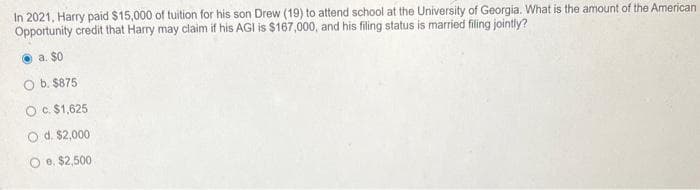

In 2021, Harry paid $15,000 of tuition for his son Drew (19) to attend school at the University of Georgia. What is the amount of the Amer Opportunity credit that Harry may claim if his AGI is $167,000, and his filing status is married filing jointly? a. $0 O b. $875 O c. $1,625 O d. $2,000 Oe. $2,500

In 2021, Harry paid $15,000 of tuition for his son Drew (19) to attend school at the University of Georgia. What is the amount of the Amer Opportunity credit that Harry may claim if his AGI is $167,000, and his filing status is married filing jointly? a. $0 O b. $875 O c. $1,625 O d. $2,000 Oe. $2,500

Chapter27: The Federal Gift And Estate Taxes

Section: Chapter Questions

Problem 5BCRQ

Related questions

Question

100%

M01

Transcribed Image Text:In 2021, Harry paid $15,000 of tuition for his son Drew (19) to attend school at the University of Georgia. What is the amount of the American

Opportunity credit that Harry may claim if his AGI is $167,000, and his filing status is married filing jointly?

a. $0

O b. $875

O c. $1,625

O d. $2,000

e. $2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT