orders of $20,000 for equipment. The equipment is received but at a cost of $20,800. In compliance with requirements for fund financial statements, an encumbrance of $20,000 was recorded when the order was placed, and an expenditure of $20,800 was recorded when the order was received.d. The government reported a landfill as an enterprise fund. At the end of Year 1, the government estimated that the landfill will cost $800,000 to clean up when it is eventually full. Currently, it is 12 percent filled. At the end of Year 2, the estimation was changed to $860,000 when it was 20 percent filled. No payments are due for several years. Fund financial statements for…