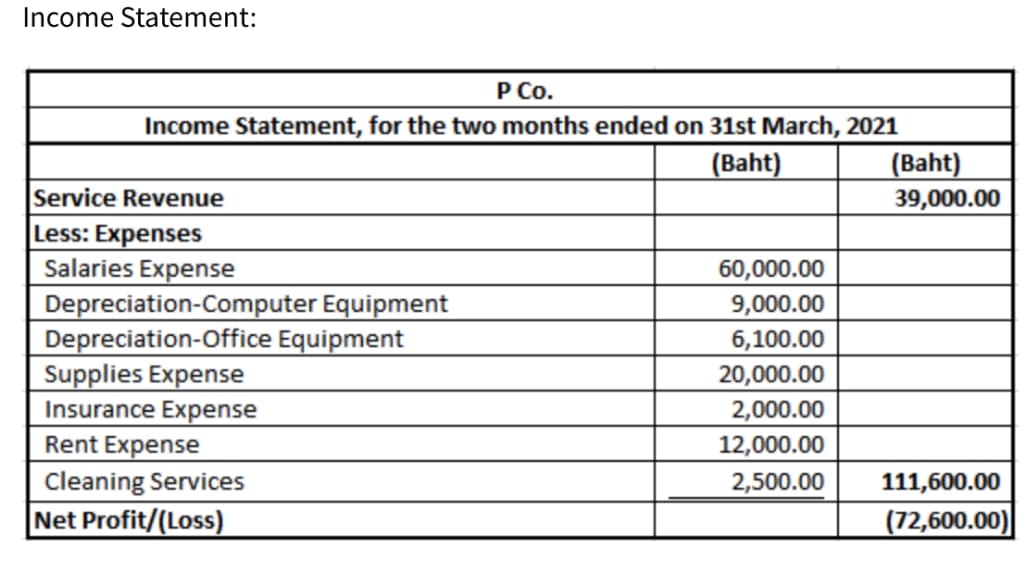

Income Statement: Р Со. Income Statement, for the two months ended on 31st March, 2021 (Baht) 39,000.00 (Baht) Service Revenue Less: Expenses Salaries Expense Depreciation-Computer Equipment Depreciation-Office Equipment Supplies Expense Insurance Expense Rent Expense 60,000.00 9,000.00 6,100.00 20,000.00 2,000.00 12,000.00 2,500.00 Cleaning Services 111,600.00 Net Profit/(Loss) (72,600.00)

Income Statement: Р Со. Income Statement, for the two months ended on 31st March, 2021 (Baht) 39,000.00 (Baht) Service Revenue Less: Expenses Salaries Expense Depreciation-Computer Equipment Depreciation-Office Equipment Supplies Expense Insurance Expense Rent Expense 60,000.00 9,000.00 6,100.00 20,000.00 2,000.00 12,000.00 2,500.00 Cleaning Services 111,600.00 Net Profit/(Loss) (72,600.00)

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter1: Introduction To Business Activities And Overview Of Financial Statements And The Reporting Process

Section: Chapter Questions

Problem 23E

Related questions

Question

100%

Where do income statements come from?

Transcribed Image Text:Income Statement:

P Co.

Income Statement, for the two months ended on 31st March, 2021

(Baht)

39,000.00

|(Baht)

Service Revenue

Less: Expenses

Salaries Expense

60,000.00

Depreciation-Computer Equipment

Depreciation-Office Equipment

Supplies Expense

Insurance Expense

9,000.00

6,100.00

20,000.00

2,000.00

Rent Expense

Cleaning Services

Net Profit/(Loss)

12,000.00

2,500.00

111,600.00

(72,600.00)

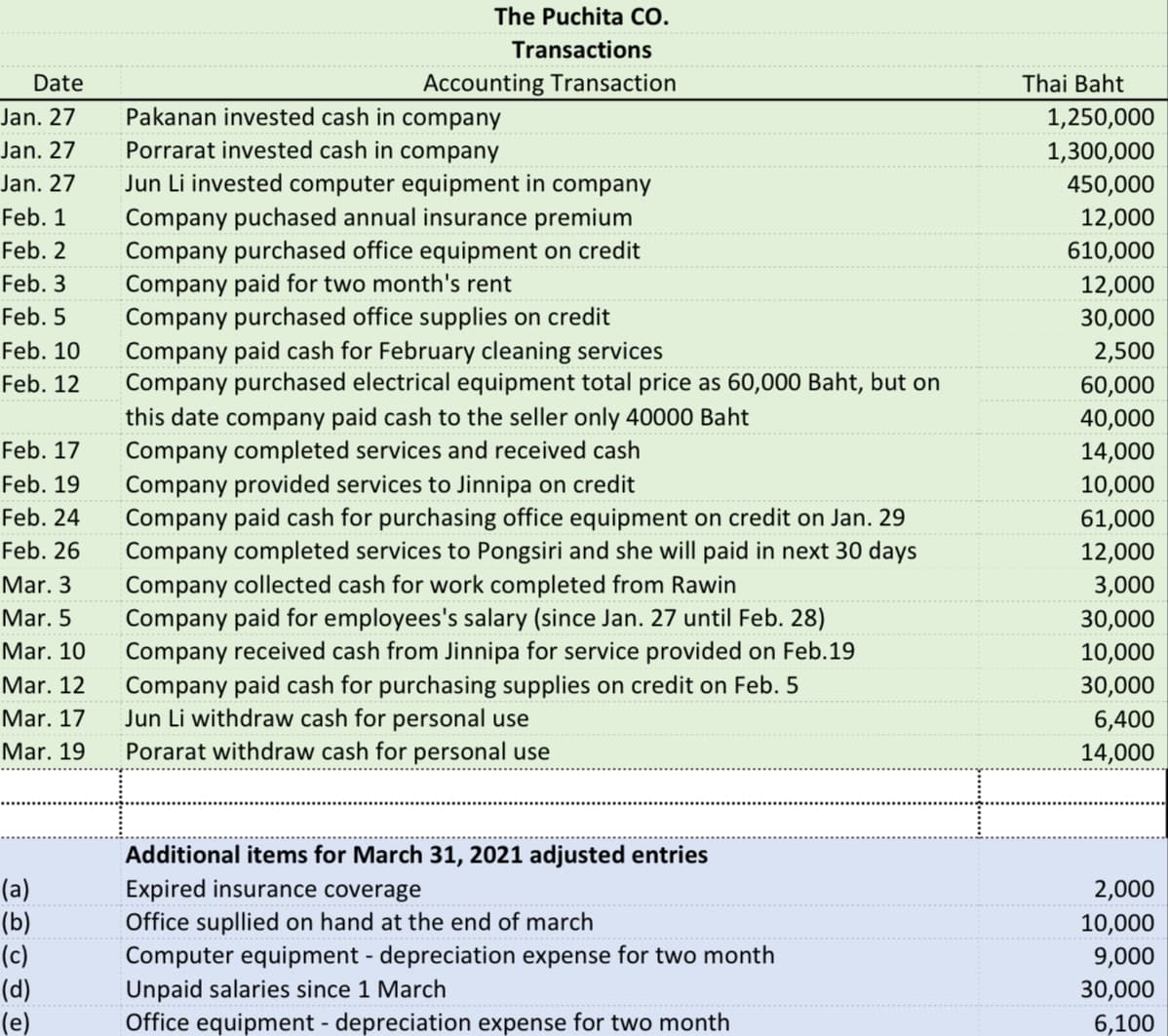

Transcribed Image Text:The Puchita CO.

Transactions

Date

Accounting Transaction

Thai Baht

Jan. 27

Pakanan invested cash in company

1,250,000

Jan. 27

Porrarat invested cash in company

1,300,000

Jan. 27

Jun Li invested computer equipment in company

450,000

Feb. 1

Company puchased annual insurance premium

Company purchased office equipment on credit

Company paid for two month's rent

Company purchased office supplies on credit

Company paid cash for February cleaning services

Company purchased electrical equipment total price as 60,000 Baht, but on

12,000

Feb. 2

610,000

Feb. 3

12,000

Feb. 5

30,000

Feb. 10

2,500

Feb. 12

60,000

this date company paid cash to the seller only 40000 Baht

Company completed services and received cash

40,000

Feb. 17

14,000

Company provided services to Jinnipa on credit

Company paid cash for purchasing office equipment on credit on Jan. 29

Company completed services to Pongsiri and she will paid in next 30 days

Feb. 19

10,000

Feb. 24

61,000

Feb. 26

12,000

Company collected cash for work completed from Rawin

Company paid for employees's salary (since Jan. 27 until Feb. 28)

Company received cash from Jinnipa for service provided on Feb.19

Company paid cash for purchasing supplies on credit on Feb. 5

Jun Li withdraw cash for personal use

Porarat withdraw cash for personal use

Mar. 3

3,000

Mar. 5

30,000

Mar. 10

10,000

Mar. 12

30,000

Mar. 17

6,400

Mar. 19

14,000

Additional items for March 31, 2021 adjusted entries

(a)

(b)

(c)

(d)

(e)

Expired insurance coverage

Office supllied on hand at the end of march

Computer equipment - depreciation expense for two month

Unpaid salaries since 1 March

Office equipment - depreciation expense for two month

2,000

10,000

9,000

30,000

6,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning