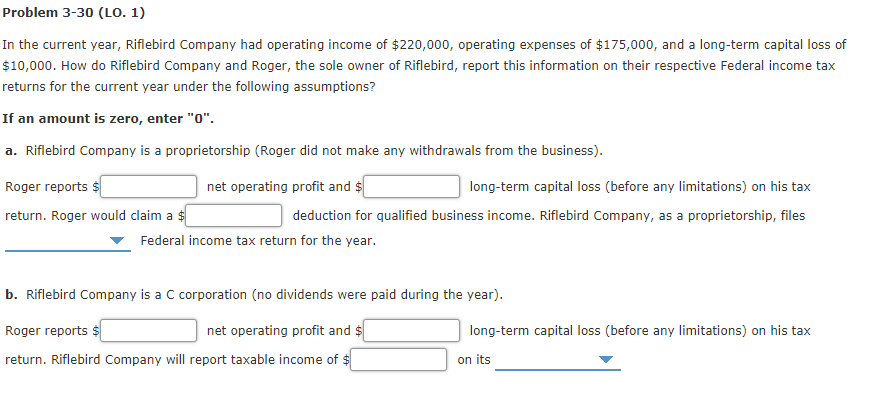

In the current year, Riflebird Company had operating income of $220,000, operating expenses of $175,000, and a long-term capital loss of $10,000. How do Riflebird Company and Roger, the sole owner of Riflebird, report this information on their respective Federal income tax returns for the current year under the following assumptions? If an amount is zero, enter "0". a. Riflebird Company is a proprietorship (Roger did not make any withdrawals from the business). Roger reports $ net operating profit and $ long-term capital loss (before any limitations) on his tax return. Roger would claim a $ deduction for qualified business income. Riflebird Company, as a proprietorship, files Federal income tax return for the year. b. Riflebird Company is a C corporation (no dividends were paid during the year). Roger reports $ net operating profit and $ long-term capital loss (before any limitations) on his tax return. Riflebird Company will report taxable income of $ on its

In the current year, Riflebird Company had operating income of $220,000, operating expenses of $175,000, and a long-term capital loss of $10,000. How do Riflebird Company and Roger, the sole owner of Riflebird, report this information on their respective Federal income tax returns for the current year under the following assumptions? If an amount is zero, enter "0". a. Riflebird Company is a proprietorship (Roger did not make any withdrawals from the business). Roger reports $ net operating profit and $ long-term capital loss (before any limitations) on his tax return. Roger would claim a $ deduction for qualified business income. Riflebird Company, as a proprietorship, files Federal income tax return for the year. b. Riflebird Company is a C corporation (no dividends were paid during the year). Roger reports $ net operating profit and $ long-term capital loss (before any limitations) on his tax return. Riflebird Company will report taxable income of $ on its

Chapter3: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

Fill in The Blank ( See attached Image)

Transcribed Image Text:Problem 3-30 (LO. 1)

In the current year, Riflebird Company had operating income of $220,000, operating expenses of $175,000, and a long-term capital loss of

$10,000. How do Riflebird Company and Roger, the sole owner of Riflebird, report this information on their respective Federal income tax

returns for the current year under the following assumptions?

If an amount is zero, enter "0".

a. Riflebird Company is a proprietorship (Roger did not make any withdrawals from the business).

Roger reports $

net operating profit and $

long-term capital loss (before any limitations) on his tax

return. Roger would claim a $

deduction for qualified business income. Riflebird Company, as a proprietorship, files

Federal income tax return for the year.

b. Riflebird Company is a C corporation (no dividends were paid during the year).

Roger reports

net operating profit and $

long-term capital loss (before any limitations) on his tax

return. Riflebird Company will report taxable income of $

on its

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you