in Market X. You note that Market Y would also be a great place for a marketing campaign. The cost of a campaign in Y wou $300K. You present the firm's CFO with two options. A) Run a campaign in just Market X. B) Run a campaign in both X and funding the Y campaign with a long term loan from Bank of China with a 10% annual interest rate. Here is more relevant fir information: Notes for Plan B Loan amount for B) Debt int. rate is: 300 K 10.0% Projected Annual Income Statements for marketing campaigns (SK) Estimated Sales Generated from Campaign(s) Direct Campaign Cost Required Interest Cost @10% Campaign Net Income Plan Plan A 1200.00 -800.00 B 750.00 500.00 0.00 250.00 Campaign Profit Margin Use this info to answer the following questions. Question 19 Vhich Plan is Riskier and Why? Choose one plan and one reason.

in Market X. You note that Market Y would also be a great place for a marketing campaign. The cost of a campaign in Y wou $300K. You present the firm's CFO with two options. A) Run a campaign in just Market X. B) Run a campaign in both X and funding the Y campaign with a long term loan from Bank of China with a 10% annual interest rate. Here is more relevant fir information: Notes for Plan B Loan amount for B) Debt int. rate is: 300 K 10.0% Projected Annual Income Statements for marketing campaigns (SK) Estimated Sales Generated from Campaign(s) Direct Campaign Cost Required Interest Cost @10% Campaign Net Income Plan Plan A 1200.00 -800.00 B 750.00 500.00 0.00 250.00 Campaign Profit Margin Use this info to answer the following questions. Question 19 Vhich Plan is Riskier and Why? Choose one plan and one reason.

Chapter7: Valuation Of Stocks And Corporations

Section: Chapter Questions

Problem 1kM

Related questions

Question

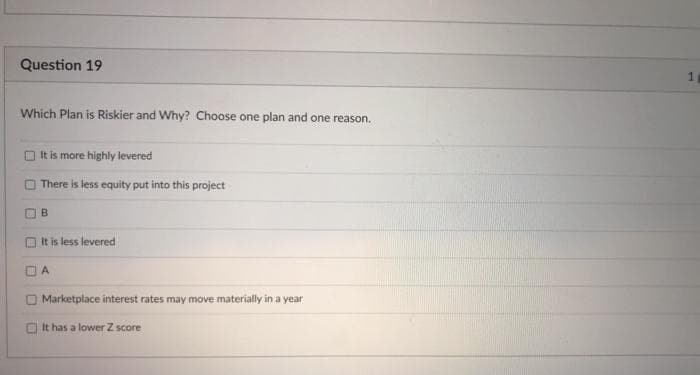

Transcribed Image Text:Question 19

Which Plan is Riskier and Why? Choose one plan and one reason.

O It is more highly levered

There is less equity put into this project

B

It is less levered

Marketplace interest rates may move materially in a year

O It has a lower Z score

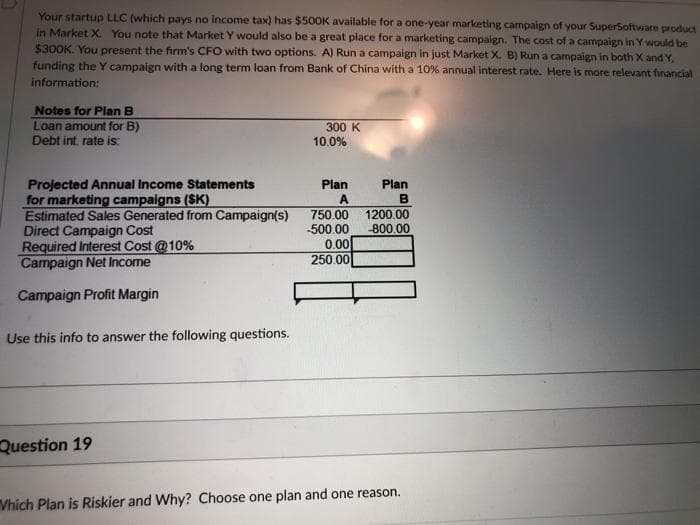

Transcribed Image Text:Your startup LLC (which pays no income tax) has $500K available for a one-year marketing campaign of your SuperSoftware product

in Market X. You note that Market Y would also be a great place for a marketing campaign. The cost of a campaign in Y would be

$300K. You present the firm's CFO with two options. A) Run a campaign in just Market X. B) Run a campaign in both X and Y,

funding the Y campaign with a long term loan from Bank of China with a 10% annual interest rate. Here is more relevant financial

information:

Notes for Plan B

Loan amount for B)

Debt int. rate is:

300 K

10.0%

Projected Annual Income Statements

for marketing campaigns (SK)

Estimated Sales Generated from Campaign(s)

Direct Campaign Cost

Required interest Cost @10%

Campaign Net Income

Plan

Plan

A

1200.00

-800.00

750.00

500.00

0.00

250.00

Campaign Profit Margin

Use this info to answer the following questions.

Question 19

Vhich Plan is Riskier and Why? Choose one plan and one reason.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you