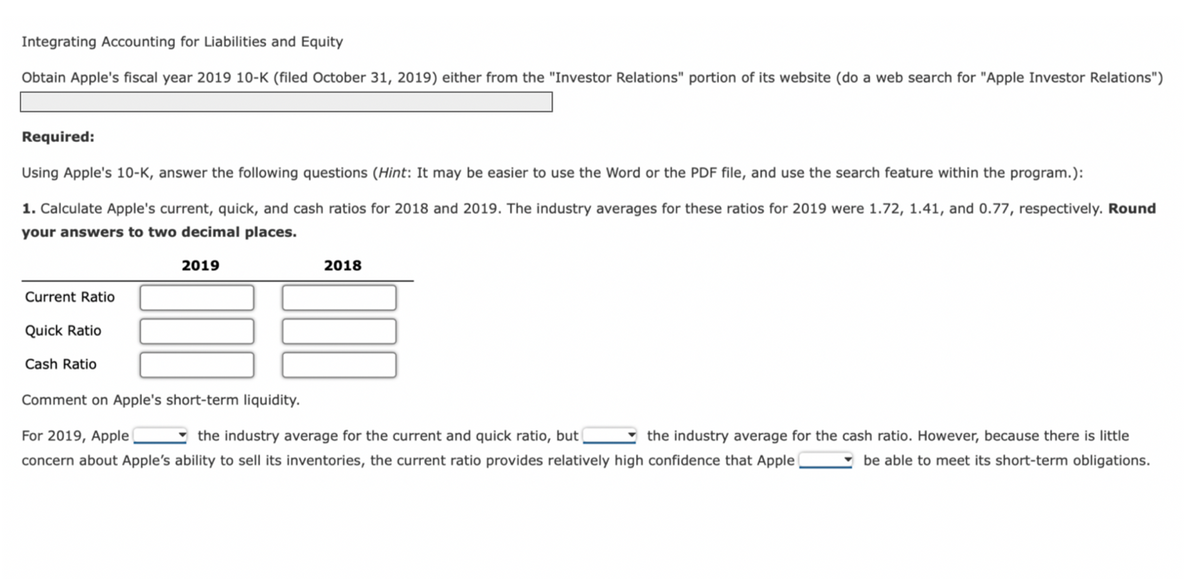

Integrating Accounting for Liabilities and Equity Obtain Apple's fiscal year 2019 10-K (filed October 31, 2019) either from the "Investor Relations" portion of its website (do a web search for "Apple Investor Relations") Required: Using Apple's 10-K, answer the following questions (Hint: It may be easier to use the Word or the PDF file, and use the search feature within the program.): 1. Calculate Apple's current, quick, and cash ratios for 2018 and 2019. The industry averages for these ratios for 2019 were 1.72, 1.41, and 0.77, respectively. Round your answers to two decimal places. 2019 Current Ratio Quick Ratio Cash Ratio 2018 Comment on Apple's short-term liquidity. For 2019, Apple the industry average for the current and quick ratio, but [ the industry average for the cash ratio. However, because there is little concern about Apple's ability to sell its inventories, the current ratio provides relatively high confidence that Apple be able to meet its short-term obligations.

Integrating Accounting for Liabilities and Equity Obtain Apple's fiscal year 2019 10-K (filed October 31, 2019) either from the "Investor Relations" portion of its website (do a web search for "Apple Investor Relations") Required: Using Apple's 10-K, answer the following questions (Hint: It may be easier to use the Word or the PDF file, and use the search feature within the program.): 1. Calculate Apple's current, quick, and cash ratios for 2018 and 2019. The industry averages for these ratios for 2019 were 1.72, 1.41, and 0.77, respectively. Round your answers to two decimal places. 2019 Current Ratio Quick Ratio Cash Ratio 2018 Comment on Apple's short-term liquidity. For 2019, Apple the industry average for the current and quick ratio, but [ the industry average for the cash ratio. However, because there is little concern about Apple's ability to sell its inventories, the current ratio provides relatively high confidence that Apple be able to meet its short-term obligations.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter11: The Statement Of Cash Flows

Section: Chapter Questions

Problem 27BE

Related questions

Question

please use the data to answer the questions.

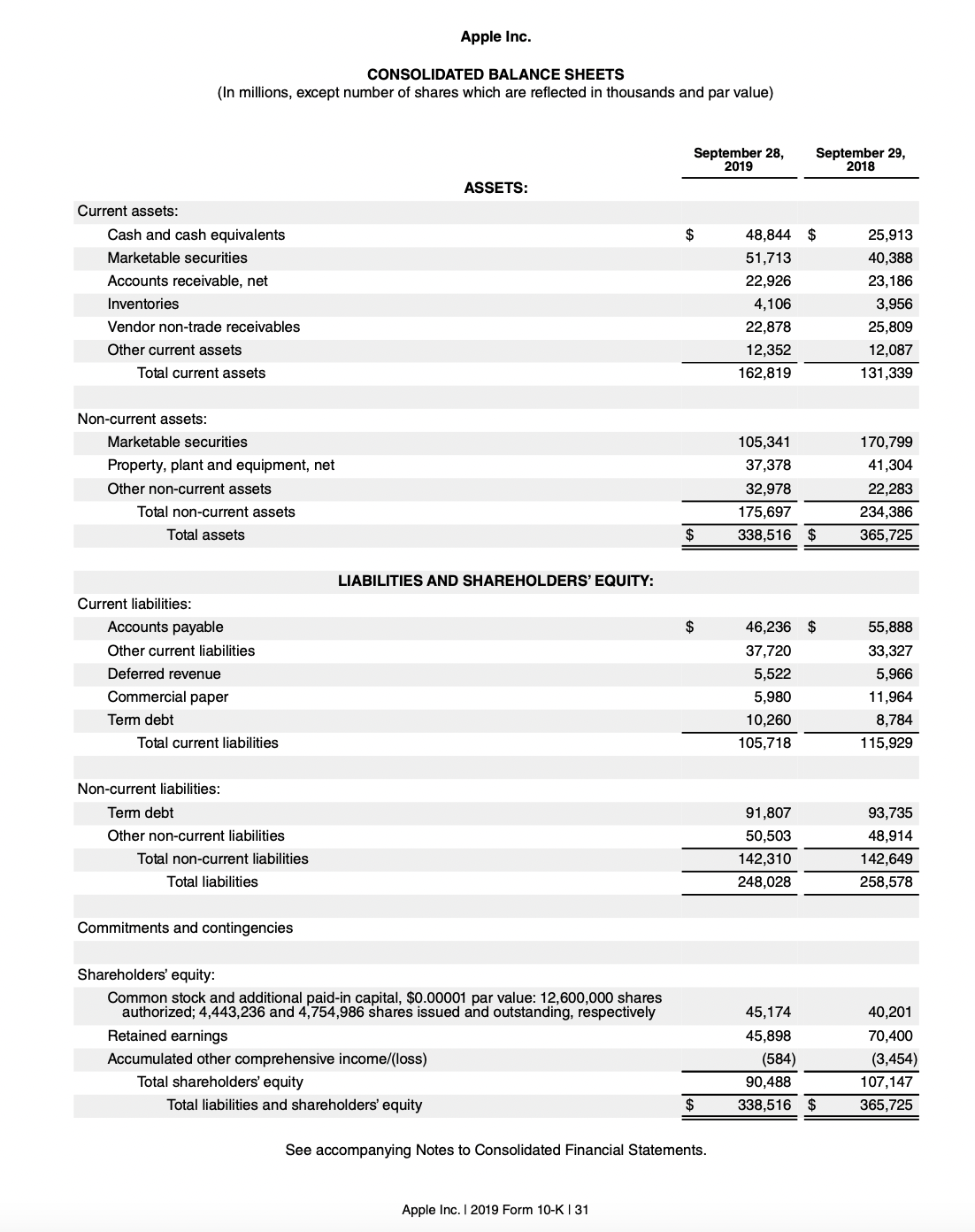

Transcribed Image Text:Current assets:

Cash and cash equivalents

Marketable securities

Accounts receivable, net

Inventories

CONSOLIDATED BALANCE SHEETS

(In millions, except number of shares which are reflected in thousands and par value)

Vendor non-trade receivables

Other current assets

Total current assets

Non-current assets:

Marketable securities

Property, plant and equipment, net

Other non-current assets

Total non-current assets

Total assets

Current liabilities:

Accounts payable

Other current liabilities

Deferred revenue

Commercial paper

Term debt

Total current liabilities

Non-current liabilities:

Term debt

Other non-current liabilities

Total non-current liabilities

Total liabilities

Commitments and contingencies

Apple Inc.

LIABILITIES AND SHAREHOLDERS' EQUITY:

Accumulated other comprehensive income/(loss)

Total shareholders' equity

ASSETS:

Shareholders' equity:

Common stock and additional paid-in capital, $0.00001 par value: 12,600,000 shares

authorized; 4,443,236 and 4,754,986 shares issued and outstanding, respectively

Retained earnings

Total liabilities and shareholders' equity

September 28,

2019

Apple Inc. I 2019 Form 10-K | 31

$

$

$

$

See accompanying Notes to Consolidated Financial Statements.

48,844 $

51,713

22,926

4,106

22,878

12,352

162,819

105,341

37,378

32,978

175,697

338,516

September 29,

2018

91,807

50,503

142,310

248,028

46,236 $

37,720

5,522

5,980

10,260

105,718

45,174

45,898

(584)

$

90,488

338,516 $

25,913

40,388

23,186

3,956

25,809

12,087

131,339

170,799

41,304

22,283

234,386

365,725

55,888

33,327

5,966

11,964

8,784

115,929

93,735

48,914

142,649

258,578

40,201

70,400

(3,454)

107,147

365,725

Transcribed Image Text:Integrating Accounting for Liabilities and Equity

Obtain Apple's fiscal year 2019 10-K (filed October 31, 2019) either from the "Investor Relations" portion of its website (do a web search for "Apple Investor Relations")

Required:

Using Apple's 10-K, answer the following questions (Hint: It may be easier to use the Word or the PDF file, and use the search feature within the program.):

1. Calculate Apple's current, quick, and cash ratios for 2018 and 2019. The industry averages for these ratios for 2019 were 1.72, 1.41, and 0.77, respectively. Round

your answers to two decimal places.

2019

Current Ratio

Quick Ratio

Cash Ratio

2018

Comment on Apple's short-term liquidity.

For 2019, Apple

the industry average for the current and quick ratio, but

the industry average for the cash ratio. However, because there is little

concern about Apple's ability to sell its inventories, the current ratio provides relatively high confidence that Apple

be able to meet its short-term obligations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning