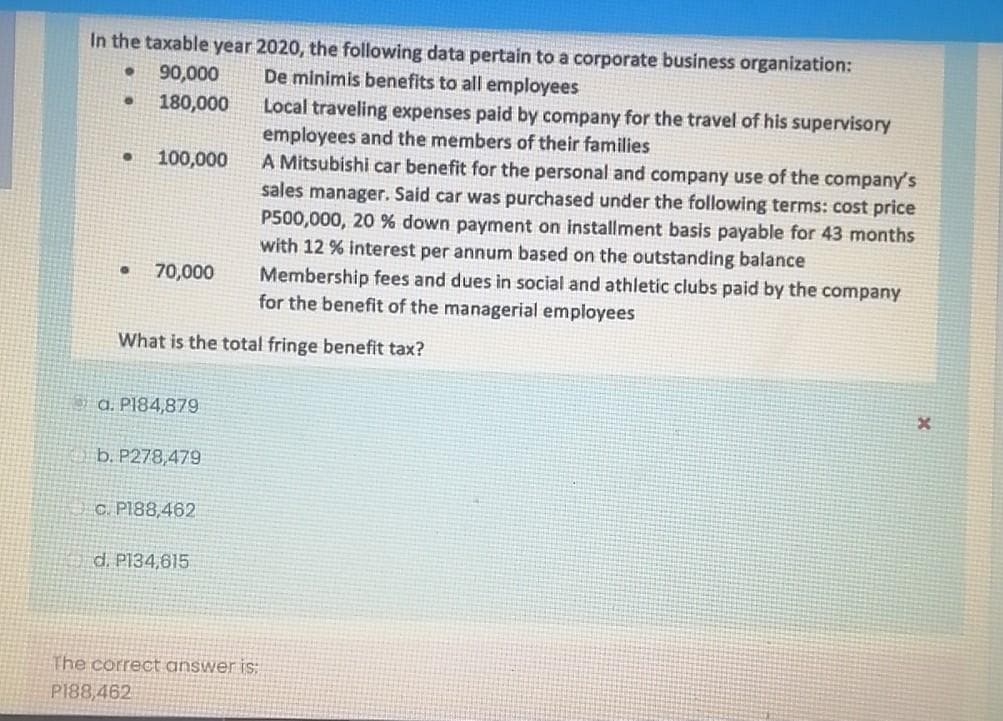

In the taxable year 2020, the following data pertain to a corporate business organization: De minimis benefits to all employees 90,000 180,000 Local traveling expenses paid by company for the travel of his supervisory employees and the members of their families A Mitsubishi car benefit for the personal and company use of the company's sales manager. Said car was purchased under the following terms: cost price P500,000, 20 % down payment on installment basis payable for 43 months with 12 % interest per annum based on the outstanding balance Membership fees and dues in social and athletic clubs paid by the company for the benefit of the managerial employees 100,000 70,000 What is the total fringe benefit tax? a. P184,879 b. P278,479 c. P188,462 d. P134,615

In the taxable year 2020, the following data pertain to a corporate business organization: De minimis benefits to all employees 90,000 180,000 Local traveling expenses paid by company for the travel of his supervisory employees and the members of their families A Mitsubishi car benefit for the personal and company use of the company's sales manager. Said car was purchased under the following terms: cost price P500,000, 20 % down payment on installment basis payable for 43 months with 12 % interest per annum based on the outstanding balance Membership fees and dues in social and athletic clubs paid by the company for the benefit of the managerial employees 100,000 70,000 What is the total fringe benefit tax? a. P184,879 b. P278,479 c. P188,462 d. P134,615

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 47P

Related questions

Question

Please show solution.if answered within 30mins, it would be great!!!

Transcribed Image Text:In the taxable year 2020, the following data pertain to a corporate business organization:

De minimis benefits to all employees

90,000

180,000

Local traveling expenses paid by company for the travel of his supervisory

employees and the members of their families

A Mitsubishi car benefit for the personal and company use of the company's

sales manager. Said car was purchased under the following terms: cost price

P500,000, 20 % down payment on installment basis payable for 43 months

with 12 % interest per annum based on the outstanding balance

Membership fees and dues in social and athletic clubs paid by the company

for the benefit of the managerial employees

100,000

70,000

What is the total fringe benefit tax?

d. PI84,879

b. P278,479

c. PI88,462

d. P134,615

The correct answer is:

P188,462

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT