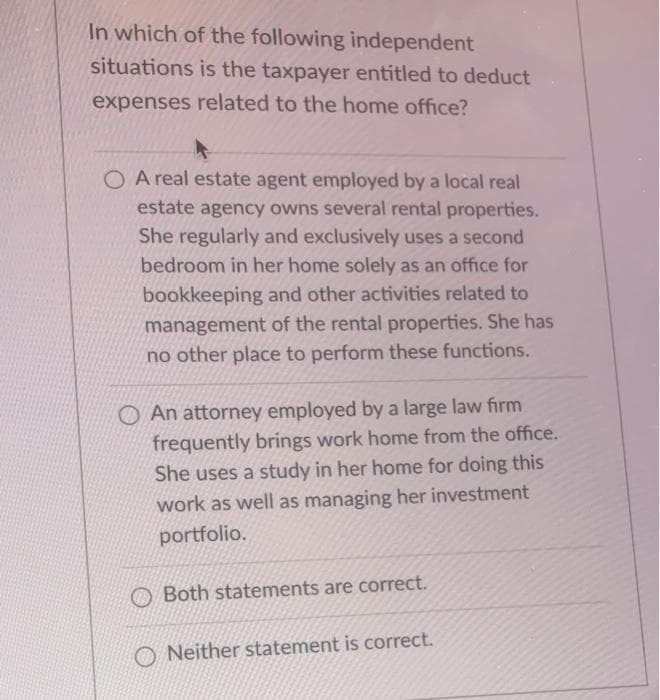

In which of the following independent situations is the taxpayer entitled to deduct expenses related to the home office?

In which of the following independent situations is the taxpayer entitled to deduct expenses related to the home office?

Chapter3: Business Income And Expenses

Section: Chapter Questions

Problem 14MCQ

Related questions

Question

Please Solve In 10mins

Transcribed Image Text:In which of the following independent

situations is the taxpayer entitled to deduct

expenses related to the home office?

O A real estate agent employed by a local real

estate agency owns several rental properties.

She regularly and exclusively uses a second

bedroom in her home solely as an office for

bookkeeping and other activities related to

management of the rental properties. She has

no other place to perform these functions.

O An attorney employed by a large law firm

frequently brings work home from the office.

She uses a study in her home for doing this

work as well as managing her investment

portfolio.

Both statements are correct.

O Neither statement is correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT