In this section we examine three theories of ivestor preference: The dividend irrelevance theory. The "bird in the hand" theory, the tax preference theory, which theory is the best? What is the different of stock dividends, stock splits, and stock repurchase.

In this section we examine three theories of ivestor preference: The dividend irrelevance theory. The "bird in the hand" theory, the tax preference theory, which theory is the best? What is the different of stock dividends, stock splits, and stock repurchase.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter9: Stocks And Their Valuation

Section: Chapter Questions

Problem 9TCL

Related questions

Question

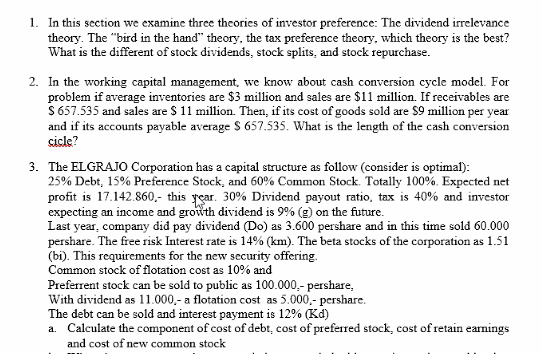

Transcribed Image Text:1. In this section we examine three theories of investor preference: The dividend irrelevance

theory. The "bird in the hand" theory, the tax preference theory, which theory is the best?

What is the different of stock dividends, stock splits, and stock repurchase.

2. In the working capital management, we know about cash conversion cycle model. For

problem if average inventories are $3 million and sales are $11 million. If receivables are

S 657.535 and sales are $ 11 million. Then, if its cost of goods sold are $9 million per year

and if its accounts payable average S 657.535. What is the length of the cash conversion

sicle?

3. The ELGRAJO Corporation has a capital structure as follow (consider is optimal):

25% Debt, 15% Preference Stock, and 60% Common Stock. Totally 100%. Expected net

profit is 17.142.860,- this rear. 30% Dividend payout ratio, tax is 40% and investor

expecting an income and growth dividend is 9% (g) on the future.

Last year, company did pay dividend (Do) as 3.600 pershare and in this time sold 60.000

pershare. The free risk Interest rate is 14% (km). The beta stocks of the corporation as 1.51

(bi). This requirements for the new security offering.

Common stock of flotation cost as 10% and

Preferrent stock can be sold to public as 100.000,- pershare,

With dividend as 11.000,- a flotation cost as 5.000,- pershare.

The debt can be sold and interest payment is 12% (Kd)

a. Calculate the component of cost of debt, cost of preferred stock, cost of retain earnings

and cost of new common stock

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage