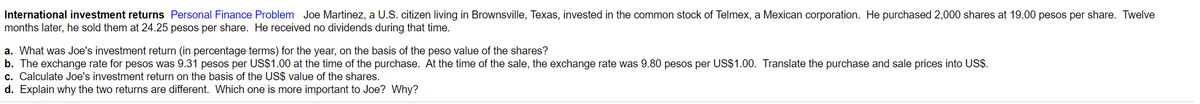

International investment returns Personal Finance Problem Joe Martinez, a U.S. citizen living in Brownsville, Texas, invested in the common stock of Telmex, a Mexican corporation. He purchased 2,000 shares at 19.00 pesos per share. Twelve months later, he sold them at 24.25 pesos per share. He received no dividends during that time. a. What was Joe's investment return (in percentage terms) for the year, on the basis of the peso value of the shares? b. The exchange rate for pesos was 9.31 pesos per US$1.00 at the time of the purchase. At the time of the sale, the exchange rate was 9.80 pesos per US$1.00. Translate the purchase and sale prices into USS. c. Calculate Joe's investment return on the basis of the US$ value of the shares. d. Explain why the two returns are different. Which one is more important to Joe? Why?

International investment returns Personal Finance Problem Joe Martinez, a U.S. citizen living in Brownsville, Texas, invested in the common stock of Telmex, a Mexican corporation. He purchased 2,000 shares at 19.00 pesos per share. Twelve months later, he sold them at 24.25 pesos per share. He received no dividends during that time. a. What was Joe's investment return (in percentage terms) for the year, on the basis of the peso value of the shares? b. The exchange rate for pesos was 9.31 pesos per US$1.00 at the time of the purchase. At the time of the sale, the exchange rate was 9.80 pesos per US$1.00. Translate the purchase and sale prices into USS. c. Calculate Joe's investment return on the basis of the US$ value of the shares. d. Explain why the two returns are different. Which one is more important to Joe? Why?

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter17: Multinational Financial Management

Section: Chapter Questions

Problem 16P: FOREIGN INVESTMENT ANALYSIS After all foreign and U.S. taxes, a U.S. corporation expects to receive...

Related questions

Question

Please do A-D thank you.

Transcribed Image Text:International investment returns Personal Finance Problem Joe Martinez, a U.S. citizen living in Brownsville, Texas, invested in the common stock of Telmex, a Mexican corporation. He purchased 2,000 shares at 19.00 pesos per share. Twelve

months later, he sold them at 24.25 pesos per share. He received no dividends during that time.

a. What was Joe's investment return (in percentage terms) for the year, on the basis of the peso value of the shares?

b. The exchange rate for pesos was 9.31 pesos per US$1.00 at the time of the purchase. At the time of the sale, the exchange rate was 9.80 pesos per US$1.00. Translate the purchase and sale prices into US$.

c. Calculate Joe's investment return on the basis of the US$ value of the shares.

d. Explain why the two returns are different. Which one is more important to Joe? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning