In the course of your audit of Jurassic World Inc.'s December 31, 2021 liabilities the following schedule was presented to you by Jurassic World Inc.'s bookkeeper: Accounts payable P225,000 Estimated premiums liability ? Estimated warranties payable 320,750 Accrued salaries 240,400 Deferred tax liability ? Notes payable, 20% due 4/1/22 Serial bonds payable, 10% Total ? Audit notes: Continuation in the photos* Assuming that the premuims are considered as a separate performance obligation under PFRS 15 (each t shirt has a stand alone sales price at 100 each), what is the correct unearned income as of December 31, 2021?

In the course of your audit of Jurassic World Inc.'s December 31, 2021 liabilities the following schedule was presented to you by Jurassic World Inc.'s bookkeeper: Accounts payable P225,000 Estimated premiums liability ? Estimated warranties payable 320,750 Accrued salaries 240,400 Deferred tax liability ? Notes payable, 20% due 4/1/22 Serial bonds payable, 10% Total ? Audit notes: Continuation in the photos* Assuming that the premuims are considered as a separate performance obligation under PFRS 15 (each t shirt has a stand alone sales price at 100 each), what is the correct unearned income as of December 31, 2021?

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

In the course of your audit of Jurassic World Inc.'s December 31, 2021 liabilities the following schedule was presented to you by Jurassic World Inc.'s bookkeeper:

Accounts payable

P225,000

Estimated premiums liability

?

Estimated warranties payable

320,750

Accrued salaries

240,400

Deferred tax liability

?

Notes payable, 20% due 4/1/22

Serial bonds payable, 10%

Total

?

Audit notes:

Continuation in the photos*

Assuming that the premuims are considered as a separate performance obligation under PFRS 15 (each t shirt has a stand alone sales price at 100 each), what is the correct unearned income as of December 31, 2021?

A. 305,555

B. 95,486

C. 138,889

D. 444,444

Transcribed Image Text:ount which amounted to P

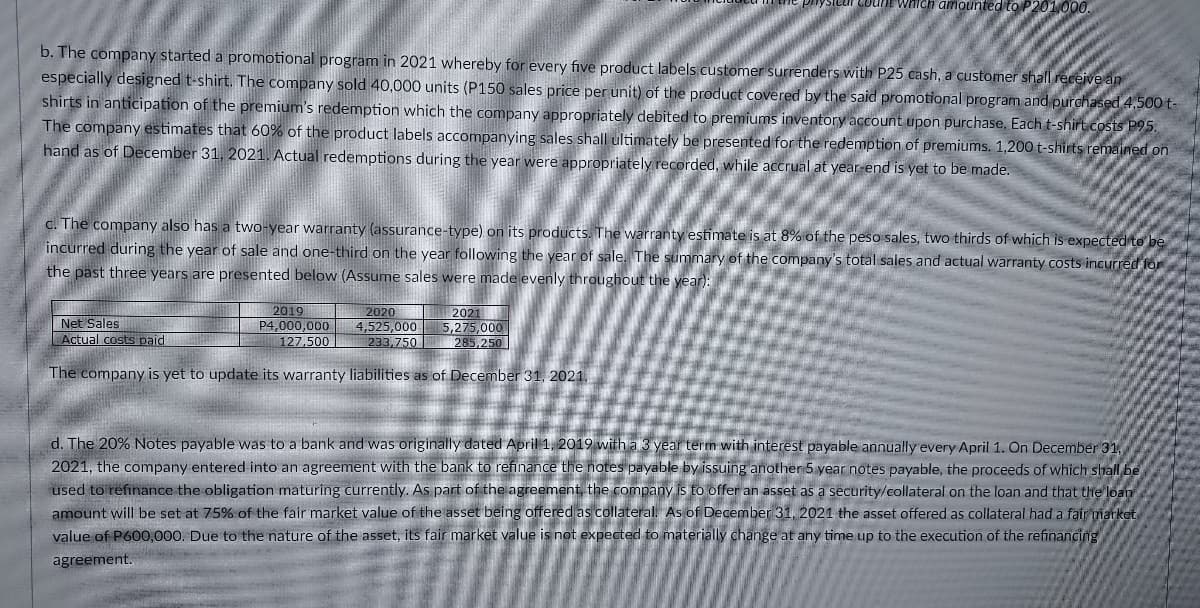

b. The company started a promotional program in 2021 whereby for every five product labels customer surrenders with P25 cash, a customer shall receive an

especially designed t-shirt. The company sold 40,000 units (P150 sales price per unit) of the product covered by the said promotional program and purchased 4,500 t-

shirts in anticipation of the premium's redemption which the company appropriately debited to premiums inventory account upon purchase, Each t-shirt costs P95.

The company estimates that 60% of the product labels accompanying sales shall ultimately be presented for the redemption of premiums. 1,200 t-shirts remained on

hand as of December 31, 2021. Actual redemptions during the year were appropriately recorded, while accrual at year-end is yet to be made.

c. The company also has a two-year warranty (assurance-type) on its products. The warranty estimate is at 8% of the peso sales, two thirds of which is expected to be

incurred during the year of sale and one-third on the year following the year of sale. The summary of the company's total sales and actual warranty costs incurred for

the past three years are presented below (Assume sales were made evenly throughout the year):

Net Sales

LActual costs paid

2019

P4,000,000

2020

4,525,000

233,750

| 2021

5,275,000

285,250

127,500

The company is yet to update its warranty liabilities as of December 31, 2021.

d. The 20% Notes payable was to a bank and was originally dated April 1, 2019 with a 3 year term with interest payable annually every April 1. On December 31,

2021, the company entered into an agreement with the bank to refinance the notes payable by issuing another 5 year notes payable, the proceeds of which shall be

used to refinance the obligation maturing currently. As part of the agreement, the company is to offer an asset as a security/collateral on the loan and that the loan

amount will be set at 75% of the fair market value of the asset being offered as collateral. As of December 31, 2021 the asset offered as collateral had a fair market

value of P600,000. Due to the nature of the asset, its fair market value is not expected to materially change at any time up to the execution of the refinancing

agreement.

Transcribed Image Text:Audit notes:

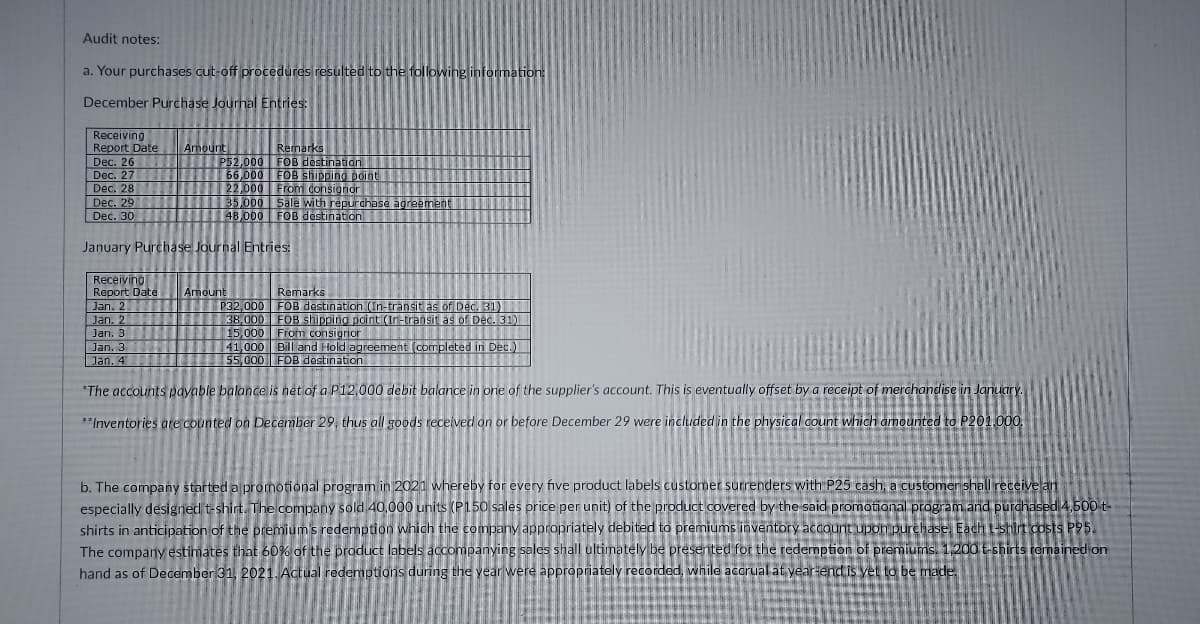

a. Your purchases cut-off procedures resulted to the following information:

December Purchase Journal Entries:

Receiving

Report Date

Dec. 26

Dec. 22

Dec. 28

Dec. 29

Dec. 30

Amount

Remarks

P52,000 FOB destination

66,000 FOB shipping point

22,000 From donsignor

35,000 Sale with repurchase agreement

48,000 FOB destination

January Purchase Journal Entries:

Receivino

Report Date

Jan. 2

Jan. 2

Amount

Remarks

FOB destination (In-transit as of Dec. 31)

P32,000

38,000 FOB Shipping point (In-transit as of Deč. 31)

15,000 From consignior

41.000 Bill and Hold agreement (completed in Dec.)

55,000 FOB destination

Jan. 3

Jan. 3

Jan. 4

*The accounts payable balance is net of a P12,000 debit balance in one of the supplier's account. This is eventually offset by a receipt of merchandise in January.

**Inventories are counted on December 29, thus all goods received on or before December 29 were included in the physical count which amounted to P201.00o.

b. The company started a promotional program in 2021 whereby for every five product labels customer surrenders with P25 cash, a customen shall receive art

especially designed t-shirt. The company sold 40,000 units (P150 sales price per unit) of the product covered by the said promotional program and purdhased 4,500 t-

shirts in anticipation of the premium's redemption which the company appropriately debited to premiums inventory account upon purehase, Each t-shirt costs P95.

The company estimates that 60% of the product labels accompanying sales shall ultimately be presented for the redemption of premiums. 1200 t-shirts ramained on

hand as of December 31, 2021. Actual redemptions during the year were appropriately recorded, while acarual at year-end is vet to be made.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education