Incorrect Question 11 Q4A. Calculate the future value of the positive cash flows, provided below, using the appropriate interest rate (i.e. the first step of the ERR). Assume the company has a MARR of 10% and a reinvestment rate of 12%. Year 1 3 Positive Net Cash Flows $156,054 $182,611 $214.376 664,480.784 Question 12 4B. Calculate the future value of the negative cash flows/initial investment given a MARR of 10.3% per year (i.e. the second step of the ERR). 462,962.3058 Incorrect Question 13 4C. Assume the future value of the positive cash flows, using the appropriate interest rate, is $548,356. Calculate the external rate of return. (note: if your answer is 10.25%, enter "10.25"). 10.7

Incorrect Question 11 Q4A. Calculate the future value of the positive cash flows, provided below, using the appropriate interest rate (i.e. the first step of the ERR). Assume the company has a MARR of 10% and a reinvestment rate of 12%. Year 1 3 Positive Net Cash Flows $156,054 $182,611 $214.376 664,480.784 Question 12 4B. Calculate the future value of the negative cash flows/initial investment given a MARR of 10.3% per year (i.e. the second step of the ERR). 462,962.3058 Incorrect Question 13 4C. Assume the future value of the positive cash flows, using the appropriate interest rate, is $548,356. Calculate the external rate of return. (note: if your answer is 10.25%, enter "10.25"). 10.7

Chapter4: Time Value Of Money

Section4.12: Uneven, Or Irregular, Cash Flows

Problem 3ST

Related questions

Question

Transcribed Image Text:Incorrect

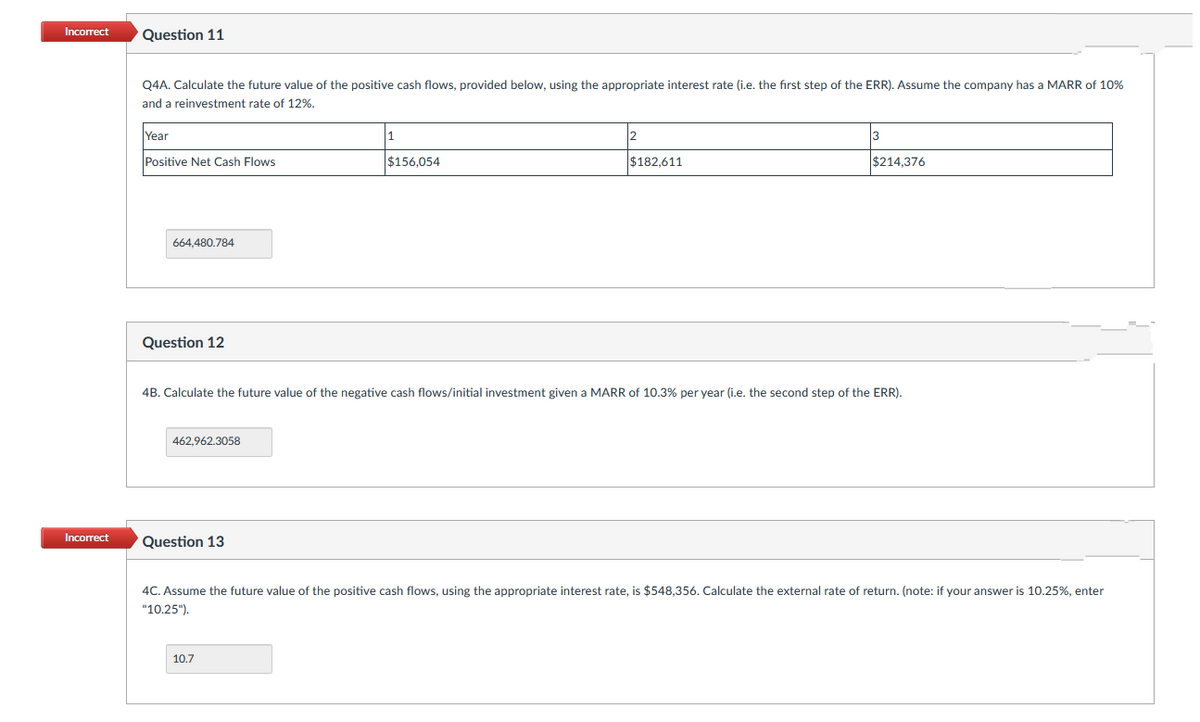

Question 11

Q4A. Calculate the future value of the positive cash flows, provided below, using the appropriate interest rate (i.e. the fırst step of the ERR). Assume the company has a MARR of 10%

and a reinvestment rate of 12%.

Year

Positive Net Cash Flows

$156.054

$182.611

$214.376

664,480.784

Question 12

4B. Calculate the future value of the negative cash flows/initial investment given a MARR of 10.3% per year (i.e. the second step of the ERR).

462,962.3058

Incorrect

Question 13

4C. Assume the future value of the positive cash flows, using the appropriate interest rate, is $548,356. Calculate the external rate of return. (note: if your answer is 10.25%, enter

"10.25").

10.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub