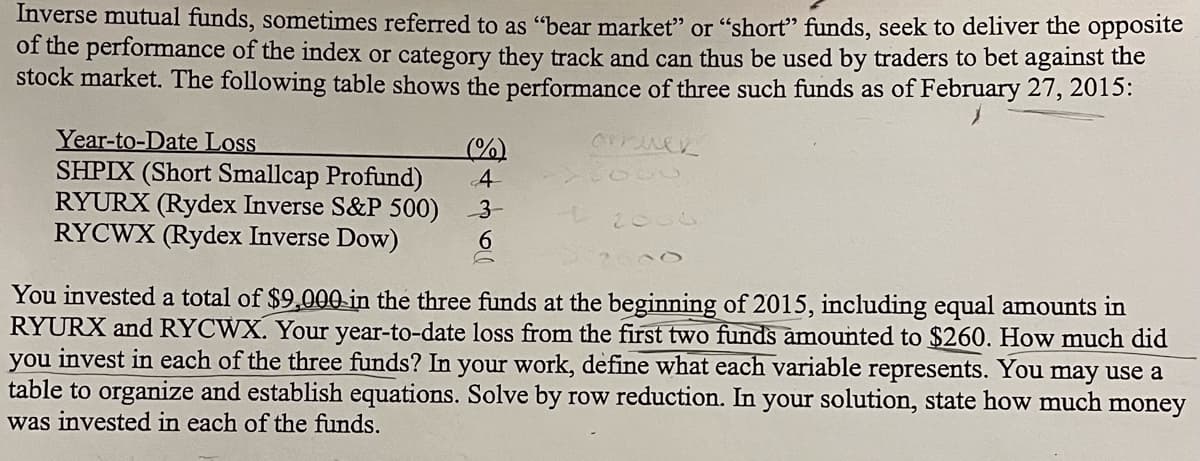

Inverse mutual funds, sometime referred to as “bear market” or “short” funds, seek to deliver the opposite of the performance of the index or category they track and can thus be used by traders to bet against the stock market. The following table shows the performance of three such funds as of February 27, 2015: Year to date loss (%) : SHPIX 4%, RYURX 3%, and RYCWX 6%. You invested a total of $9,000 in the three funds at the beginning of 2015, including equal amounts in RYURX and RYCWX. Your year-to-date loss from the first two funds amounted to $260. How much did you invest in each of the three funds? Solve by row reduction. In your solution, state how much money was invested in each of the funds.

Inverse mutual funds, sometime referred to as “bear market” or “short” funds, seek to deliver the opposite of the performance of the index or category they track and can thus be used by traders to bet against the stock market. The following table shows the performance of three such funds as of February 27, 2015: Year to date loss (%) : SHPIX 4%, RYURX 3%, and RYCWX 6%. You invested a total of $9,000 in the three funds at the beginning of 2015, including equal amounts in RYURX and RYCWX. Your year-to-date loss from the first two funds amounted to $260. How much did you invest in each of the three funds? Solve by row reduction. In your solution, state how much money was invested in each of the funds.

Calculus: Early Transcendentals

8th Edition

ISBN:9781285741550

Author:James Stewart

Publisher:James Stewart

Chapter1: Functions And Models

Section: Chapter Questions

Problem 1RCC: (a) What is a function? What are its domain and range? (b) What is the graph of a function? (c) How...

Related questions

Question

Inverse mutual funds, sometime referred to as “bear market” or “short” funds, seek to deliver the opposite of the performance of the index or category they track and can thus be used by traders to bet against the stock market. The following table shows the performance of three such funds as of February 27, 2015: Year to date loss (%) : SHPIX 4%, RYURX 3%, and RYCWX 6%. You invested a total of $9,000 in the three funds at the beginning of 2015, including equal amounts in RYURX and RYCWX. Your year-to-date loss from the first two funds amounted to $260. How much did you invest in each of the three funds? Solve by row reduction. In your solution, state how much money was invested in each of the funds.

Transcribed Image Text:Inverse mutual funds, sometimes referred to as "bear market" or "short" funds, seek to deliver the opposite

of the performance of the index or category they track and can thus be used by traders to bet against the

stock market. The following table shows the performance of three such funds as of February 27, 2015:

Year-to-Date Loss

SHPIX (Short Smallcap Profund)

RYURX (Rydex Inverse S&P 500)

RYCWX (Rydex Inverse Dow)

(%)

4

3

6

6

Cruck

دری

You invested a total of $9,000 in the three funds at the beginning of 2015, including equal amounts in

RYURX and RYCWX. Your year-to-date loss from the first two funds amounted to $260. How much did

you invest in each of the three funds? In your work, define what each variable represents. You may use a

table to organize and establish equations. Solve by row reduction. In your solution, state how much money

was invested in each of the funds.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781285741550

Author:

James Stewart

Publisher:

Cengage Learning

Thomas' Calculus (14th Edition)

Calculus

ISBN:

9780134438986

Author:

Joel R. Hass, Christopher E. Heil, Maurice D. Weir

Publisher:

PEARSON

Calculus: Early Transcendentals (3rd Edition)

Calculus

ISBN:

9780134763644

Author:

William L. Briggs, Lyle Cochran, Bernard Gillett, Eric Schulz

Publisher:

PEARSON

Calculus: Early Transcendentals

Calculus

ISBN:

9781319050740

Author:

Jon Rogawski, Colin Adams, Robert Franzosa

Publisher:

W. H. Freeman

Calculus: Early Transcendental Functions

Calculus

ISBN:

9781337552516

Author:

Ron Larson, Bruce H. Edwards

Publisher:

Cengage Learning