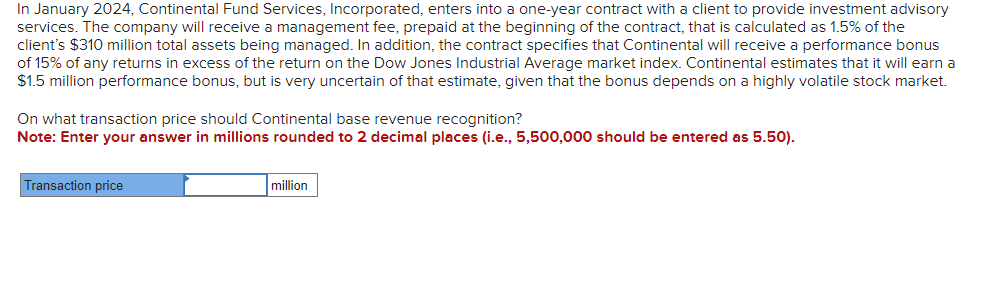

In January 2024, Continental Fund Services, Incorpo services. The company will receive a management f client's $310 million total assets being managed. In a of 15% of any returns in excess of the return on the

Q: In early December Alice and Bob decided to open Sample Cafe with $15,000 of their own money and…

A: Financial statement means statement which shows the financial position as on date and financial…

Q: The following transactions of Berain Manufacturers, that uses the perpetual inve 2024 in respect of…

A: First in first out method (FIFO) method 28 February 2024 :- ending inventory360 units at 35.50 per…

Q: Ruby Company produces a chair for which the standard specifies 5 yards of material per unit. The…

A: DIRECT MATERIALS COST VARIANCEDirect materials cost variance is the difference between the actual…

Q: Beckett Company received its bank statement for the month ending June 30, 2022, and reconciled the…

A: Bank reconciliation statement :— It is the statement that shows the reconciliation of balance as per…

Q: Solomon Information Services, Incorporated, has two service departments: human resources and…

A: Cost allocation is the process of relieving the cost centers of common service organizations that…

Q: Jax Incorporated reports the following data for its only product. The company had no beginning…

A: The cost of goods sold includes the cost of goods that are sold during the period. The gross profit…

Q: Revenue Raw materials Wages Utilities Rent Insurance Miscellaneous Revenue Expenses: Fixed Element…

A: Variance is the difference between actual data and planned data. Variance can be for revenue or for…

Q: The net income reported on the income statement for the current year was $287,618. Depreciation…

A: Cash flow statement :— It is one of the financial statements that shows change in cash and cash…

Q: The following summarizes Tesla's merchandising activities for the year. Cost of merchandise sold to…

A: Merchandise purchase, net = Merchandise inventory, gross - Purchase return and allowances - purchase…

Q: Required: Compute Berclair's basic and diluted earnings per share for the year ended December 31,…

A: Earnings per share:EPS is the ratio between the net profit and outstanding shares of the company. It…

Q: On 1/1/21, Sargento leased equipment under a two-year operating lease agreement from Great American…

A: An agreement of contract that is prepared to transfer the right to use the resources for a…

Q: Required information [The following information applies to the questions displayed below] As of…

A: Financial Statements:There are several steps for preparing financial statements,journal entryLedger…

Q: Rutland Business Services (RBS) provides miscellaneous consulting and services to local businesses.…

A: The service revenue by providing services to the customers by a company. For earnings service…

Q: Hoi Chong Transport, Limited, operates a fleet of delivery trucks in Singapore. The company has…

A: Variable cost is the cost that changes with change in the activity of cost driver used. The variable…

Q: Which statement regarding the current Form W-4 is accurate? Answer: A. It uses fewer…

A: Form W-4 is an Internal Revenue Service (IRS) tax form that employees complete to provide their…

Q: Annin Laboratories uses the FIFO method to account for its work-in-process inventories. The…

A: The equivalent units are calculated on the basis of the percentage of the work completed during the…

Q: a. Calvin's AGI is $140,000. Charitable contribution deduction Carryover 0

A: Adjusted Gross Income is the gross income after adjusting certain specific deductions.

Q: Waterway Company purchased equipment on January 1 at a list price of $121500, with credit terms…

A: Total cost is the amount of money incurred by the entity on the making and selling of the goods or…

Q: Requirements 1. Prepare the April income statement using variable costing. 2. Determine the product…

A: Income statement :— It is one of the financial statements that shows the profitability, total…

Q: 1.1) Calculate and advise if there were there any additions to or disposals of property, plant and…

A: There are two types of assets(1) Current assets : these are the assets which is converted into…

Q: Clarks Incorporated, a shoe retailer, sells boots in different styles. In early November, the…

A: Journal entry refers to the systematic documentation of the financial transactions of a company in…

Q: Steps in the accounting cycle Rearrange the following steps in the accounting cycle in proper…

A: Accounting cycle is a series of different steps starting from the identification of a transaction,…

Q: Cherokee Incorporated is a merchandiser that provided the following information: Number of units…

A: Income Statement :Which reveals the actual position of a firm, whether the firm making is a profit…

Q: How much is the cost of goods available for sale on the Schedule of Cost of Goods Sold?

A: Cost of goods sold refers to the direct cost of producing the product for sale.It includes direct…

Q: Consider the following financial information and answer the questions that follow: Sales :…

A: Operating Cash Flow (OCF) can be calculated using the following formula:OCF = EBIT + Depreciation -…

Q: The cost accounting system at McClellan allocates overhead to products based on direct labor cost.…

A: Direct material cost is the cost of raw material produced or purchased to produce the final…

Q: Required information [The following information applies to the questions displayed below.] O'Brien…

A: The income statement can be prepared using various methods as variable costing, absorption costing,…

Q: Prepare a schedule of the cost of the goods manufactured 2. Prepare the multi-step income statement…

A: The cost of goods manufactured refers to all the production cost involved in producing the…

Q: Kai is the president of Zebra Antiques

A: To reduce social security overpayment and unanticipated benefit loss, benefit analysis report…

Q: Pay Corporate Secretary Wages $1,457 Advertising Expense $1,809 Depreciation Expense (factory…

A: Overheads means all type of indirect costs and expenses being incurred in business. These costs can…

Q: ohn and Jamie Kerr (ages 67 and 64, respectively) do not claim any dependents on their joint tax…

A: Taxable income refers to the portion of an individual's income that is subject to income tax. It is…

Q: Charlize Theron has been put on 'fast track' to becoming a partner in one of the Big 4 accounting…

A: Everyone before accepting the offer of becoming a partner to the partnership firm or even for the…

Q: QUESTIONS: Direction: Journalize the following transactions and post the accounts to the general…

A: Journal means the book of original entry where the first time entry is passed. Journal book will…

Q: Enter the following December 31 normal balances in the first row of T-accounts below: K. Korver,…

A: Closing entries are those which are recorded in the books at the end of the period for the purpose…

Q: A machine was purchased for $54,000 and it was estimated to have a $9,000 salvage value at the end…

A: Depreciation is considered an expense charge on the value of the asset. It can be calculated by…

Q: Which of the following is desirable in a good system of i

A: Internal accounting controls cover a wide range of topics, including division of roles,…

Q: Current Attempt in Progress 40 Crane Oil Imports is a partnership owned by Magda William and Giannis…

A: Partnership Firm is an organization where an agreement is formed between two or more individuals for…

Q: which of the followingtaxpayers has a deductible loss from identity thief? ashen he hasnt received…

A: Deductible losses refer to financial losses that can be subtracted or deducted from a person's or…

Q: The adjusted trial balance of Pacific Scientific Corporation on December 31, 2024, the end of the…

A: Income statement is one of the financial statements that shows the profitability, total revenue and…

Q: Explain the purpose of identifying related parties and importance of disclosing related party…

A: International Accounting Standard (IAS) 24,"Related Party Disclosures," is an accounting standard…

Q: REI sells snowboards. Assume the following information relates to REI's purchases of snowboards…

A: The inventory can be valued using various methods as FIFO, LIFO and average method. Using average…

Q: PetPro Corporation sells three products: dog beds, cat beds, and fish tanks. The following…

A: Breakeven is the point at which an entity is in a situation of no profit and no loss. At this point,…

Q: QUESTIONS: Direction: Prepare Trial Balance of balance, Income Statement, and Owner's Equity. In…

A: As per dual concept of accounting, every transaction has dual impact on the books of accounts.Trial…

Q: Sandhill Tools manufactures lawnmowers, weed-trimmers, and chainsaws. Its sales mix (as a percentage…

A: The break even point is the sales level at which the net operating income of the company is zero or…

Q: What were Lore's 2005 net credit sales?

A: The account receivable turnover ratio indicates the number of times the average debtors have been…

Q: Bramble Inc. is considering the following alternatives: Alternative 1 Alternative 2 $119000 65100…

A: Variable cost means the cost which vary with the level of output which means that variable cost…

Q: Current Attempt in Progress Culver Inc. reports under IFRS and has adopted the policy of classifying…

A: CASH FLOW STATEMENTCash flow statement provides additional information to user of financial…

Q: Present value of bonds payable; premium Moss Co. issued $140,000 of five-year, 13% bonds, with…

A: Since you have posted multiple questions, we have answered first question for you. Kindly repost and…

Q: Kronk, Incorporated provides the following information concerning the work in process at its plant:…

A: Material is the cost which is incurred by the entity on the making of the goods. It is a direct…

Q: Munoz Company is a retail company that specializes in selling outdoor camping equipment. The company…

A: Hi studentSince there are multiple subparts asked, we will answer only first three subparts.Budgets…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- On March 1, 2019, Elkhart enters into a new contract to build a specialized warehouse for 7 million. The promise to transfer the warehouse is determined to be a performance obligation. The contract states that if the warehouse is usable by November 30, 2019, Elkhart will receive a bonus of 600,000. For every week after November 30 that the warehouse is not usable, the bonus will decrease by 150,000. Elkhart provides the following completion schedule: Required: 1. Assume that Elkhart uses the expected value approach. What amount should Elkhart use for the transaction price? 2. Assume that Elkhart uses the most likely amount approach. What amount should Elkhart use for the transaction price? 3. Next Level What is the purpose of assessing whether a constraint on the variable consideration exists?On January 1, 2019, Mopps Corp. agrees to provide Conklin Company 3 years of cleaning and janitorial services. The contract sets the price at 12,000 per year, which is the normal standalone price that Mopps charges. On December 31, 2020, Mopps and Conklin agree to modify the contract. Mopps reduces the fee for the third year to 10,000, and Conklin agrees to a 4-year extension that will extend services through December 31, 2024, at a price of 15,000 per year. At the time that the contract is modified, Mopps is charging other customers 13,500 for the cleaning and janitorial service. Required: Should Mopps and Conklin treat the modification as a separate contract? If so how should Mopps account for the contract modification on December 31, 2020? Support your opinion by discussing the application to this case of the factors that need to be considered for determining the accounting for contract modifications.In January 2021, Continental Fund Services, Inc., enters into a one-year contract with a client to provide investment advisory services. The company will receive a management fee, prepaid at the beginning of the contract, that is calculated as 1% of the client’s $150 million total assets being managed. In addition, the contract specifies that Continental will receive a performance bonus of 20% of any returns in excess of the return on the Dow Jones Industrial Average market index. Continental estimates that it will earn a $2 million performance bonus, but is very uncertain of that estimate, given that the bonus depends on a highly volatile stock market. On what transaction price should Continental base revenue recognition?

- In January 2018, Continental Fund Services, Inc., enters into a one-year contract with a client to provide investment advisory services. The company will receive a management fee, prepaid at the beginning of the contract,that is calculated as 1% of the client’s $150 million total assets being managed. In addition, the contract specifiesthat Continental will receive a performance bonus of 20% of any returns in excess of the return on the Dow JonesIndustrial Average market index. Continental estimates that it will earn a $2 million performance bonus, but isvery uncertain of that estimate, given that the bonus depends on a highly volatile stock market. On what transaction price should Continental base revenue recognition?On January 1, 2023, Caramel Company enters into a contract with Keystone Inc. to perform asset management servcies for one year. Caramel Company receives a quarterly management fee of 2% of Keystone's assets under management at the end of each quarter. Caramel Company also receives a performance-based incentive fee of 10% of the fund's return in excess of the return of an observable index at the end of the year. When should Caramel Company recognize the revenue from the management fee and the performance based incentive fee?On January 2, 2019, TI enters into a contract with Drewry Corp. to build a new piece of equipment. The contract price is $3,000,000, and construction is expected to take 18 months. Drewry is billed and pays $1,500,000 of the contract price on January 2, 2019, and will pay the balance at completion. TI estimates that the cost of construction will be $2,100,000. Drewry includes two performance bonuses in the contact: • U.S. Bonus: If the equipment design receives a U.S. patent by March 15, 2020, Drewry will pay a $300,000 bonus. • International Bonus: If the equipment receives approval for international distribution by January 31, 2020, Drewry will pay a $1,000,000 bonus. The bonuses are payable when a U.S. patent is approved and when international distribution is approved. On the date the contract is signed, TI estimates that there is an 80% chance it will receive U.S. patent protection by March 15, 2020, but only a 30% chance that the equipment will be approved for…

- On January 2, 2019, TI enters into a contract with Drewry Corp. to build a new piece of equipment. The contract price is $3,000,000, and construction is expected to take 18 months. Drewry is billed and pays $1,500,000 of the contract price on January 2, 2019, and will pay the balance at completion. TI estimates that the cost of construction will be $2,100,000. Drewry includes two performance bonuses in the contact: • U.S. Bonus: If the equipment design receives a U.S. patent by March 15, 2020, Drewry will pay a $300,000 bonus. • International Bonus: If the equipment receives approval for international distribution by January 31, 2020, Drewry will pay a $1,000,000 bonus. The bonuses are payable when a U.S. patent is approved and when international distribution is approved. On the date the contract is signed, TI estimates that there is an 80% chance it will receive U.S. patent protection by March 15, 2020, but only a 30% chance that the equipment will be approved for…On Jan. 1, 2022, ABC Corporation would be entering into an outsourcing contract which requires payment of P100,000 annually for the first five years starting Dec. 31, 2022 and P150,000 annually for ten years after that. Assuming that ABC has an effective cost of capital of 8%, what is the equivalent annual cost of this contract?On June 1, 2021, Consulting Inc. enters into a contract with a customer to build a website for its start-up business for $100,000, plus a possible performance bonus. The contract includes the creation of the website to communicate information about the customer’s products, to sell products, and to collect payment for the products. The target completion date for the project is October 22, 2021. The pricing of the customized website includes a potential performance bonus to be paid to Consulting Inc. if the website is completed between October 1 - October 22, 2021. The performance bonus will be reduced each week closer to the October 22, 2021 deadline. A bonus will not be paid if the project is completed after October 22, 2021. Based on Consulting Inc.’s historical experience and the assessment of its current capabilities, the potential bonuses/probability are summarized in the table below: Completion Date Probability of Outcome Performance Bonus October 1, 2021…

- Blue Spruce Corp. enters into a contract with a customer to build an apartment building for $830,000. The customer hopes to rent apartments at the beginning of the school year and offers a performance bonus of $165,000 to be paid if the building is ready for rental beginning August 1, 2020. The bonus is reduced by $55,000 each week that completion is delayed. Blue Spruce commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2020 70 % August 8, 2020 20 August 15, 2020 5 After August 15, 2020 5 Determine the transaction price for this contract, assuming Blue Spruce is only able to estimate whether the building can be completed by August 1, 2020, or not. (Blue Spruce estimates that there is a 70% chance that the building will be completed by August 1, 2020.) Transaction price : ……………? Determine the transaction price for…SAPPHIRE CO. charges new franchisees an initial fee of P5,000,000. Of this amount, P2,000,000 is payable in cash when the agreement is signed, and the remainder is to be paid in three equal annual installments which are evidenced by an interest-bearing promissory note. In consideration therefore, SAPPHIRE CO. will assist in locating the business site, conduct a market study to estimate earnings potential, supervise construction of a building, and provide initial training to employees. On December 3, 2021, Sapphire Co. entered into a franchising agreement with EMERALD, INC. by the end of the year, SAPPHIRE CO. has completed about 25% of the initial services at a cost of P300,000 and it has ascertained that collection of the notes is reasonably assured. For 2021, SAPPHIRE CO. should recognized franchise revenue of:A. 5,000,000 C. 1,700,000B. 2,000,000Culver Corp. enters into a contract with a customer to build an apartment building for $970,000. The customer hopes to rent apartments at the beginning of the school year and offers a performance bonus of $171,000 to be paid if the building is ready for rental beginning August 1, 2020. The bonus is reduced by $57,000 each week that completion is delayed. Culver commonly includes these completion bonuses in its contracts and, based on prior experience, estimates the following completion outcomes: Completed by Probability August 1, 2020 70 % August 8, 2020 20 August 15, 2020 5 After August 15, 2020 5 Determine the transaction price for this contract, assuming Culver is only able to estimate whether the building can be completed by August 1, 2020, or not. (Culver estimates that there is a 70% chance that the building will be completed by August 1, 2020.) Transaction price $…