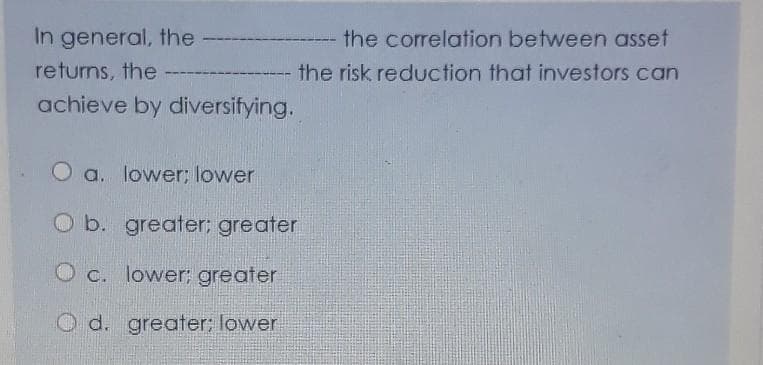

In general, the the correlation between asset returns, the the risk reduction that investors can achieve by diversifying. O a. lower; lower b. greater; greater O c. lower; greater d. greater; lower

Q: How do an investment's required rate of return vary with perceived risk? Explain with an example?

A: Required rate of return refers to the rate which the investors expects from their investments. This…

Q: It is important to diversify your investments to maximize your returns and lower your overall risks.…

A: Diversification reduces risk by investing in a wide range of financial instruments, industries, and…

Q: Beta measures the sensitivity of the asset's return to variation in the market return. What is…

A: Beta of a stock measures the sensitivity of assets return to variation in market return It means…

Q: Using a payback period rule tends to bias investors toward Select one: a. riskier investments. b.…

A: Payback period: This method is used to calculate how many years a project will take to recover its…

Q: Asset allocation is performed to A) reduce the load that intermediaries charge maximize the earning…

A: Asset Allocation means the process of allocating money across different financial assets (such as…

Q: When comparing NPV and IRR, which is incorrect? * . With NPV, the discount rate can be adjusted to…

A: Net present value is the difference between the present value of cash inflows and cash outflows.…

Q: The desired rate of return on an investment should reflect the degree of risk involved. A. True…

A: Riskier investments may give higher returns to the investors as they provide favorable ratio of risk…

Q: The following are the reasons why investors are holding different investment despite of having…

A: Note: We’ll answer the first question since the exact one wasn’t specified. Please submit a new…

Q: (Net income ∕ Total assets)

A: Operating Profit Margin: It shows the performance of the firm in generating operating profit from…

Q: Critically evaluate the importance of the standard deviation factor in comparing investments.

A: Standard deviation helps the investor to measure the volatility of the market. It helps an investor…

Q: This is a generalized framework for analyzing the relationship between risk and return: a. capital…

A: Risk refers to the uncertainty related to the investment within the future. Risk arises within the…

Q: The following is a concise explanation of the primary investment risk characteristics that investors…

A: Introduction : Investing assessment and appraisal is crucial for investors because it is a kind of…

Q: On Estimating Risks and Return on Assets * Statement I: Portfolio risk can be reduced by…

A: Risk is an important parameter while making investments which plays a key role in making investment…

Q: What does it mean to adopt a maturity matching approach to financing assets, including current…

A: Matching concept while preparing the income statement , revenue and profits are matched with…

Q: The most accurate way to analyze the profitability of an investment is to compute the payback…

A: Payback period is the period for time taken of project to repay the initial investment. Payback…

Q: Whether the following statement is true or wrong. Briefly explain your answer. "It is impossible to…

A: The asset which has no risk associated with it is known as risk free asset. The return from risk…

Q: Which of the following statements describing the elements of intrinsic valuation is most accurate?…

A: The present value of an asset or project is computed to determine which investment must be selected.…

Q: 1. Why methods and tools of the statistics are so important in investment decision making.

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Q: Calculating the payback time is the most precise technique to determine the profitability of an…

A: Payback technique helps us to compute the time period in which the project's cash inflows cover the…

Q: When adding real estate to an asset allocation program that currently includes only stocks, bonds,…

A: The question is based on the concept of risk of portfolio, which different asset class. The…

Q: The time weighted return is a method of measuring performance. Which of the following statements…

A: The time-weighted return method is a method to compute the compound rate of interest in portfolio…

Q: Generally, the ____ is considered to be a more realistic reinvestment rate than the ____. a.…

A: Cost of capital is the required rate for make capital budgeting decision

Q: What are the quantitative characteristics of the assets and how to measure them?

A: An economic resource that helps the businessman to conducting business activity effectively and…

Q: What role does the correlation what role does the correlation of two assets play in computation of…

A: The answer and the explanation can be seen below:

Q: Which of the following is TRUE about liquidity? a. All assets should be put in liquid asset so that…

A: The simplicity with which an asset, or security, might be changed into immediate cash without…

Q: Whenever you make an investment decision, you need to consider its impacts on the diversification of…

A: Investment decision and diversification go hand in hand. One should be careful while making an…

Q: What does it mean that portfolio diversification can reduce risk, and how does the efficient…

A: Risk is the measurable probability of loss on an investment. It includes the possibility of losing…

Q: Which of the following investment strategies involves generating a higher expected rate of return…

A: The risk and return of investment are usually positively related. An investor cannot earn an extra…

Q: Which of the following is true of risk-return trade off? A) Risk can be measured on the basis of…

A: Risk are there in financial world but no return exists in financial world without risk.

Q: Which of the following statements describing the elements of intrinsic valuation is most accurate?…

A: Intrinsic value of any project or any assets is how value being added by asset to value of investors…

Q: If net present values are used to evaluate two investments that have equal costs and equal total…

A: Net Present Value is determined by discounting net cash flows by an appropriate required rate of…

Q: A reasonable probability that an investment will produce a loss a. risk b. value c. specualtion…

A: There are several investment styles through which one can generate profits or build wealth.

Q: True or false DCF Approach Model examines the price of "similar" assets in relation to a common…

A: 1. DCF Approach Model examines the price of "similar" assets in relation to a common variable, such…

Q: Which is least likely correct about security valuation? a. The calculated or determined value…

A: Security valuation is technique o knowing the value of securities.

Q: According to the capital asset pricing model, assets with Lower; lower; unsystematic Higher; higher,…

A: Solution:- Capital Asset Pricing Model (CAPM) is the equity model to determine the required rate of…

Q: Which of the following statements correctly describe aspects of the diversification benefit…

A: A portfolio between stocks is formed to reduce the total risk incurred on the investment. The…

Q: 1. Define the components of holding period return. Can any of these components be negative? 2. How…

A: Hello. Since your question has multiple parts, we will solve the first question for you. If you want…

Q: When adding a risky asset to a portfolio of may risky assets, which property of the asset has a…

A: Portfolios can consist of a variety of investments such as equities, bonds, commodities, cash and…

Q: Assume that a new law is passed which restricts investors to holding only one asset. A risk-averse…

A:

Q: What is the best way to measure of risk for an asset held in isolation, and which is the best…

A: The "coefficient of variation" is the ideal indicator of the hazard of an individual asset.…

Q: How to compare different assets in investment selection process?

A: “Since you have posted multiple questions, we will solve first question for you. If you want any…

Q: When comparing NPV and IRR, which is incorrect? With NPV, the discount rate can be adjusted to take…

A: Net present value is the difference between the present value of cash inflows and cash outflows.…

Q: What is the expected return of investing in asset M alone

A: Expected Return = (probability of boom*return on boom)+(probability of normal*return on…

Q: If a financial asset has an expected return that is greater than what is necessary to compensate for…

A: If expected return is more than necessary for compensating risk, investors are earning alpha return…

Step by step

Solved in 3 steps

- What does Jensen's alpha measure? a. An investor's reward in proportion to their assumption of systematic risk b. The abnormal return of an asset, defined as the degree to which its actual return exceeds that predicted by the capital asset pricing model c. The degree to which diversifiable risk is eliminated d. How much reward an investor is getting for each unit of risk assumedFinance Combining two assets having perfectly negatively correlated returns will result in the creation of a portfolio with an overall risk that: Group of answer choices decreases to a level below that of either asset. remains unchanged. increases to a level above that of either asset. stabilises to a level between the asset with the higher risk and the asset with the lower risk.In order to benefit from diversification, the returns on assets in a portfolio must: Answer a. Not be perfectly positively correlated b. Have the same idiosyncratic risks c. Be perfectly positively correlated d. Be perfectly negatively correlated

- Which of the following statements describing the elements of intrinsic valuation is most accurate? a. A simple calculation of present values of expected cashflows of different investments using the risk free rate would be enough to determine which asset is best. b. The risk-free rate is the lowest rate that an investor can earn from short-term investments.c. When the present value of the cashflows is discounted with the appropriate rate end this present value is positive, then the asset providing these cashflows have a value to the investor. d.Cashflows may include depreciatipon expenses and amortization costs.When adding a risky asset to a portfolio of may risky assets, which property of the asset has a greater influence on risk: its standard deviation or its covariance with other assets? ExplainWhich of the following statements describing the elements of intrinsic valuation is most accurate? A.) When the present value of the cashflows is discounted with the appropriate rate and this present value is positive, then the asset providing these cashflows has a value to the investor. B.) The risk-free rate is the lowest rate that an investor can earn from short-term investments. C.) Cashflows may include depreciation expenses and amortization costs. D.) A simple calculation of present values of expected cashflows of different investments using the risk free rate would be enough to determine which asset is best.

- Whenever you make an investment decision, you need to consider its impacts on the diversification of your portfolio and the allocation of your assets. a. false b. depends c. maybe d. trueDiversification refers to the _________.a. reduction of the stand-alone risk of an individual investment, measured by its beta coefficient, by combining it with other investments in a portfolio b. reduction of the stand-alone risk of an individual investment, measured by the standard deviation of its returns, by combining it with other investments in a portfolio c. reduction of systematic risk of an individual, measured by its beta coefficient, by combining it with other investments in a portfolio d. reduction of systematic risk of an individual, measured by the standard deviation of its returns, by combining it with other investments in a portfolio e. reduction of the unsystematic risk of an individual, measured by its coefficient of variation, by combining it with other investments in a portfolioThe Capital Asset Pricing Model (CAPM) asserts that an asset’s expected return is equal to the risk-free rate plus a risk premium for: a. Volatility b. Systematic risk c. Non-systematic risk d. Diversification e. Marginal utility of consumption

- Which of the following is true of risk-return trade off? A) Risk can be measured on the basis of variability of return. B) Risk and return are inversely proportional to each other. C) T-bills are more riskier than equity due to imbalances in government policies. D) Riskier investments tend to have lower returns.Indicate whether its True or False. Then write the explanation! In the presence of diversification benefits, when we combine two assets together into a portfolio, the systematic risk of the portfolio will be less than the weighted average systematic risk of the individual assets in the portfolio.Benefits of diversification. What is the expected return of investing in asset M alone?