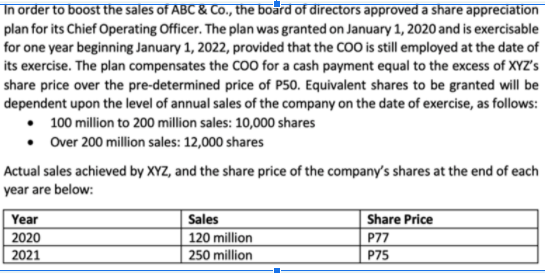

In order to boost the sales of ABC & Co., the board of directors approved a share appreciation plan for its Chief Operating Officer. The plan was granted on January 1, 2020 and is exercisable for one year beginning January 1, 2022, provided that the CO0 is still employed at the date of its exercise. The plan compensates the COO for a cash payment equal to the excess of XYZ's share price over the pre-determined price of P50. Equivalent shares to be granted will be dependent upon the level of annual sales of the company on the date of exercise, as follows: • 100 million to 200 million sales: 10,000 shares • Over 200 million sales: 12,000 shares Actual sales achieved by XYZ, and the share price of the company's shares at the end of each year are below: Year Sales Share Price 2020 120 million P77 2021 250 million P75

Depreciation Methods

The word "depreciation" is defined as an accounting method wherein the cost of tangible assets is spread over its useful life and it usually denotes how much of the assets value has been used up. The depreciation is usually considered as an operating expense. The main reason behind depreciation includes wear and tear of the assets, obsolescence etc.

Depreciation Accounting

In terms of accounting, with the passage of time the value of a fixed asset (like machinery, plants, furniture etc.) goes down over a specific period of time is known as depreciation. Now, the question comes in your mind, why the value of the fixed asset reduces over time.

How much should the company recognized as compensation expense for 2021?

To input answers, kindly follow the sample format below(no peso sign, with comma, no space):

ex.100,000

If answer is not exact, input your answer up to two decimal places:

ex. 100,235.5678 ---> 100,235.57

Step by step

Solved in 2 steps