In 2021, Miranda records net earnings from self-employment of $244,400. She has no other gross income. Determine the amount Miranda's self-employment tax and her for AGI income tax deduction. In your computations round all amounts to two decimal places. Round your final answers to the nearest dollar. Miranda's self-employment tax is $ 24,794.80 X and she has a $ 12,397.40 X deduction for AGI.

In 2021, Miranda records net earnings from self-employment of $244,400. She has no other gross income. Determine the amount Miranda's self-employment tax and her for AGI income tax deduction. In your computations round all amounts to two decimal places. Round your final answers to the nearest dollar. Miranda's self-employment tax is $ 24,794.80 X and she has a $ 12,397.40 X deduction for AGI.

Chapter13: Tax Credits And Payment Procedures

Section: Chapter Questions

Problem 22CE

Related questions

Question

Ef 453.

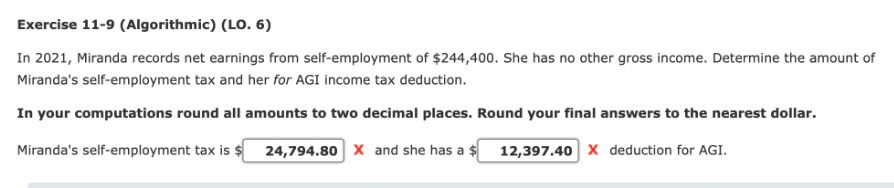

Transcribed Image Text:Exercise 11-9 (Algorithmic) (LO. 6)

In 2021, Miranda records net earnings from self-employment of $244,400. She has no other gross income. Determine the amount of

Miranda's self-employment tax and her for AGI income tax deduction.

In your computations round all amounts to two decimal places. Round your final answers to the nearest dollar.

Miranda's self-employment tax is $ 24,794.80 X and she has a $

12,397.40 X deduction for AGI.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning