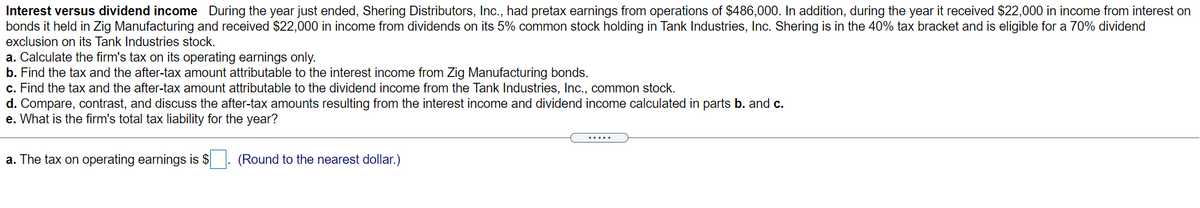

Interest versus dividend income During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $486,000. In addition, during the year it received $22,000 in income from interest on bonds it held in Zig Manufacturing and received $22,000 in income from dividends on its 5% common stock holding in Tank Industries, Inc. Shering is in the 40% tax bracket and is eligible for a 70% dividend exclusion on its Tank Industries stock. a. Calculate the firm's tax on its operating earnings only. b. Find the tax and the after-tax amount attributable to the interest income from Zig Manufacturing bonds. c. Find the tax and the after-tax amount attributable to the dividend income from the Tank Industries, Inc., common stock. d. Compare, contrast, and discuss the after-tax amounts resulting from the interest income and dividend income calculated in parts b. and c. e. What is the firm's total tax liability for the year? a. The tax on operating earnings is $ (Round to the nearest dollar.)

Interest versus dividend income During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $486,000. In addition, during the year it received $22,000 in income from interest on bonds it held in Zig Manufacturing and received $22,000 in income from dividends on its 5% common stock holding in Tank Industries, Inc. Shering is in the 40% tax bracket and is eligible for a 70% dividend exclusion on its Tank Industries stock. a. Calculate the firm's tax on its operating earnings only. b. Find the tax and the after-tax amount attributable to the interest income from Zig Manufacturing bonds. c. Find the tax and the after-tax amount attributable to the dividend income from the Tank Industries, Inc., common stock. d. Compare, contrast, and discuss the after-tax amounts resulting from the interest income and dividend income calculated in parts b. and c. e. What is the firm's total tax liability for the year? a. The tax on operating earnings is $ (Round to the nearest dollar.)

Chapter11: The Corporate Income Tax

Section: Chapter Questions

Problem 5P: Fisafolia Corporation has gross income from operations of $210,000 and operating expenses of...

Related questions

Question

2

Transcribed Image Text:Interest versus dividend income During the year just ended, Shering Distributors, Inc., had pretax earnings from operations of $486,000. In addition, during the year it received $22,000 in income from interest on

bonds it held in Zig Manufacturing and received $22,000 in income from dividends on its 5% common stock holding in Tank Industries, Inc. Shering is in the 40% tax bracket and is eligible for a 70% dividend

exclusion on its Tank Industries stock.

a. Calculate the firm's tax on its operating earnings only.

b. Find the tax and the after-tax amount attributable to the interest income from Zig Manufacturing bonds.

c. Find the tax and the after-tax amount attributable to the dividend income from the Tank Industries, Inc., common stock.

d. Compare, contrast, and discuss the after-tax amounts resulting from the interest income and dividend income calculated in parts b. and c.

e. What is the firm's total tax liability for the year?

.....

a. The tax on operating earnings is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning