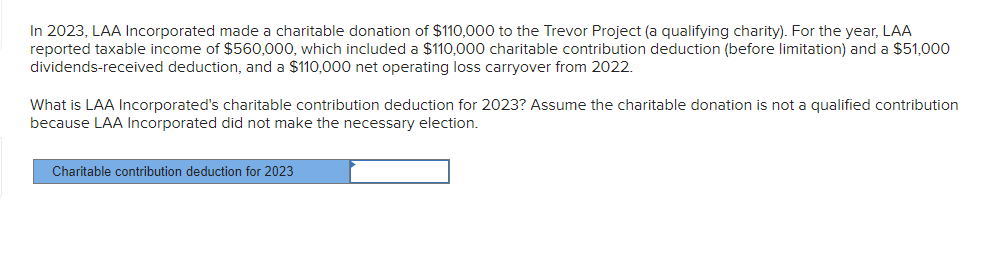

In 2023, LAA Incorporated made a charitable donation of $110,000 to the Trevor Project (a qualifying charity). For the year, LAA reported taxable income of $560,000, which included a $110,000 charitable contribution deduction (before limitation) and a $51,000 dividends-received deduction, and a $110,000 net operating loss carryover from 2022. What is LAA Incorporated's charitable contribution deduction for 2023? Assume the charitable donation is not a qualified contribution because LAA Incorporated did not make the necessary election. Charitable contribution deduction for 2023

In 2023, LAA Incorporated made a charitable donation of $110,000 to the Trevor Project (a qualifying charity). For the year, LAA reported taxable income of $560,000, which included a $110,000 charitable contribution deduction (before limitation) and a $51,000 dividends-received deduction, and a $110,000 net operating loss carryover from 2022. What is LAA Incorporated's charitable contribution deduction for 2023? Assume the charitable donation is not a qualified contribution because LAA Incorporated did not make the necessary election. Charitable contribution deduction for 2023

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 9DQ

Related questions

Question

Pls answer without plagiarism.plz

Transcribed Image Text:In 2023, LAA Incorporated made a charitable donation of $110,000 to the Trevor Project (a qualifying charity). For the year, LAA

reported taxable income of $560,000, which included a $110,000 charitable contribution deduction (before limitation) and a $51,000

dividends-received deduction, and a $110,000 net operating loss carryover from 2022.

What is LAA Incorporated's charitable contribution deduction for 2023? Assume the charitable donation is not a qualified contribution

because LAA Incorporated did not make the necessary election.

Charitable contribution deduction for 2023

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you