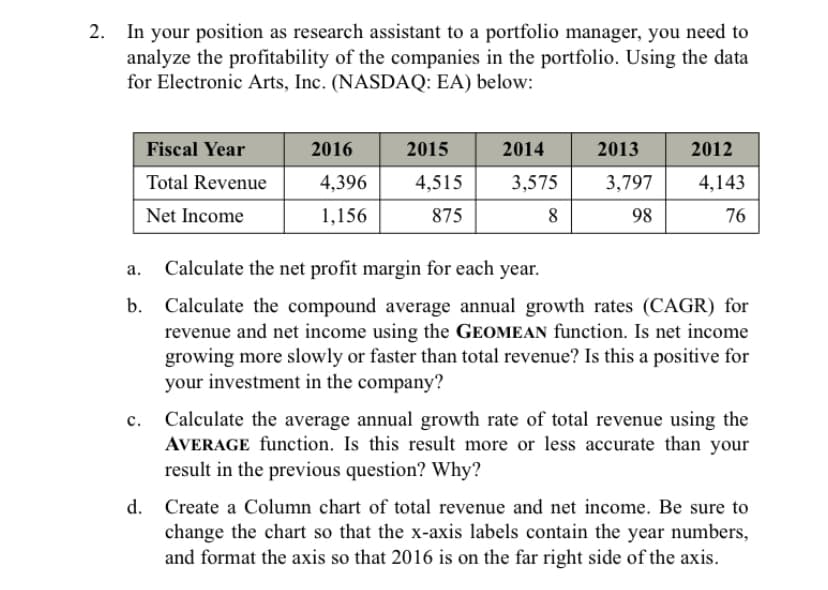

In your position as research assistant to a portfolio manager, you need to analyze the profitability of the companies in the portfolio. Using the data for Electronic Arts, Inc. (NASDAQ: EA) below: a. Fiscal Year Total Revenue Net Income 2016 4,396 1,156 2015 4,515 875 2014 3,575 8 2013 3,797 98 2012 4,143 76 Calculate the net profit margin for each year. Calculate the compound average annual growth rates (CAGR) for revenue and net income using the GEOMEAN function. Is net income growing more slowly or faster than total revenue? Is this a positive for your investment in the company? Calculate the average annual growth rate of total revenue using the AVERAGE function. Is this result more or less accurate than your result in the previous question? Why?

In your position as research assistant to a portfolio manager, you need to analyze the profitability of the companies in the portfolio. Using the data for Electronic Arts, Inc. (NASDAQ: EA) below: a. Fiscal Year Total Revenue Net Income 2016 4,396 1,156 2015 4,515 875 2014 3,575 8 2013 3,797 98 2012 4,143 76 Calculate the net profit margin for each year. Calculate the compound average annual growth rates (CAGR) for revenue and net income using the GEOMEAN function. Is net income growing more slowly or faster than total revenue? Is this a positive for your investment in the company? Calculate the average annual growth rate of total revenue using the AVERAGE function. Is this result more or less accurate than your result in the previous question? Why?

Chapter9: Responsibility Accounting And Decentralization

Section: Chapter Questions

Problem 3PB: The income statement comparison for Rush Delivery Company shows the income statement for the current...

Related questions

Question

Transcribed Image Text:2. In your position as research assistant to a portfolio manager, you need to

analyze the profitability of the companies in the portfolio. Using the data

for Electronic Arts, Inc. (NASDAQ: EA) below:

a.

b.

C.

Fiscal Year

Total Revenue

Net Income

2016

4,396

1,156

2015

4,515

875

2014

3,575

8

2013

3,797

98

2012

4,143

76

Calculate the net profit margin for each year.

Calculate the compound average annual growth rates (CAGR) for

revenue and net income using the GEOMEAN function. Is net income

growing more slowly or faster than total revenue? Is this a positive for

your investment in the company?

Calculate the average annual growth rate of total revenue using the

AVERAGE function. Is this result more or less accurate than your

result in the previous question? Why?

d. Create a Column chart of total revenue and net income. Be sure to

change the chart so that the x-axis labels contain the year numbers,

and format the axis so that 2016 is on the far right side of the axis.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning