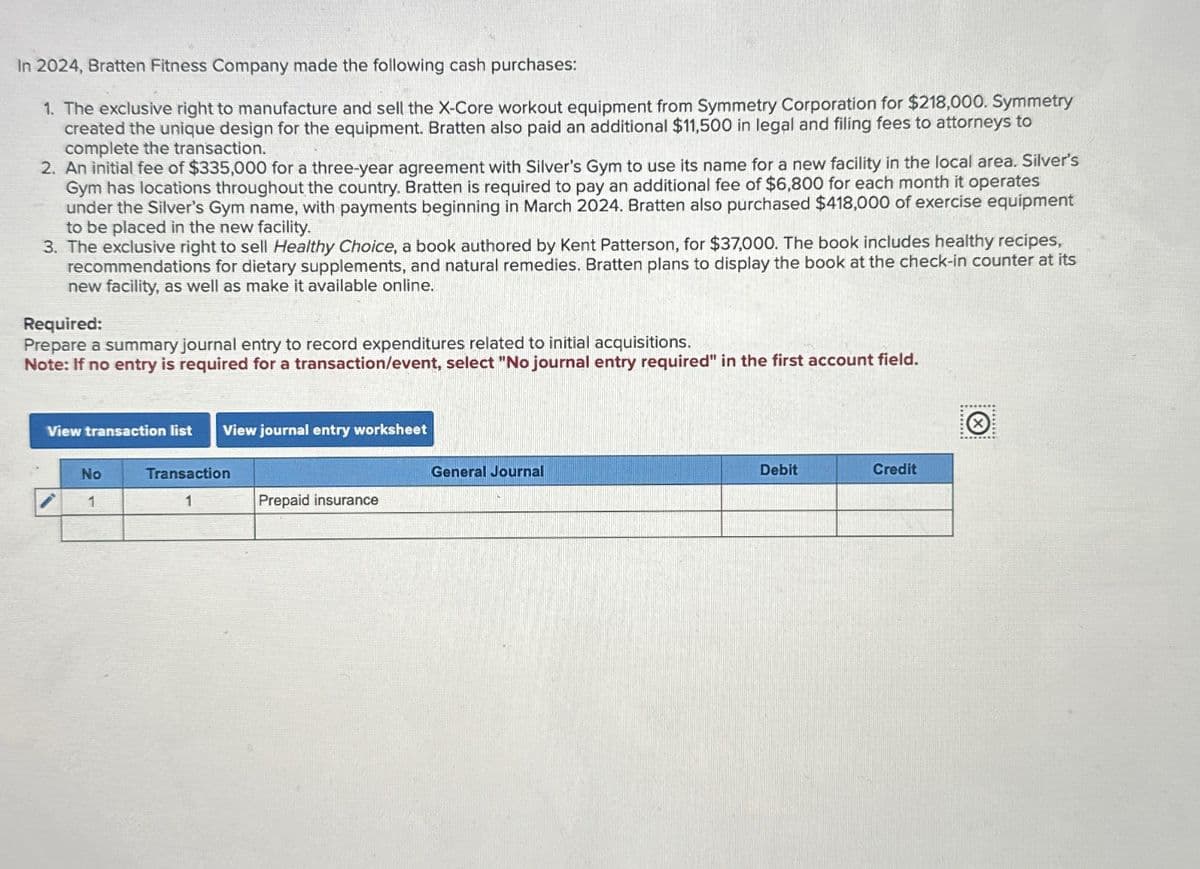

In 2024, Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $218,000. Symmetry created the unique design for the equipment. Bratten also paid an additional $11,500 in legal and filing fees to attorneys to complete the transaction. 2. An initial fee of $335,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's Gym has locations throughout the country. Bratten is required to pay an additional fee of $6,800 for each month it operates under the Silver's Gym name, with payments beginning in March 2024. Bratten also purchased $418,000 of exercise equipment to be placed in the new facility. 3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $37,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in counter at its new facility, as well as make it available online. Required: Prepare a summary journal entry to record expenditures related to initial acquisitions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet No Transaction 1 1 Prepaid insurance General Journal Debit Credit

In 2024, Bratten Fitness Company made the following cash purchases: 1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $218,000. Symmetry created the unique design for the equipment. Bratten also paid an additional $11,500 in legal and filing fees to attorneys to complete the transaction. 2. An initial fee of $335,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's Gym has locations throughout the country. Bratten is required to pay an additional fee of $6,800 for each month it operates under the Silver's Gym name, with payments beginning in March 2024. Bratten also purchased $418,000 of exercise equipment to be placed in the new facility. 3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $37,000. The book includes healthy recipes, recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in counter at its new facility, as well as make it available online. Required: Prepare a summary journal entry to record expenditures related to initial acquisitions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list View journal entry worksheet No Transaction 1 1 Prepaid insurance General Journal Debit Credit

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter8: Property Transactions: Capital Gains And Losses, Section 1231 And Recapture Provisions

Section: Chapter Questions

Problem 38P

Question

Meman

Transcribed Image Text:In 2024, Bratten Fitness Company made the following cash purchases:

1. The exclusive right to manufacture and sell the X-Core workout equipment from Symmetry Corporation for $218,000. Symmetry

created the unique design for the equipment. Bratten also paid an additional $11,500 in legal and filing fees to attorneys to

complete the transaction.

2. An initial fee of $335,000 for a three-year agreement with Silver's Gym to use its name for a new facility in the local area. Silver's

Gym has locations throughout the country. Bratten is required to pay an additional fee of $6,800 for each month it operates

under the Silver's Gym name, with payments beginning in March 2024. Bratten also purchased $418,000 of exercise equipment

to be placed in the new facility.

3. The exclusive right to sell Healthy Choice, a book authored by Kent Patterson, for $37,000. The book includes healthy recipes,

recommendations for dietary supplements, and natural remedies. Bratten plans to display the book at the check-in counter at its

new facility, as well as make it available online.

Required:

Prepare a summary journal entry to record expenditures related to initial acquisitions.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

View transaction list View journal entry worksheet

No

Transaction

1

1

Prepaid insurance

General Journal

Debit

Credit

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT