In general, a partnership is described as a legal relationship that exists between two or more people who carry on a joint business with the goal of benefit. (a) Describe the different types of partners and their characteristics. (attached point form answer for this question; kindly assist me to elaborate more on each points) (b) Determine the conditions that must be met for a partnership to exist.(attached point form answer for this question; kindly assist me to elaborate more on each points)

In general, a partnership is described as a legal relationship that exists between two or more people who carry on a joint business with the goal of benefit. (a) Describe the different types of partners and their characteristics. (attached point form answer for this question; kindly assist me to elaborate more on each points) (b) Determine the conditions that must be met for a partnership to exist.(attached point form answer for this question; kindly assist me to elaborate more on each points)

Chapter10: Partnership Taxation

Section: Chapter Questions

Problem 23MCQ

Related questions

Question

In general, a

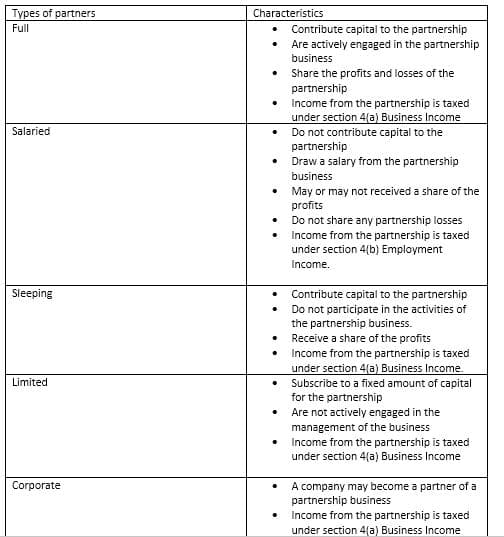

(a) Describe the different types of partners and their characteristics. (attached point form answer for this question; kindly assist me to elaborate more on each points)

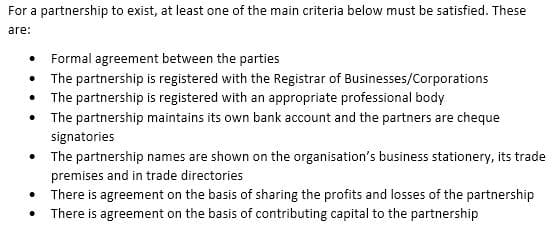

(b) Determine the conditions that must be met for a partnership to exist.(attached point form answer for this question; kindly assist me to elaborate more on each points)

Transcribed Image Text:Types of partners

Characteristics

Full

Contribute capital to the partnership

• Are actively engaged in the partnership

business

• Share the profits and losses of the

partnership

• Income from the partnership is taxed

under section 4(a) Business Income

• Do not contribute capital to the

partnership

• Draw a salary from the partnership

Salaried

business

• May or may not received a share of the

profits

• Do not share any partnership losses

Income from the partnership is taxed

under section 4(b) Employment

Income.

Sleeping

Contribute capital to the partnership

Do not participate in the activities of

the partnership business.

• Receive a share of the profits

• Income from the partnership is taxed

under section 4(a) Business Income.

• Subscribe to a fixed amount of capital

for the partnership

• Are not actively engaged in the

Limited

management of the business

Income from the partnership is taxed

under section 4(a) Business Income

• A company may become a partner of a

partnership business

Income from the partnership is taxed

under section 4(a) Business Income

Corporate

Transcribed Image Text:For a partnership to exist, at least one of the main criteria below must be satisfied. These

are:

• Formal agreement between the parties

• The partnership is registered with the Registrar of Businesses/Corporations

• The partnership is registered with an appropriate professional body

• The partnership maintains its own bank account and the partners are cheque

signatories

• The partnership names are shown on the organisation's business stationery, its trade

premises and in trade directories

• There is agreement on the basis of sharing the profits and losses of the partnership

There is agreement on the basis of contributing capital to the partnership

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you