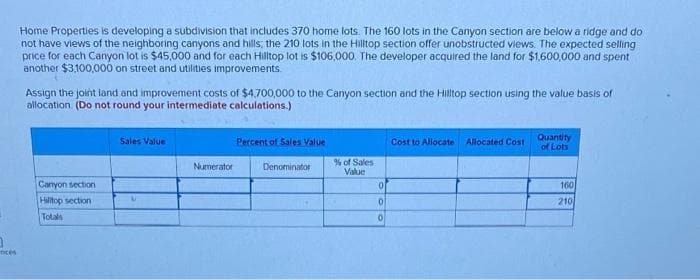

} inces Home Properties is developing a subdivision that includes 370 home lots. The 160 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 210 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $45,000 and for each Hilltop lot is $106,000. The developer acquired the land for $1,600,000 and spent another $3,100,000 on street and utilities improvements. Assign the joint land and improvement costs of $4,700,000 to the Canyon section and the Hilltop section using the value basis of allocation (Do not round your intermediate calculations.) Canyon section Hilltop section Totals Sales Value L Numerator Percent of Sales Value Denominator % of Sales Value 0 0 0 Cost to Allocate Allocated Cost Quantity of Lots 160 210

} inces Home Properties is developing a subdivision that includes 370 home lots. The 160 lots in the Canyon section are below a ridge and do not have views of the neighboring canyons and hills; the 210 lots in the Hilltop section offer unobstructed views. The expected selling price for each Canyon lot is $45,000 and for each Hilltop lot is $106,000. The developer acquired the land for $1,600,000 and spent another $3,100,000 on street and utilities improvements. Assign the joint land and improvement costs of $4,700,000 to the Canyon section and the Hilltop section using the value basis of allocation (Do not round your intermediate calculations.) Canyon section Hilltop section Totals Sales Value L Numerator Percent of Sales Value Denominator % of Sales Value 0 0 0 Cost to Allocate Allocated Cost Quantity of Lots 160 210

Chapter9: Acquisitions Of Property

Section: Chapter Questions

Problem 42P

Related questions

Question

Transcribed Image Text:1

inces

Home Properties is developing a subdivision that includes 370 home lots. The 160 lots in the Canyon section are below a ridge and do

not have views of the neighboring canyons and hills, the 210 lots in the Hilltop section offer unobstructed views. The expected selling

price for each Canyon lot is $45,000 and for each Hilltop lot is $106,000. The developer acquired the land for $1,600,000 and spent

another $3,100,000 on street and utilities improvements.

Assign the joint land and improvement costs of $4,700,000 to the Canyon section and the Hilltop section using the value basis of

allocation (Do not round your intermediate calculations.)

Canyon section

Hilltop section

Totals

Sales Value

U

Numerator

Percent of Sales Value

Denominator

% of Sales

Value

0

0

0

Cost to Allocate Allocated Cost

Quantity

of Lots

160

210

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning