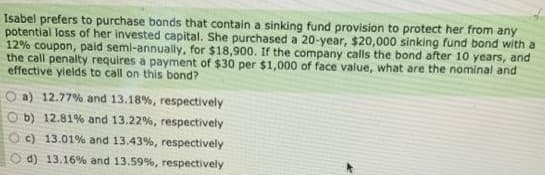

Isabel prefers to purchase bonds that contain a sinking fund provision to protect her from any potential loss of her invested capital. She purchased a 20-year, $20,000 sinking fund bond with a 12% coupon, paid semi-annually, for $18,900. If the company calls the bond after 10 years, and the call penalty requires a payment of $30 per $1,000 of face value, what are the nominal and effective yields to call on this bond? Oa) 12.77% and 13.18%, respectively Ob) 12.81% and 13.22%, respectively Oc) 13.01% and 13.43% respectivel

Isabel prefers to purchase bonds that contain a sinking fund provision to protect her from any potential loss of her invested capital. She purchased a 20-year, $20,000 sinking fund bond with a 12% coupon, paid semi-annually, for $18,900. If the company calls the bond after 10 years, and the call penalty requires a payment of $30 per $1,000 of face value, what are the nominal and effective yields to call on this bond? Oa) 12.77% and 13.18%, respectively Ob) 12.81% and 13.22%, respectively Oc) 13.01% and 13.43% respectivel

Chapter4: Income Exclusions

Section: Chapter Questions

Problem 87TPC

Related questions

Question

Transcribed Image Text:Isabel prefers to purchase bonds that contain a sinking fund provision to protect her from any

potential loss of her invested capital. She purchased a 20-year, $20,000 sinking fund bond with a

12% coupon, paid semi-annually, for $18,900. If the company calls the bond after 10 years, and

the call penalty requires a payment of $30 per $1,000 of face value, what are the nominal and

effective yields to call on this bond?

a) 12.77% and 13.18%, respectively

Ob) 12.81% and 13.22 %, respectively

Oc) 13.01% and 13.43%, respectively

d) 13.16% and 13.59%, respectively

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you