In millions, except per share data Years ended December 31, 2019 2018 2017 REVENUES Sales by Company-operated restaurants Revenues from franchised restaurants $ 9,420.8 $ 10,012.7 $ 12,718.9 11,655.7 11,012.5 10,101.5 Total revenưes ...... .. 21,076.5 21,025.2 22,820.4 ..... ............. ... .................. OPERATING COSTS'AND EXPENSES Company-operated restaurant expenses Food & paper 2,980.3 3,153.8 4,033.5 Payroll & employee benefits Occupancy & other operating expenses ranchised restaurants-occupancy expenses 2,704.4 2,937.9 3,528.5 2,075.9 2,174.2 2,847.6 2,200.6 1,973.3 1,790.0 elling, general & administrative expenses ther operating (income) expense, net Total operating costs and expenses perating income erest expense-net of capitalized interest of $7.4, $5.6 and $5.3 2,229.4 2,200.2 2,231.3 (183.9) (236.8) (1,163.2) 12,006.7 12,202.6 13,267.7 8,822.6 981.2 9,069.8 9,552.7 1,121.9 921.3 ד

In millions, except per share data Years ended December 31, 2019 2018 2017 REVENUES Sales by Company-operated restaurants Revenues from franchised restaurants $ 9,420.8 $ 10,012.7 $ 12,718.9 11,655.7 11,012.5 10,101.5 Total revenưes ...... .. 21,076.5 21,025.2 22,820.4 ..... ............. ... .................. OPERATING COSTS'AND EXPENSES Company-operated restaurant expenses Food & paper 2,980.3 3,153.8 4,033.5 Payroll & employee benefits Occupancy & other operating expenses ranchised restaurants-occupancy expenses 2,704.4 2,937.9 3,528.5 2,075.9 2,174.2 2,847.6 2,200.6 1,973.3 1,790.0 elling, general & administrative expenses ther operating (income) expense, net Total operating costs and expenses perating income erest expense-net of capitalized interest of $7.4, $5.6 and $5.3 2,229.4 2,200.2 2,231.3 (183.9) (236.8) (1,163.2) 12,006.7 12,202.6 13,267.7 8,822.6 981.2 9,069.8 9,552.7 1,121.9 921.3 ד

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter3: The Adjusting Process

Section: Chapter Questions

Problem 3.1ADM

Related questions

Question

100%

Transcribed Image Text:Styles

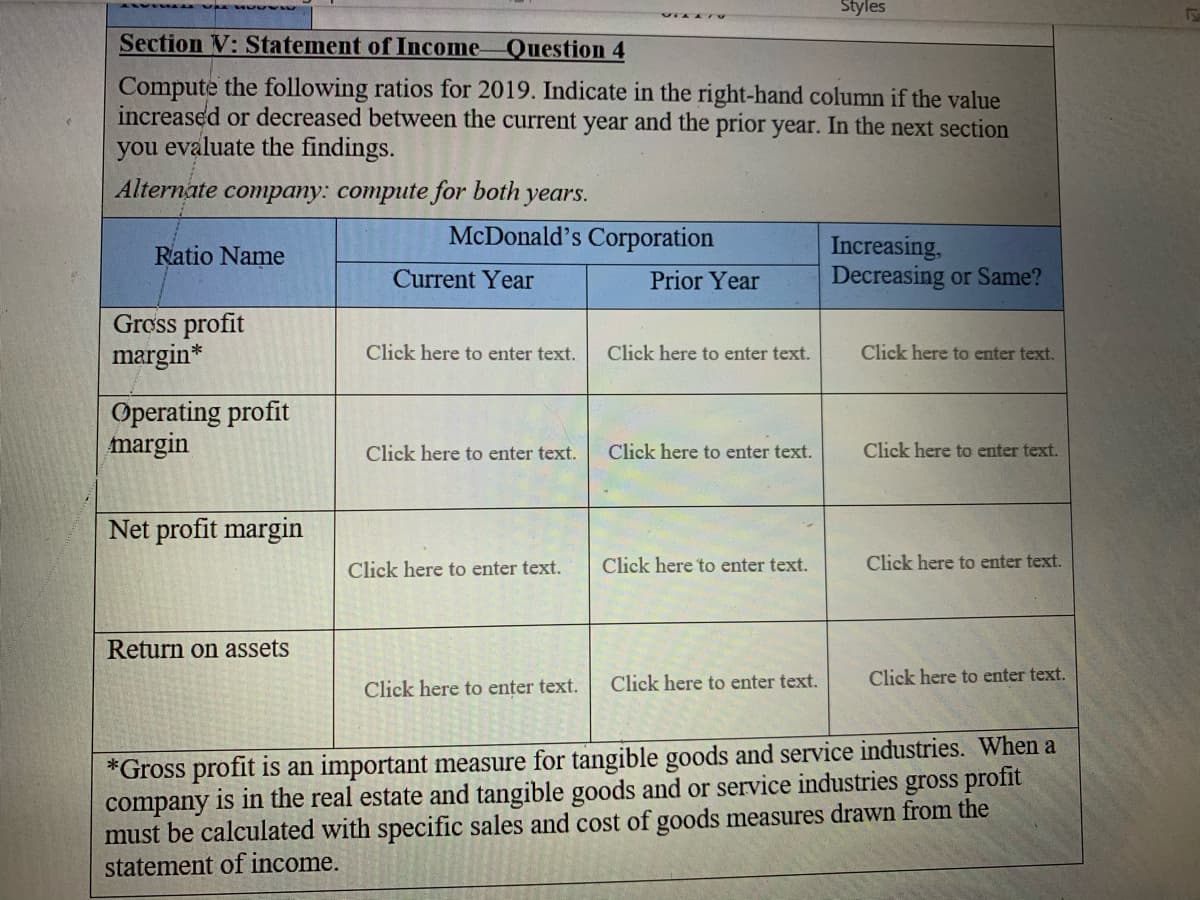

Section V: Statement of Income

Question 4

Compute the following ratios for 2019. Indicate in the right-hand column if the value

increased or decreased between the current year and the prior year. In the next section

you evaluate the findings.

Alternate company: compute for both years.

McDonald's Corporation

Increasing,

Decreasing or Same?

Ratio Name

Current Year

Prior Year

Gross profit

margin*

Click here to enter text.

Click here to enter text.

Click here to enter text.

Operating profit

margin

Click here to enter text.

Click here to enter text.

Click here to enter text.

Net profit margin

Click here to enter text.

Click here to enter text.

Click here to enter text.

Return on assets

Click here to enter text.

Click here to enter text.

Click here to enter text.

*Gross profit is an important measure for tangible goods and service industries. When a

company is in the real estate and tangible goods and or service industries gross profit

must be calculated with specific sales and cost of goods measures drawn from the

statement of income.

Transcribed Image Text:A Read aloud

7 Draw

H Highlight

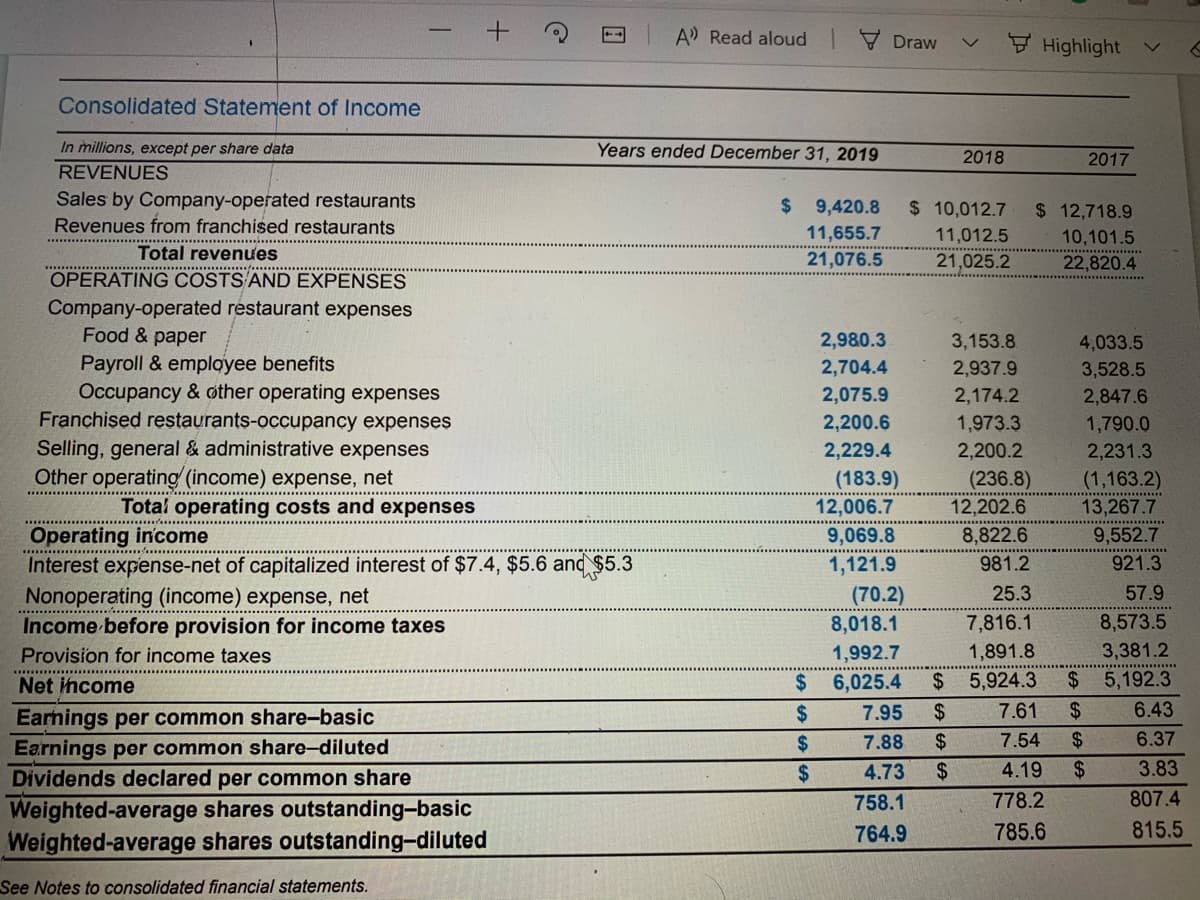

Consolidated Statement of Income

In millions, except per share data

Years ended December 31, 2019

2018

2017

REVENUES

Sales by Company-operated restaurants

Revenues from franchised restaurants

%24

9,420.8

$ 10,012.7

$ 12,718.9

11,655.7

11,012.5

10,101.5

Total revenues

21,076.5

21,025.2

22,820.4

............................

OPERATING COSTS'AND EXPENSES

Company-operated restaurant expenses

Food & paper

2,980.3

3,153.8

4,033.5

Payroll & emplgyee benefits

Occupancy & other operating expenses

Franchised restaurants-occupancy expenses

Selling, general & administrative expenses

Other operating (income) expense, net

2,704.4

2,075.9

2,937.9

3,528.5

2,174.2

2,847.6

2,200.6

1,973.3

1,790.0

2,229.4

2,200.2

2,231.3

(183.9)

(236.8)

(1,163.2)

13,267.7

Total operating costs and expenses

12,006.7

12,202.6

Operating income

Interest expense-net of capitalized interest of $7.4, $5.6 and $5.3

Nonoperating (income) expense, net

Income before provision for income taxes

9,069.8

8,822.6

9,552.7

1,121.9

981.2

921.3

25.3

57.9

(70.2)

8,018.1

7,816.1

8,573.5

1,891.8

3,381.2

1,992.7

%$4

Provision for income taxes

.................

Net income

2$

6,025.4

5,924.3

24

5,192.3

24

7.95

2$

7.61

2$

6.43

Earnings per common share-basic

Earnings per common share-diluted

Dividends declared per common share

2$

7.88

2$

7.54

2$

6.37

24

4.73

2$

4.19

2$

3.83

758.1

778.2

807.4

Weighted-average shares outstanding-basic

Weighted-average shares outstanding-diluted

764.9

785.6

815.5

See Notes to consolidated financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning