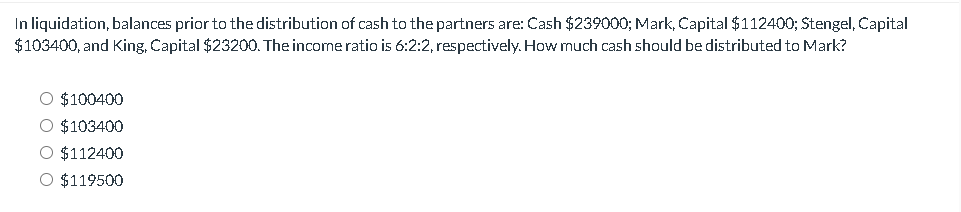

In liquidation, balances prior to the distribution of cash to the partners are: Cash $239000; Mark, Capital $112400; Stengel, Capital $103400, and King, Capital $23200. The income ratio is 6:2:2, respectively. How much cash should be distributed to Mark? $100400 $103400 $112400 $119500

Q: any has two manufacturing departments-Molding and Fabrication. Estimated data Molding Fabrication…

A: The overhead is applied to the production on the basis of the pre-determined overhead rate. The…

Q: Riverside Inc. makes one model of wooden canoe. Partial information for it follows: Number of Canoes…

A: Variable cost per unit = Total variable costs / Nos of unitsFixed cost per unit = Total fixed costs…

Q: The managing partner at Mina's Accounting Service typically hires one part-time intern to complete…

A: The objective of the question is to calculate the total cost of services that Mina should budget for…

Q: Question 2 Suppose Cyberdyne Systems creates a Professional version of its machine learning…

A: The objective of the question is to determine the optimal pricing strategy for Cyberdyne Systems to…

Q: Three independent situations are given. Each describes a finance lease in which annual lease…

A: A lease is a contractual agreement between two parties, ordinarily a lessor (proprietor) and a…

Q: Assume Avaya contracted to provide a customer with Internet infrastructure for $2,250,000. The…

A: Revenue:Revenue refers to gross revenue. It is the sum of all the sources where the company earns…

Q: On October 15, 2023, the board of directors of Martinez Materials Corporation approved a stock…

A: Answer:- Stock options provide the investor with a choice to purchase or sell the options or stock…

Q: Boston Home Center (BHC) offers customers the use of a truck at $66 per trip to take purchased…

A: In Activity Based Costing, activity rate is used to allocate overhead. According to the used of…

Q: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases.…

A: The tax liability refers to the amount of tax that is required to be paid which depends on the…

Q: Give me correct answer with explanation..h

A: Non Current Assets are the assets which are not current assets. They will generate benefits for a…

Q: Sandhill Inc. sells prepaid telephone cards to customers in its convenience stores. When Sandhill…

A: As per the revenue recognition principle, the revenue is required to be reported when the revenue is…

Q: Consider the following information for Maynor Company, which uses a perpetual inventory system:…

A: FIFO method : Under FIFO method , The inventory which is purchased first is given first preference…

Q: Wildlife Wholesale Supply sold birdseed to a retailer for $860, receiving cash at the time of sale.…

A: (1) Debit what comes in, Credit what goes out.(2) Debit all expenses and losses, Credit all incomes…

Q: Exercise 7-13 (Algo) Computing ABC Product Costs [LO7-3, LO7-4] Fogerty Company makes two…

A: Activity Rate :— It is the rate used to allocate manufacturing overhead cost to cost object under…

Q: a. Complete the schedule of cash payments for inventory purchases by filling in the missing amounts.…

A: A cash payment schedule shows the estimated payments to be made in each specified period. It helps…

Q: 9. Create a PivotTable and complete the following fixed asset schedule. Future Electronics will…

A: Depreciation is an accounting method where the value of the asset is reduced over a period of time.…

Q: Hammond Manufacturing Inc. was legally incorporated on January 2, 2023. Its articles of…

A: The journals are posted to record the business transactions in the accounting record. The respective…

Q: 1. Explain with examples the purpose, usefulness, and limitations of the Income Statement and the…

A: Income Statement:The income statement, also known as the profit and loss statement or statement of…

Q: [The following information applies to the questions displayed below.] This year Diane intends to…

A: To find Diane's Adjusted Gross Income (AGI) with the additional income from the partnership, we need…

Q: DMH Corporation sold Sugar Frosted Cocoa Bombs, a children's breakfast cereal. As a promotion, DMH…

A: Postage expenses are a crucial factor to take into account when creating a budget and making…

Q: Kamili Company reported the following income statement items for 20X1: Sales: $100,000 Net Income…

A: Profit, after expenses also known as income or earnings is an indicator of how well a company is…

Q: A company acquired an item of plant under a finance lease on 1 April 2007. The present value of the…

A: A lease a contractual agreement whereby one party grants the other party the right to use the asset…

Q: Question content area top Part 1 Zephron Music purchased inventory for $ 4 comma 200 and also paid a…

A: Zephron Music's final cost of the inventory that it kept is approximately $3,673.…

Q: Sheri is a car distributor in a rural area. She has customers that own relatively old cars. To…

A: InventoryInventory is the material available to the company for the process of production and sale.…

Q: Sheridan Grocers has a reward program by which credit is provided on account every time a customer…

A: Liability means the amount which is to be paid to an outsider by business. It is the present…

Q: Tracy Company, a manufacturer of air conditioners, sold 100 units to Thomas Company on November 17,…

A: Journal Entry :— It is an act of recording transactions in books of account when transaction…

Q: On January 1, 2023, Ivanhoe Corp. signed a ten-year non-cancellable lease for new machinery. The…

A: Lease is a financial arrangement in which one party agrees to grant the right of use assets to other…

Q: GrandSlam Incorporated incurred the following costs during March: Selling expenses Direct labor…

A: Summary of Answers:a. COGM $940,800 ; Average Cost per Unit $49b. COGS $543,900c. Difference of…

Q: Determine the tax liability, marginal tax rate, and average tax rate in each of the following cases.…

A: 1. Tax Liability: Tax liability refers to the total amount of tax owed to the government based on an…

Q: Marilyn, age 38, is employed as an architect. For calendar year 2023, she had AGI of $100,000 and…

A: Deductions The amount that a person or individual will reduce from the gross income earned is called…

Q: On June 1, 2025, Sandhill Company sells $165,000 of shelving units to a local retailer, Sweet…

A: Solution:-The inquiry pertains to the journal entries that Sandhill Company records in a particular…

Q: 3 5 points 00:34:04 Mcconkey Corporation produces and sells a single product. The company's…

A: The objective of the question is to recalculate the contribution format income statement of Mcconkey…

Q: what is the p value for the last two it is not the same as the first one.

A: a. H1:μY−μN>0p-value: 0.276Conclusion: Therefore, fail to reject the null hypothesis. The data…

Q: Ruiz Company provides the following budgeted sales for the next four months. The company wants to…

A: PRODUCTION BUDGETA production budget is a financial plan that outlines the expected quantity and…

Q: min.6

A: The objective of the question is to identify which of the given expenses can be claimed as a tax…

Q: A couple would like to accumulate $20,000 in 3 years as a down payment on a house, by making…

A: The objective of the question is to find out the amount of weekly deposit that the couple needs to…

Q: Which of the following would depict a logical order for (1) forecasting tax expense, (2) forecasting…

A: Forecasting is a process of estimating the future outcomes well in advance so that informed decision…

Q: Larner Corporation is a diversified manufacturer of industrial goods. The company's activity-based…

A: ACTIVITY BASED COSTINGActivity Based Costing is a Powerful tool for measuring…

Q: Exercise 1-11 (Algo) Cost Behavior; Contribution Format Income Statement [LO1-4, LO1-6] Harris…

A: Variable cost is the cost that changes with change in the activity of cost driver used. The variable…

Q: Direct Organic Paid Search First-Click Interaction 145 Conversions 30 Conversions 147 Conversions…

A: Based on the table provided, the first channel for customers to discover the website is most likely…

Q: The Gourmand Cooking School runs short cooking courses at its small campus. Management has budgeting…

A: The flexible budget performance report is prepared to compare the actual and planned production…

Q: (a) Compute the amount of cash and cash equivalents to be reported on Crane Co's balance sheet at…

A: Cash refers to physical currency or money in the form of notes and coins that a company has on hand,…

Q: Brady Sports began operations on January 2, 2025. The following stock record card for footballs was…

A: LIFO (last in, first out) is an inventory valuation method that determines the cost of goods sold…

Q: Prepare the company's cash budget for the upcoming fiscal year.

A: Budgeting is the process of estimating future income and expenses for a specified period of time.…

Q: Required information [The following information applies to the questions displayed below.] Hughes…

A: Gross Profit is the profit earned by the organization after deducting costs incurred on the goods.…

Q: The property is a specialty retail property (which is interesting, but not relevant to the…

A: ATIRR stands for 'After-Tax Internal Rate of Return' in the field of accounting. It is a metric used…

Q: On December 31, 2023, Berclair Incorporated had 320 million shares of common stock and 9 million…

A: Earnings per share is the earnings per common share available to common stockholders of the company.…

Q: The following information relates to Splish Brothers Ltd.'s inventory transactions during the month…

A: FIFO is first in first out which means inventory bought first is sold first.Inventory means the…

Q: Ayayai Automotive is looking to expand its operations and has approached Dynatech Garage to acquire…

A: The objective of this question is to record the journal entry for the purchase of Dynatech Garage by…

Q: am.201.

A: The objective of the question is to calculate the unit product cost for one storage cabinet using…

Step by step

Solved in 3 steps

- The balance sheet of Maroon and White was as follows immediately prior to the partnership's being liquidated: cash, P20,000; other assets, P160,000; liabilities, P40,000; Maroon capital, P60,000; White capital, P80,000. The other assets were sold for P139,000. Maroon and White share profits and losses in a 2:1 ratio. As a final cash distribution from the liquidation, how much cash will Maroon receive? Prepare a statement of liquidation.After all noncash assets have been converted to cash in the liquidation of MM Partnership, the ledger contains the following account balances: Debit balances: Cash: P 34, 000; Mae, Capital: P 8, 000; Credit balances: A/P: P 25, 000; Mae, Loan: P 9, 000; Mila, Capital: P 8, 000. After paying the A/P of P25, 000, available cash should be distributed toIn liquidation, balances prior to the distribution of cash to the partners are: Cash P255,000; Moore, Capital P140,000; Simon, Capital P130,000, and Kelly, Capital P30,000. The income ratio is 6:2:2, respectively. How much cash should be distributed to Simon if Kelly does not pay his deficiency? -P122,500 -P130,000 -P126,250 -P118,750 the Following are classified under PPE Except? -Building -Land -Machinery -All are PPE Which of the following is considered as a Cash Equivalent? -Check -Postal money Order -Treasury Bill Issued 5 Months Ago , Acquired and Maturing 4 months from now -Treasury Bill Issued 1 year ago Acquired and Maturing 3 months from now

- Prior to the distribution of cash to the partners, the accounts in the Blossom Company are Cash $32,400; Vogel, Capital (Cr.) $19,200; Utech, Capital (Cr.) $17,200; and Pena, Capital (Dr.) $4,000. The income ratios are 5:3:2, respectively. Blossom Company decides to liquidate the company.Slick, Tony and Sam partnership began the process of liquidation with the following account balances: Cash 16,000 Non-cash assets 434,000 Liabilities 150,000 Slick, Capital (30%) 80,000 Tony, Capital (20%) 90,000 Sam, Capital (50%) 130,000 Liquidation expenses are expected to be P12,000. After the liquidation expenses of P12,000 had been paid and the non-cash assets sold, Sam had a deficit of P8,000. Assuming all partners are personally insolvent, how much is the final settlement to Tony? P24,000 P34,800 P36,000 P37,200Partners E, F, and G who share profits and losses in the ratio of 2: 2: 1, respectively decided to liquidate. The condensed statement of financial position immediately prior to the liquidation shows the following: Cash P 400,000 Non-cash Assets 1,600,000 Liabilities 560,000 E, Loan 40,000 E, Capital 180,000 F, Capital 420,000 G, Capital 800,000 After paying liabilities to partnership creditors, cash of P830,000 is available for distribution to partners. Any…

- After all the non-cash assets have been converted into cash in the liquidation of Sun and Star Partnership, the ledger contains the following account balances: Cash-P141,000: Accounts Payable - P 96,000; Sun, Loan - P 45,000: Sun, Capital -(P21.000); Star, Capital - P21,000. How much is the final settlement to Sun assuming cash of P 96,000 is paid to Accounts Payable?After all the non-cash assets have been converted into cash in the liquidation of Sun and Star Partnership, the ledger contains the following account balances: Cash - P141,000; Accounts Payable - P 96,000; Sun, Loan - P 45,000; Sun, Capital -(P21,000); Star, Capital - P21,000. How much is the final settlement to Sun assuming cash of P 96,000 is paid to Accounts Payable? how much is the final settlement to Star?The Drysdale, Koufax, and Marichal partnership has the following balance sheet immediately prior to liquidation: Cash . . . . . . . . . . . . . . . . . . . $ 36,000 Liabilities . . . . . . . . . . . . . .. . $50,000Noncash assets . . . . . . . . . 204,000 Drysdale, loan . . . . . . . . . . . 10,000Drysdale, capital (50%) . .. . 70,000Koufax, capital (30%) . . . . . 60,000Marichal, capital (20%) . . . 50,000 a. Liquidation expenses are estimated to be $15,000. Prepare a predistribution schedule to guide the distribution of cash.b. Assume that assets costing $74,000 are sold for $60,000. How is the available cash to be divided?

- Before liquidation, the following is the financial position of the partnership W, X, Y and Z: W, capital 275,000 W, loan 50,000 X, capital 225,000 Y, capital 257,500 Z, capital 342,500 P&L ratio is 4:3:2:1, respectively. 300,000 was received from certain assets are sold and are distributed to partners. What cash amount should Z receive? a. 300,000 b. 0 c. 135,834 d. 166,166The balance sheet of Morgan and Rockwell was as follows immediately prior to the partnership's liquidation: cash, $20,500; other assets, $141,300; liabilities, $26,800; Morgan, capital, $64,000; Rockwell, capital, $71,000. The other assets were sold for $120,900. Morgan and Rockwell share profits and losses in a 2:1 ratio. As a final cash distribution from the liquidation, Morgan will receive cash totalingCarney, Pierce, Menton, and Hoehn are partners who share profits and losses on a 4:3:2:1 basis, respectively. They are beginning to liquidate the business. At the start of this process, capital balances are Carney, capital $ 67,000 Pierce, capital 29,100 Menton, capital 50,000 Hoehn, capital 22,100 Which of the following statements is true? Multiple Choice Carney will collect a portion of any available cash before Hoehn receives money. Carney will be the last partner to receive any available cash. The first available $4,100 will go to Hoehn. The first available $5,800 will go to Menton.