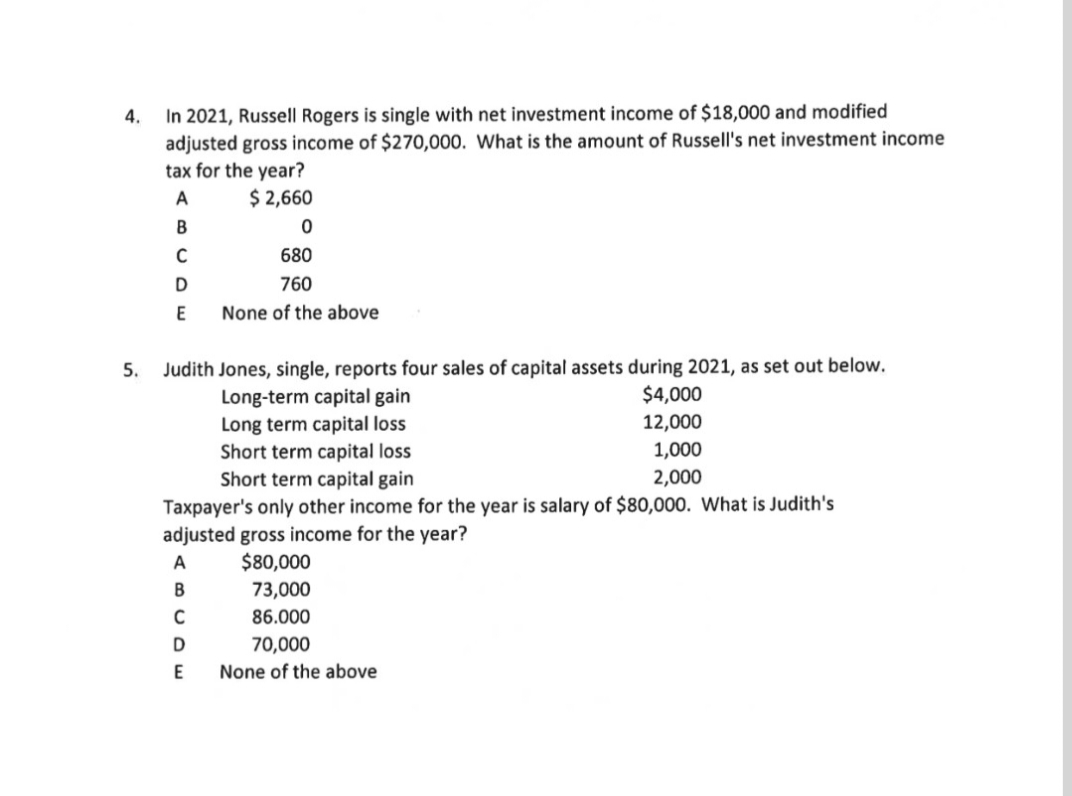

In 2021, Russell Rogers is single with net investment income of $18,000 and modified adjusted gross income of $270,000. What is the amount of Russell's net investment income tax for the year? A $ 2,660 B 680 760 E None of the above Judith Jones, single, reports four sales of capital assets during 2021, as set out below. $4,000 12,000 Long-term capital gain Long term capital loss Short term capital loss Short term capital gain 1,000 2,000 Taxpayer's only other income for the year is salary of $80,000. What is Judith's adjusted gross income for the year? A $80,000 B 73,000 86.000 D 70,000 None of the above

In 2021, Russell Rogers is single with net investment income of $18,000 and modified adjusted gross income of $270,000. What is the amount of Russell's net investment income tax for the year? A $ 2,660 B 680 760 E None of the above Judith Jones, single, reports four sales of capital assets during 2021, as set out below. $4,000 12,000 Long-term capital gain Long term capital loss Short term capital loss Short term capital gain 1,000 2,000 Taxpayer's only other income for the year is salary of $80,000. What is Judith's adjusted gross income for the year? A $80,000 B 73,000 86.000 D 70,000 None of the above

Chapter14: Property Transactions: Capital Gains And Losses, § 1231, And Recapture Provisions

Section: Chapter Questions

Problem 30CE

Related questions

Question

100%

Plz both answer with explain plz sir I give upvote

Transcribed Image Text:In 2021, Russell Rogers is single with net investment income of $18,000 and modified

adjusted gross income of $270,000. What is the amount of Russell's net investment income

tax for the year?

4.

A

$ 2,660

В

680

760

None of the above

Judith Jones, single, reports four sales of capital assets during 2021, as set out below.

Long-term capital gain

Long term capital loss

Short term capital loss

Short term capital gain

5.

$4,000

12,000

1,000

2,000

Taxpayer's only other income for the year is salary of $80,000. What is Judith's

adjusted gross income for the year?

A

$80,000

B

73,000

86.000

D

70,000

E

None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you