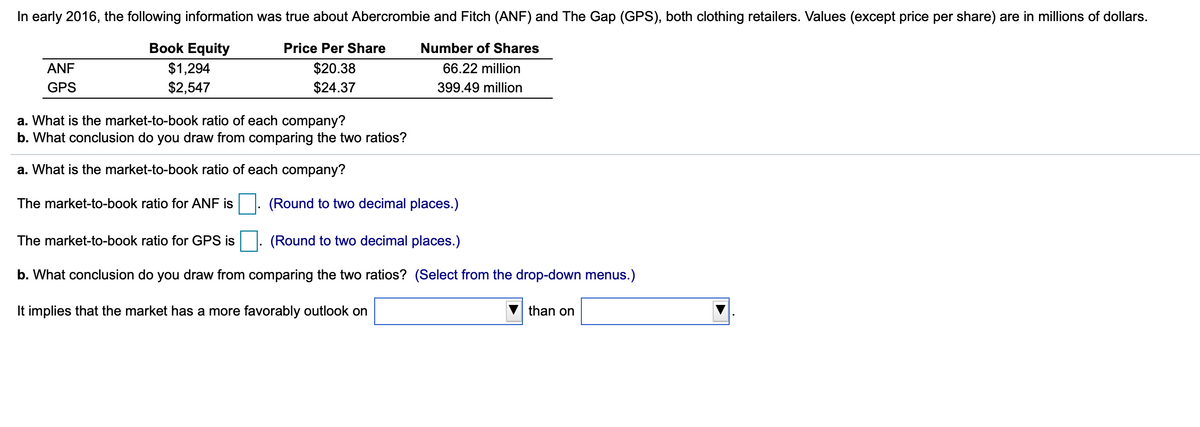

In early 2016, the following information was true about Abercrombie and Fitch (ANF) and The Gap (GPS), both clothing retailers. Values (except price per share) are in millions of dollars. Book Equity Price Per Share Number of Shares ANF $1,294 $2,547 $20.38 66.22 million GPS $24.37 399.49 million a. What is the market-to-book ratio of each company? b. What conclusion do you draw from comparing the two ratios? a. What is the market-to-book ratio of each company? The market-to-book ratio for ANF is (Round to two decimal places.) The market-to-book ratio for GPS is (Round to two decimal places.) b. What conclusion do you draw from comparing the two ratios? (Select from the drop-down menus.) It implies that the market has more favorably outlook on V than on

In early 2016, the following information was true about Abercrombie and Fitch (ANF) and The Gap (GPS), both clothing retailers. Values (except price per share) are in millions of dollars. Book Equity Price Per Share Number of Shares ANF $1,294 $2,547 $20.38 66.22 million GPS $24.37 399.49 million a. What is the market-to-book ratio of each company? b. What conclusion do you draw from comparing the two ratios? a. What is the market-to-book ratio of each company? The market-to-book ratio for ANF is (Round to two decimal places.) The market-to-book ratio for GPS is (Round to two decimal places.) b. What conclusion do you draw from comparing the two ratios? (Select from the drop-down menus.) It implies that the market has more favorably outlook on V than on

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 54E: Rebert Inc. showed the following balances for last year: Reberts net income for last year was...

Related questions

Question

Transcribed Image Text:In early 2016, the following information was true about Abercrombie and Fitch (ANF) and The Gap (GPS), both clothing retailers. Values (except price per share) are in millions of dollars.

Book Equity

Price Per Share

Number of Shares

$1,294

$20.38

$24.37

ANF

66.22 million

GPS

$2,547

399.49 million

a. What is the market-to-book ratio of each company?

b. What conclusion do you draw from comparing the two ratios?

a. What is the market-to-book ratio of each company?

The market-to-book ratio for ANF is

(Round to two decimal places.)

The market-to-book ratio for GPS is

(Round to two decimal places.)

b. What conclusion do you draw from comparing the two ratios? (Select from the drop-down menus.)

It implies that the market has a more favorably outlook on

than on

Expert Solution

Step 1

The market-to-book ratio helps to identify the market value of a firm relative to its book value. A higher ratio suggests that the market has a favorable outlook for the firm.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning