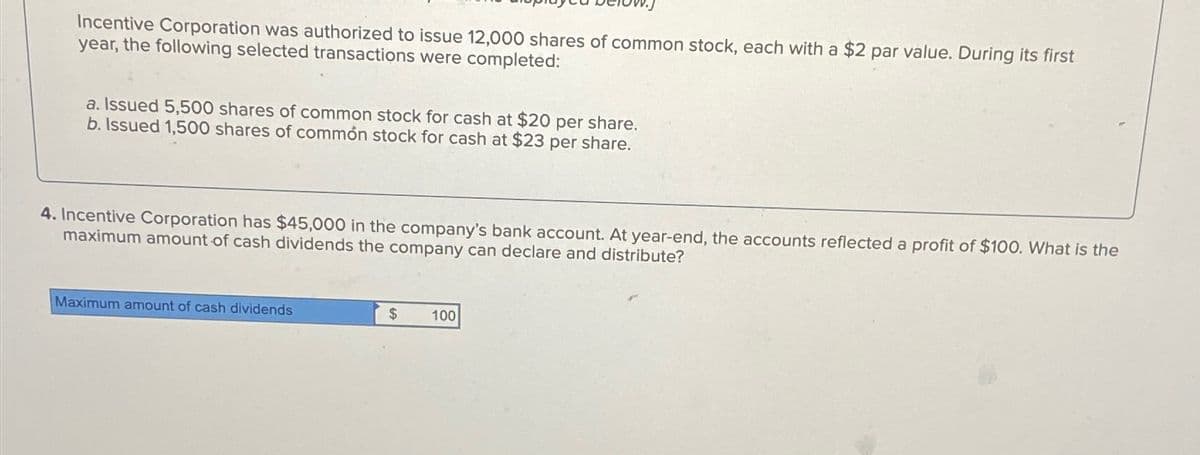

Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $2 par value. During its first year, the following selected transactions were completed: a. Issued 5,500 shares of common stock for cash at $20 per share. b. Issued 1,500 shares of common stock for cash at $23 per share. 4. Incentive Corporation has $45,000 in the company's bank account. At year-end, the accounts reflected a profit of $100. What is the maximum amount of cash dividends the company can declare and distribute? Maximum amount of cash dividends $ 100

Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $2 par value. During its first year, the following selected transactions were completed: a. Issued 5,500 shares of common stock for cash at $20 per share. b. Issued 1,500 shares of common stock for cash at $23 per share. 4. Incentive Corporation has $45,000 in the company's bank account. At year-end, the accounts reflected a profit of $100. What is the maximum amount of cash dividends the company can declare and distribute? Maximum amount of cash dividends $ 100

Chapter14: Corporation Accounting

Section: Chapter Questions

Problem 4PB: MacKenzie Mining Corporation is authorized to issue 50,000 shares of $500 par value 7% preferred...

Related questions

Question

Transcribed Image Text:Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $2 par value. During its first

year, the following selected transactions were completed:

a. Issued 5,500 shares of common stock for cash at $20 per share.

b. Issued 1,500 shares of common stock for cash at $23 per share.

4. Incentive Corporation has $45,000 in the company's bank account. At year-end, the accounts reflected a profit of $100. What is the

maximum amount of cash dividends the company can declare and distribute?

Maximum amount of cash dividends

$

100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning