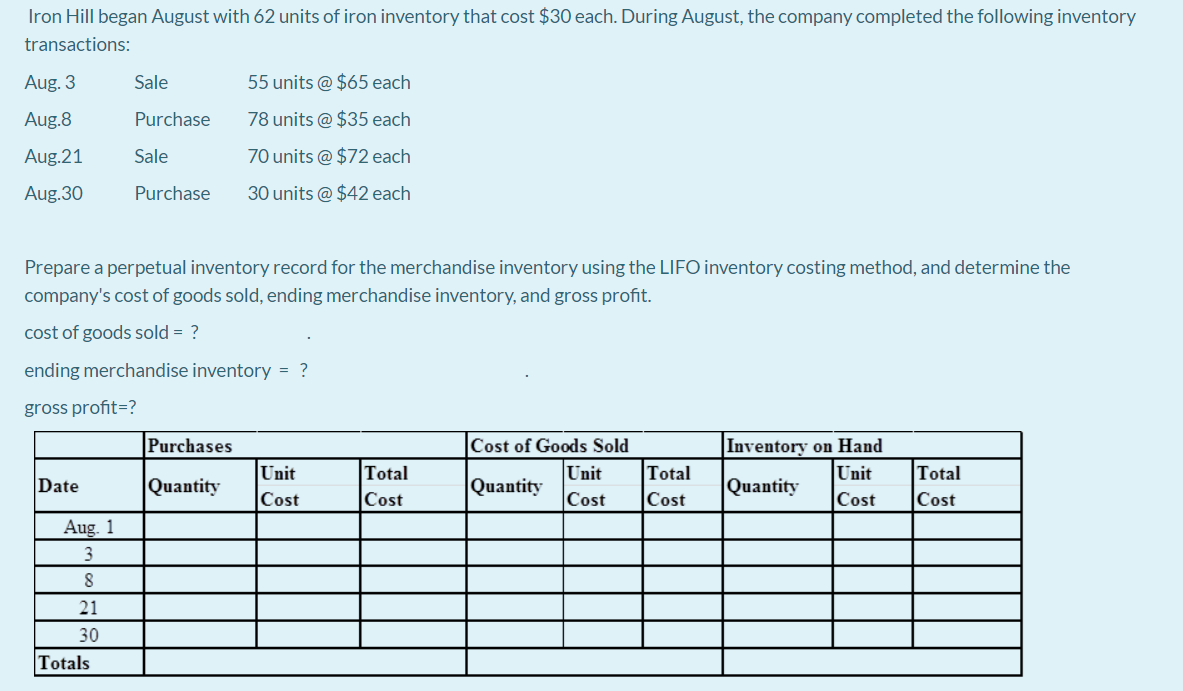

Iron Hill began August with 62 units of iron inventory that cost $30 each. During August, the company completed the following inventory transactions: Aug. 3 Sale 55 units @ $65 each Aug.8 Purchase 78 units @ $35 each Aug.21 Sale 70 units @ $72 each Aug.30 Purchase 30 units @ $42 each Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. cost of goods sold = ? ending merchandise inventory = ? gross profit=? Cost of Goods Sold Unit Cost Purchases |Inventory on Hand Unit Unit Total Cost Total Cost Total Date Quantity Quantity Quantity Cost Cost Cost Aug. 1 21 30 Totals

Iron Hill began August with 62 units of iron inventory that cost $30 each. During August, the company completed the following inventory transactions: Aug. 3 Sale 55 units @ $65 each Aug.8 Purchase 78 units @ $35 each Aug.21 Sale 70 units @ $72 each Aug.30 Purchase 30 units @ $42 each Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method, and determine the company's cost of goods sold, ending merchandise inventory, and gross profit. cost of goods sold = ? ending merchandise inventory = ? gross profit=? Cost of Goods Sold Unit Cost Purchases |Inventory on Hand Unit Unit Total Cost Total Cost Total Date Quantity Quantity Quantity Cost Cost Cost Aug. 1 21 30 Totals

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 11RE: Jessie Stores uses the periodic system of calculating inventory. The following information is...

Related questions

Topic Video

Question

Transcribed Image Text:Iron Hill began August with 62 units of iron inventory that cost $30 each. During August, the company completed the following inventory

transactions:

Aug. 3

Sale

55 units @ $65 each

Aug.8

Purchase

78 units @ $35 each

Aug.21

Sale

70 units @ $72 each

Aug.30

Purchase

30 units @ $42 each

Prepare a perpetual inventory record for the merchandise inventory using the LIFO inventory costing method, and determine the

company's cost of goods sold, ending merchandise inventory, and gross profit.

cost of goods sold = ?

ending merchandise inventory = ?

gross profit=?

Purchases

Cost of Goods Sold

Inventory on Hand

Unit

Cost

Total

Total

Unit

Cost

Unit

Cost

Total

Cost

Date

Quantity

Quantity

Quantity

Cost

Cost

Aug. 1

3

8

21

30

Totals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,