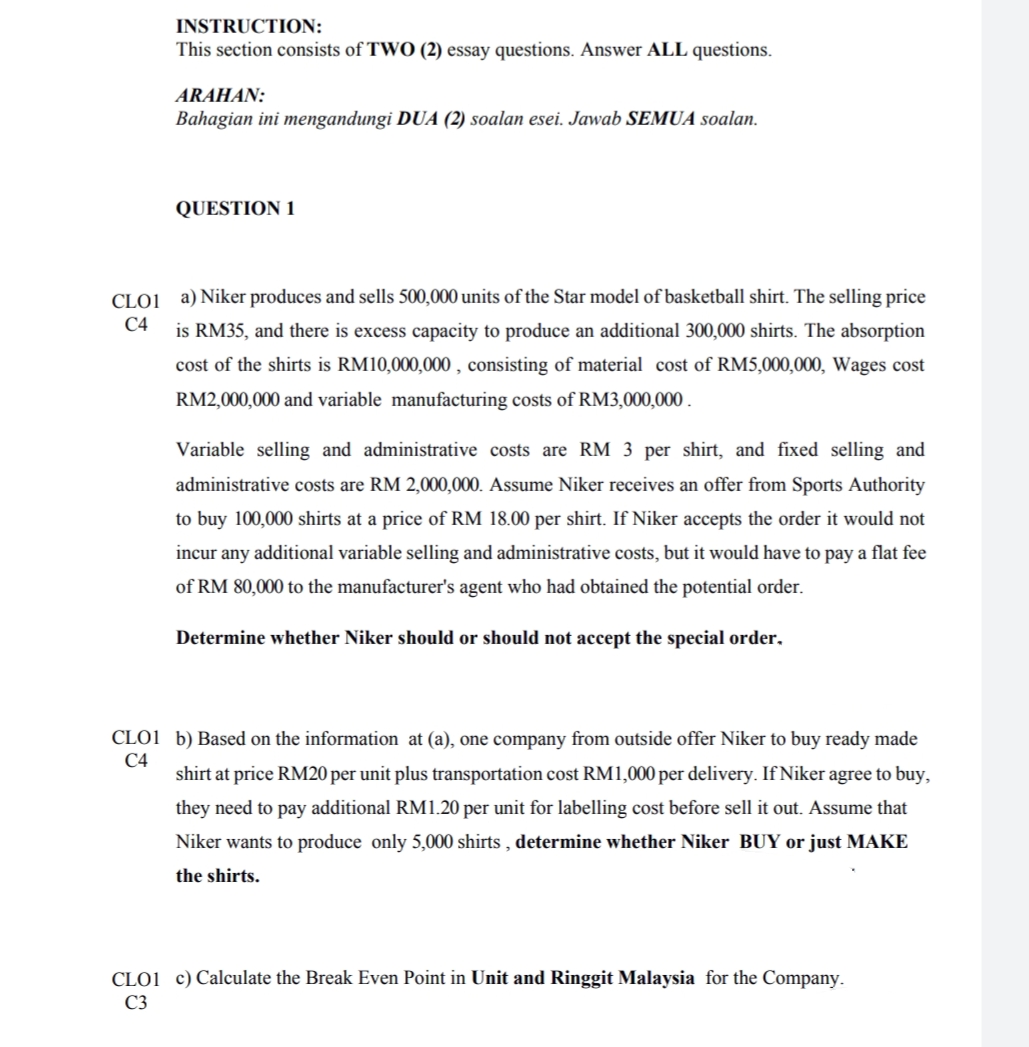

INSTRUCTION: This section consists of TWO (2) essay questions. Answer ALL questions. ARAHAN: Bahagian ini mengandungi DUA (2) soalan esei. Jawab SEMUA soalan. QUESTION 1 CLOI a) Niker produces and sells 500,000 units of the Star model of basketball shirt. The selling price С4 is RM35, and there is excess capacity to produce an additional 300,000 shirts. The absorption cost of the shirts is RM10,000,000 , consisting of material cost of RM5,000,000, Wages cost RM2,000,000 and variable manufacturing costs of RM3,000,000 . Variable selling and administrative costs are RM 3 per shirt, and fixed selling and administrative costs are RM 2,000,000. Assume Niker receives an offer from Sports Authority to buy 100,000 shirts at a price of RM 18.00 per shirt. If Niker accepts the order it would not incur any additional variable selling and administrative costs, but it would have to pay a flat fee of RM 80,000 to the manufacturer's agent who had obtained the potential order. Determine whether Niker should or should not accept the special order, CLO1 b) Based on the information at (a), one company from outside offer Niker to buy ready made С4 shirt at price RM20 per unit plus transportation cost RM1,000 per delivery. If Niker agree to buy, they need to pay additional RM1.20 per unit for labelling cost before sell it out. Assume that Niker wants to produce only 5,000 shirts , determine whether Niker BUY or just MAKE the shirts. CLO1 c) Calculate the Break Even Point in Unit and Ringgit Malaysia for the Company. C3

INSTRUCTION: This section consists of TWO (2) essay questions. Answer ALL questions. ARAHAN: Bahagian ini mengandungi DUA (2) soalan esei. Jawab SEMUA soalan. QUESTION 1 CLOI a) Niker produces and sells 500,000 units of the Star model of basketball shirt. The selling price С4 is RM35, and there is excess capacity to produce an additional 300,000 shirts. The absorption cost of the shirts is RM10,000,000 , consisting of material cost of RM5,000,000, Wages cost RM2,000,000 and variable manufacturing costs of RM3,000,000 . Variable selling and administrative costs are RM 3 per shirt, and fixed selling and administrative costs are RM 2,000,000. Assume Niker receives an offer from Sports Authority to buy 100,000 shirts at a price of RM 18.00 per shirt. If Niker accepts the order it would not incur any additional variable selling and administrative costs, but it would have to pay a flat fee of RM 80,000 to the manufacturer's agent who had obtained the potential order. Determine whether Niker should or should not accept the special order, CLO1 b) Based on the information at (a), one company from outside offer Niker to buy ready made С4 shirt at price RM20 per unit plus transportation cost RM1,000 per delivery. If Niker agree to buy, they need to pay additional RM1.20 per unit for labelling cost before sell it out. Assume that Niker wants to produce only 5,000 shirts , determine whether Niker BUY or just MAKE the shirts. CLO1 c) Calculate the Break Even Point in Unit and Ringgit Malaysia for the Company. C3

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:INSTRUCTION:

This section consists of TWO (2) essay questions. Answer ALL questions.

ARAHAN:

Bahagian ini mengandungi DUA (2) soalan esei. Jawab SEMUA soalan.

QUESTION 1

CLOI a) Niker produces and sells 500,000 units of the Star model of basketball shirt. The selling price

С4

is RM35, and there is excess capacity to produce an additional 300,000 shirts. The absorption

cost of the shirts is RM10,000,000 , consisting of material cost of RM5,000,000, Wages cost

RM2,000,000 and variable manufacturing costs of RM3,000,000 .

Variable selling and administrative costs are RM 3 per shirt, and fixed selling and

administrative costs are RM 2,000,000. Assume Niker receives an offer from Sports Authority

to buy 100,000 shirts at a price of RM 18.00 per shirt. If Niker accepts the order it would not

incur any additional variable selling and administrative costs, but it would have to pay a flat fee

of RM 80,000 to the manufacturer's agent who had obtained the potential order.

Determine whether Niker should or should not accept the special order,

CLO1 b) Based on the information at (a), one company from outside offer Niker to buy ready made

С4

shirt at price RM20 per unit plus transportation cost RM1,000 per delivery. If Niker agree to buy,

they need to pay additional RM1.20 per unit for labelling cost before sell it out. Assume that

Niker wants to produce only 5,000 shirts , determine whether Niker BUY or just MAKE

the shirts.

CLO1 c) Calculate the Break Even Point in Unit and Ringgit Malaysia for the Company.

C3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education