irrecoverable debts t

Q: Define cost of borrowing.

A: Company needs to complete the goal set initially by the top level of management. These goals include…

Q: What are Contingent Liabilities? Give an example. What are the factors that determine the reason…

A: A liability, the occurrence of which is uncertain that is it may or may not occur is known as a…

Q: ne debt to O the F

A: The debt to asset ratio is a leverage ratio that measures the number of total assets that are…

Q: Secured vs Unsecured debt

A: Secured Debt: These are debts backed up with some collateral like assets. Hence the borrower of the…

Q: Difference between current assets and current liabilities.

A: Current assets are those assets which can be realized within short term period or less than one year…

Q: n what way do assets differ from liabilities?

A: Solution: Asset is a resource owned by the business having some economic value with expectation of…

Q: What is a debt security?

A: Bonds: Bonds are long-term promissory notes that are issued by a company while borrowing money from…

Q: What are accrued liabilities?

A: Accrued liabilities are the outstanding expenses which are due or incurred but not yet paid in cash.…

Q: What are contingent liabilities?

A: Liabilities by and large, are a commitment to, or it is an amount that one owes to another person.…

Q: Difference between current and long term liabilities?

A: Liabilities: The claims creditors have over assets or resources of a company are referred to as…

Q: What is Debt Service?

A: Step 1 The amount of money required to pay interest on the loan with the principal over some time is…

Q: Why is Unearned Revenue considered a liability?

A: Unearned revenue is the revenue that has not been earned yet but payment has been received from the…

Q: what is total liabilities?

A: Solution- Total Liability-Total liabilities are the combined debts and obligations that an…

Q: What is issue of payments deficits

A: Introduction:- payment of deficit means:- Country imports more goods, services, and capital than…

Q: Define CDO, collateralized debt obligation

A: The question is based on the structure and definition of Collateralized debt obligation (CDO), the…

Q: uded debt i t will increa

A: Introduction : In simple words, recapitalization refers to the process in which a firm changes its…

Q: What is liabilities?

A: Liabilities: The claims creditors have over assets or resources of a company are referred to as…

Q: What is the difference between "change in current assets" and "change in liabilities?

A: Current assets: The assets which could be converted into cash within one year like accounts…

Q: Entires for bad debt expense - direct write off method

A: Direct write off method is to be used when a business for invoice uncollectible

Q: what is the difference between unsecured and secured transactions in terms of default

A: These types of transactions are based on the creditworthiness. These are loan or other credit…

Q: What amount should be reported as total noncurrent liabilities?

A: Answer: 1,620,00

Q: Liabilities are

A: Balance sheet includes the assets, liabilities and stockholders' equity of the company that…

Q: What are the advantages of matching the maturities of assets and liabilities? What are the…

A: Matching the maturities of assets and liabilities refers to matching the similar category of assets…

Q: a. WACC b. Aftertax cost of debt

A: Given : Capital Structure Weights Cost (%) Common Stock 65% 10% Preferred stock 10% 4%…

Q: prediction of doubtful debts,

A: Allowance for doubtful debts is the provision for uncollectible account estimated on the basis of…

Q: ation of debt income from qualifi

A: The Qualified Principal Residence exclusion enables a taxpayer to deduct up to $2,000,000 of the…

Q: Contingent liabilities are obligations that may or may not materialize

A: Contingent liabilities are obligations that may or may not materialize will be explained:

Q: When should a debt security be classified as held-tomaturity?

A: Debt securities: Debt security is money borrowed at a specific rate of interest which must be repaid…

Q: How are liabilities classified? Why is it important to classify liabilities?

A: A liability is a present obligation of the enterprise arising from past events, the settlement of…

Q: Which of the following liabilities would be considered nonrecourse?

A: "As the student have not been given the options to choose the nonrecourse liabilities, I will give…

Q: O No, because it represents debt.

A: IOU in money shows the existence of debt which represents the informal written agreement that is a…

Q: What types of short-term credit are classified as accrued liabilities?

A: An accrued liability means the expense of the business incurred during a specific period but has yet…

Q: Obligation to pay back your monetary debt. What kind of obligation is involve here?

A: Obligation to pay the debt: In the context of financial responsibilities, this refers to any…

Q: gent liab

A: Contingent Liability A contingent liability is an obligation that may arise as a result of the…

Q: What is the difference between liabilities and assets?

A: The balance sheet represents the financial position of the business with assets and liabilities at…

Q: In what way do current liabilities and long-term liabilities differ from each other?

A: Current liabilities are liabilities that are due within one year. In other words, current…

Q: Define what is an off-balance sheet activity? Also provide example of an off-balance sheet an…

A: Off-Balance sheet Activity means the assets or liabilities which are not reflected in the balance…

Q: What is the difference between fully secured liabilities, partially secured liabilities, and…

A: Liabilities: The claims creditors have over assets or resources of a company are referred to as…

Q: Define secured debt

A: The term debt refers to the money taken out a loan from individuals, financial institutions, or…

Q: What are out of period debts? Explain?

A: Out of Period debts: It is also known as time barred debts.

Q: What is debt

A: The financial statements of the business includes the income statement and balance sheet of the…

Q: Explain Contingent Liabilities.

A: Contingent liabilities are the liabilities of the company but they can not be classified as current…

Step by step

Solved in 3 steps

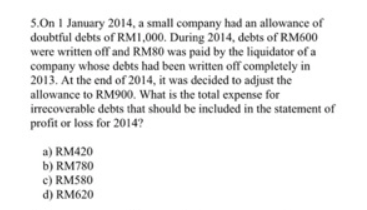

- DAD Company used the allowance method of accounting for uncollectible accounts. During2021, the entity had charged 750,000 to bad debt expense and wrote off accounts receivableof 780,000 as uncollectible. What was the decrease in working capital?*Ameera Enterprise had a balance on its allowance for doubtful debts of RM26,250 as at 31 December 2019. Allowance for doubtful debts was estimated at 5% on account receivable. On 31 December 2020, the balance of its net accounts receivable was RM550,000. Calculate the amount of doubtful debts to be shown in the statement of profit or loss for the year ending 31 December 2020 A.RM25,000 B.RM1,250 C.RM2,500 D.RM27,500At 30 June 20X6 a business had a provision for doubtful debts of £37600. At 30 June 20X7 it was decided to write-off £21900 as bad debts and that a specific provision for doubtful debts of £45300 was required. What is the total expense for bad and doubtful debts which will appear in the business's income statement for the year ended 30 June 20X7?

- On January 1, 2020, Ocean Company's Allowance for Bad debts had a credit balance of P 120,000. During the year, the company wrote off P 205,000 of uncollectible Accounts Receivable, and unexpectedly recovered P 65,000 of bad debts written off in the prior year. Also at the end of this year, the company charged P 280,000 to bad debts expense. How much is the adjusted balance of Allowance for Bad Debts on Dec. 31, 2020? .Ali Company borrowed OMR50, 000 in December 2019 for a period of three months from Azzan and will make its interest payment three months later. The total interest for the three months will be OMR 1500. At the end of the year 2019 in the financial statement, the company reported Interest Expense of OMR 500 in Income Statement. a. This action was the result of which accounting principle? Explain. b. Do you think, the borrowed money will increase the assets/ Liabilities of the business? Yes/ No Justify your answer.On January 1, 2022, Amoeba Company changed its method of accounting for bad debts from the direct write-off method to the allowance method. The company's controller determined that an allowance of P 30,000 should be established on that date. Ignoring income taxes, what is the adjustment required to record the change? a. Debit - Retained Earnings, P 30,000; Credit - Allowance for Doubtful Accounts, P 30,000. b. Debit - Doubtful Accounts Expense, P 30,000; Credit - Allowance for Doubtful Accounts, P 30,000. c. Debit - Doubtful Accounts Expense, P 30,000; Credit - Retained Earnings, P 30,000. d. Debit - Retained Earnings, P 30,000; Credit - Doubtful Accounts Expense, P 30,000.

- Lithium Co.'s current liabilities totaled USD1,600,000 as of December 31, 2014, before any necessary year-end adjustments. Lithium Co. purchased and received goods for USD300,000 terms 2/10, n/30 on December 28, 2014. On January 4, 2015, the invoice was recorded and paid.In its December 31, 2014 balance sheet, how much should Lithium Co. report as total current liabilities?RM1. During March, Company A wrote off a $15,000 account receivable because a customer went bankrupt (assume the company uses the GAAP-required method). This will: Group of answer choices a) Increase bad debt expense b) Reduce the net realizable value of accounts receivable c) Reduce accounts receivable d)Increase the allowance for doubtful accounts e)Reduce net income for the yearOn December 31, 2015, the accounts receivable account and allowance for doubtful accounts of Beckman Corporation have the balances of $600,000 debit and $5,000 debit, respectively. Net sales for the year 2015 are $1,000,000. The company uses percentage of receivables method to account for bad debts and the percentage for estimated uncollectible is 5%. The amount of adjusting entry for bad debt expense that would be recorded on December 31.2015 is: a. S30,000 b. S35,000 c. S50,000 d. S29,750

- XYZ Company showed the following account balances as of December 31, 2020 : Net sales -P400,000; Accounts receivable - P150,000; and Allowance for bad debts - P10,000. The policy of the business states that allowance for bad debts should be 7% of net sales, how much is the doubtful accounts expense on December 31, 2020?On April 4, 2021, LASTNATOBEYBE, Inc. sold goods on account to acustomer for P1,000,000, terms were 2/10, n/30. The company factoredthe accounts receivable on April 4 to a financial institution on April 14,2021. The factor charged 8% and withheld 15% of the receivablesfactored.How much is the proceeds from factoring?5. Oriental Company follows the procedure of debiting bad debt expense for 2% of all new sales. Sales for three consecutive years and year-end allowance account balances were as follows: Sales Allowance for Bad Debts 2018 3,000,000 40,000 2019 2,800,000 60,000 2020 3,500,000 80,000 What is the amount of accounts written off in 2020?