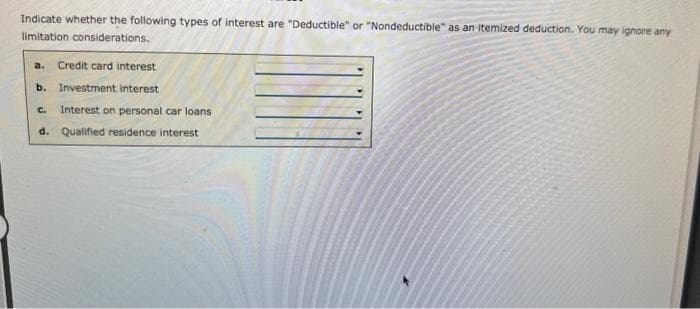

Indicate whether the following types of interest are "Deductible" or "Nondeductible" as an itemized deduction. You may ignore any limitation considerations. a. Credit card interest b. Investment interest C. Interest on personal car loans d. Qualified residence interest

Indicate whether the following types of interest are "Deductible" or "Nondeductible" as an itemized deduction. You may ignore any limitation considerations. a. Credit card interest b. Investment interest C. Interest on personal car loans d. Qualified residence interest

Chapter6: Deductions And Losses: In General

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

Gg.36.

Transcribed Image Text:Indicate whether the following types of interest are "Deductible" or "Nondeductible" as an itemized deduction. You may ignore any

limitation considerations.

a. Credit card interest

b. Investment interest

C. Interest on personal car loans

d. Qualified residence interest

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT