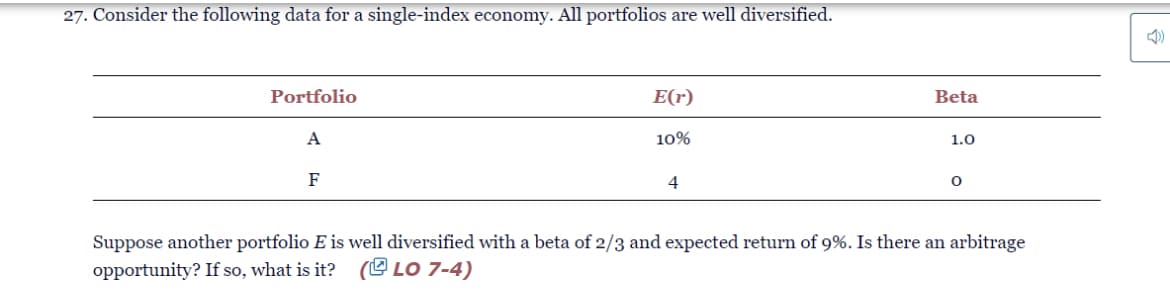

isider the Iollowing data for a single-index econo All portiollos are well diversiled. Portfolio E(r) Beta 10% 1.0 F 4 Suppose another portfolio E is well diversified with a beta of 2/3 and expected return of 9%. Is there an arbitrage opportunity? If so, what is it? ( LO 7-4)

Q: c) Assume that using the Security Market Line (SML) the required rate of return (Ra) on stock A is…

A: We’ll answer the first question since the exact one wasn’t specified. Please submit a new question…

Q: The Treasury bill rate is 4%, and the expected return on the market portfolio is 12%. According to…

A: Financial statements are statements which states the business activities performed by the company .…

Q: The Treasury bill rate is 6%, and the expected return on the market portfolio is 10%. According to…

A: Expected Return on Market = 10% Risk free Rate = 6%

Q: Please help me with 11-5 ??♀️

A:

Q: You have estimated a firm's beta value to be 1.2. The expected return of the market portfolio is 12%…

A: We require to calculate the required rate of return for the firm in this question. We can solve this…

Q: beta

A: Formula to calculate portfolio beta is: Portfolio beta = wA*Beta A + wB*Beta B +......+wN*Beta N…

Q: If a firm's beta is 1.1, the risk-free rate is 6%, and the expected return on the market is 14%,…

A: Details given are : Beta = 1.1 Risk free rate = 6% Expected market return = 14% We need to compute…

Q: CAPM The Treasury bill rate is 4%, and the expected return on the market portfolio is 12%. Using the…

A: Because you have asked question with multiple parts (MULTI PART) , we will solve the first 3 parts…

Q: CAPM: The Treasury bill rate is 5%, and the expected return on the market portfolio is 12%. On the…

A: Risk premium = Expected return on market portfolio - Treasury bill rate Risk premium on investment =…

Q: c) Assume that using the Security Market Line (SML) the required rate of return (RA) on stock A is…

A: The question is based on the concept Capital asset pricing model (CAPM) and beta of a stock, the…

Q: a.) Using Capital Asset Pricing Model (CAPM) to compute an appropriate rate of return for Intel…

A: In this question we are required to calculate rate of return of Intel common stock using CAPM: As…

Q: Treasury bills currently have a return of 2.5% and the market risk premium is 7%. If a firm has a…

A: The cost of equity can be calculated with the help of CAPM equation. The risk free rate is usually…

Q: Assume that the risk-free rate of return is 4% and the market risk premium (i.e., Rm - Rf) is 8%. If…

A: Financial statements are statements which states the business activities performed by the company .…

Q: HR Industries (HRI) has a beta of 2.3, while LR Industries's (LRI) beta is 1.0. The risk-free rate…

A: The mathematical equation for computing the required return is:

Q: e Treasury bill rate is 6%, and the expected return on the market portfolio is 14%. According to the…

A: We need to use CAPM to calculate required rate of return. The equation Required rate of return =Risk…

Q: assume that expected return of the stock A in Rachel's portfolio is 13.6% this year.The risk premium…

A:

Q: State of Economy Probability of State of Economy Rate of Return if State Occurs Stock A Stock B…

A: d) Expected return of the portfolio:(Ba×Pa)+(Bb×Pb)Where,Ba=Beta of stock A Bb=Beta of stock…

Q: If the firm’s beta is 1.75, the risk-free rate is 8%, and the average return on the market is 12%,…

A: Firm beta (B) = 1.75 Risk free rate (Rf) = 8% Market return (Rm) = 12%

Q: The Treasury bill rate is 4.9%, and the expected return on the market portfolio Is 11.1%. Use the…

A: According to the rule, we will answer the first three subparts, for the remaining subparts, kindly…

Q: The risk-free rate of return is 7%. The average market return is 11%. (a) What will be the return…

A: The capital asset pricing model(CAPM) is the model which shows the relationship between systematic…

Q: Consider the following well diversified portfolios A: expected ROR =7% with beta=0.5, B: expected…

A: we will make a new portfolio D with the help of portfolio A and B with equal share. Thus, the return…

Q: HR Industries (HRI) has a beta of 2.3, while LR Industries's (LRI) beta is 1.0. The risk-free rate…

A: Required rate: It is the minimum return that is required by an investor for investing in a company's…

Q: SR Industries (SRI) has a beta of 1.6; KR Industries's (KRI) beta is 0.4. The risk-free rate is 6%,…

A: Given data; For SR industries= Risk free rate ( Rf) = 6% beta = 1.6 market rate of return ( Rm) =…

Q: Assume that the risk-free rate of return is 4% and the market risk premium (i.e., Rm - R) is 8%. If…

A: Given: Risk free rate of return =4%Market risk premium =8%Beta =1.28

Q: 1. Consider the following states of outcomes, probabilities, and expected returns on only stocks…

A: Portfolio refers to basket of different financial assets in which investment is made by single…

Q: Here are data on Afterpay and ZIP shares. Firm Afterpay ZIP Forecast return 11% 9% Standard…

A: This question contain two different question so we are answering only the first part (a & b) of…

Q: Need help

A: The formula to calculate required return is given below:

Q: Assume that expected return of the stock A in your portfolio is 14.6%. The risk premium on the…

A: CAPM is the relationship between systematic risk and returns for assets. This concept is used for…

Q: Suppose there are two independent economic factors, M, and M2. The risk-free rate is 5%, and all…

A: Formula for expected return: Expected return=Risk free rate + Beta1×Expected return1+Beta2×Expected…

Q: HR Industries (HRI) has a beta of 1.2, while LR Industries's (LRI) beta is 0.5. The risk-free rate…

A: The minimum amount of profit that the investors are expected in order to invest in specific security…

Q: Suppose that you know that the following well-diversified portfolios are fairly priced in a…

A: Investment in the security market contains a high degree of risk. The investor is attached to the…

Q: The Treasury bill rate is 6%, and the expected return on the market portfolio is 10%. According to…

A: Since you have asked a question with multiple parts, we will solve the first 3 parts for you. Please…

Q: Assume the risk-free rate is 3% and the market return is 10%. Stock X Stock Y Stock Z Beta 0.65 0.90…

A: “Since you have posted a question with multiple sub-parts, we will solve first three sub-parts for…

Q: The risk free rate of return is 3.4%; the expected return of the market portfolio is 12.2% and the…

A: CAPM return CAPM model is used for describing the relationship between the expected return and the…

Q: Consider the two risky investments below: Scenario Asset 1 Asset 2 Probability Returns 0.1…

A: Part 2 of the questio is : What is the difference between systematic and non-systematic risk. There…

Q: . Suppose there are two independent economic factors, M, and M,. The risk-free rate is 7%, and all…

A: Portfolio A beta1 is 1.8, Beta 2 is 2.1 and Expected return is 40% Portfolio B beta1 is 2.0, Beta 2…

Q: The Treasury bill rate is 6%, and the expected return on the market portfolio is 10%. According to…

A: Given information: Treasury bill rate is 6% Expected return on market portfolio is 10% Market…

Q: The return on market portfolio is 12% and the risk-free is 6%. The beta coefficient is 1.3.Using the…

A: Market return (MR) = 12% Risk free rate (RF) = 6% Beta (B) = 1.3

Q: Assume that the risk-free rate of return is 4% and the market risk premium (ie, Rm - Rp) is 8%. If…

A: Financial statements are statements which states the business activities performed by the company .…

Q: 1. Stock A has a required expected return of 6 percent and stock B has a required expected return of…

A: Required return of A (Ra) = 6% Required return of B (Rb) = 10% Beta of A = B Beta of B = twice that…

Q: The firm's beta is 1.2. The risk-free rate is 4.0% and the expected market return is 9%. What is the…

A: As per CAPM, Cost of equity = Risk free Rate + Beta * (Market return - Risk free Rate)

Q: Q2

A: Beta Coefficient The Beta coefficient is a measure of a security's sensitivity or correlation. or…

Q: Consider the three well diversified portfolios below. what will be the arbitrage profit per $10,000…

A: Portfolios are the collections or combinations of various investments and financial assets that are…

Q: HR Industries (HRI) has a beta of 1.6; LR Industries’s(LRI) beta is 0.8. The risk-free rate is 6%,…

A: Risk Free Rate = 6% Required Return on average stock = 13% Updated Required Return on market = 10.5%…

How to solve from essentials of investment chapter 7?

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- Suppose there are two independent economic factors, M1 and M2. The risk-free rate is 5%, and all stocks have independent firm-specific components with a standard deviation of 40%. Portfolios A and B are both well diversified. Portfolio Beta on M1 Beta on M2 Expected Return (%) A 1.8 2.2 30 B 2.1 -0.5 8 Required: What is the expected return–beta relationship in this economy? (Do not round intermediate calculations. Round your answers to 2 decimal places.)Suppose that there are two independent economic factors, F1 and F2, the risk-free rate is 6%, and all stocks have independent firm-specific components with a standard deviation of 30%. The following are well-diversified portfolios: Portfolio Beta on F1 Beta on F2 Expected Return A 1.1 1.5 15% B 0.9 0.5 13% What is the expected return-beta relationship in this economy?Suppose there are two independent economic factors, M1 and M2. The risk-free rate is 4%, and all stocks have independent firm-specific components with a standard deviation of 49%. Portfolios A and B are both well diversified. Portfolio Beta on M1 Beta on M2 Expected Return (%) A 1.6 2.4 39 B 2.3 -0.7 9 Required: What is the expected return–beta relationship in this economy?

- Assume that both portfolios A and B are well diversified, that E(rA) = 20% and E(rB) = 15%. If the economy has only one factor, and BetaA = 1.3, whereas BetaB = 0.8, what must be the risk-free rate (write as percentage, rounded to two decimal places)?Suppose that there are two independent economic factors, F, and F2. The risk-free rate is 6%, and all stocks have independent firm-specific components with a standard deviation of 46%. Portfolios A and 8 are both well-diversified with the following properties: Expected Portfolio Beta on F1 Beta on F2 Es ReturnA 2.1 2.4 35%B 3.0 -0.24 30% What is the expected return-beta relationship in this economy? Calculate the risk-free rate, rf, and the factor risk premiums, RP1 and RP2, to complete the equation below. (Do not round intermediate calculations. Round your answers to two decimal places.) Blrp) = r¢ + (Ber * RP1) + (Bp2 * RP2) Please see attached image for more details.Suppose that there are two independent factors, F1 and F2. The risk-free rate is 3%, and all stocks have independent firm-specific components with a standard deviation of 42%. Portfolios A and B are both well-diversified with the following properties: Portfolio Beta on F1 Beta on F2 Expected Return A 1.8 2.1 32% B 2.7 -0.21 27% What is the expected return-beta relationship in this economy? Calculate the risk-free rate, rf, and the factor risk premiums, RP1 and RP2, to complete the equation below (write answers as percentages, rounded to two decimal places). E(rp) = rf + (BP1 X RP1) + (BP2 X RP2) (Note: B = Beta) rf ?% RP1 ?% RP2 ?%

- 4. Suppose that there are two independent economic factors, F1 and F2. The risk-free rate is 6%,and all stocks have independent firm-specific components with a standard deviation of 45%.Portfolios A and B are both well-diversified with the following properties: What is the expected return–beta relationship in this economy?Suppose that there are two independent economic factors, F1 and F2. The risk-free rate is 10%, and all stocks have independent firm-specific components with a standard deviation of 40%. Portfolios A and B are both well-diversified with the following properties: Portfolio Beta on F1 Beta on F2 Expected Return A 1.6 2.0 30 % B 2.5 –0.20 25 % What is the expected return-beta relationship in this economy? Calculate the risk-free rate, rf, and the factor risk premiums, RP1 and RP2, to complete the equation below. (Do not round intermediate calculations. Round your answers to two decimal places.)E(rP) = rf + (βP1 × RP1) + (βP2 × RP2)Using CAPM to determine the expected rate of return for risky assets, consider the following example stocks, assuming that you have already compute the betas Stock Beta A 0.70 B 1.00 C 1.15 D 1.40 E -0.30 Assume that we expect the economy’s RFR to be 5 percent (0.05) and the expected return on the market portfolio (E(RM)) to be 9 percent (0.09), 1, what would this imply? With these inputs, what would the be the following required rate of returns for these five stocks, show the formula for each in your calculations.

- The treasury bill rate is 6%, and the expected return on the market portfolio is 10%. According to the capital asset pricing model: A. What is the risk premium on the market? B. What is the required return on an investment with a beta of 1.4? C. If an investment with a beta of 0.8 offers an expected return of 9.0% does it have positive or negative NPV? D. If the market expects a return of 11.0% from stock X, what is its beta?Consider the following data for a one-factor economy. All portfolios are assumed to be well diversified. Portfolio. A. F Expected return 12% 6% Beta. 1.2 0.0 Suppose that another portfolio, portfolio E, is well diversified with a beta of 0.6 and expected return of 8%. Would an arbitrage opportunity exist? If so, what would be the arbitrage strategy? (Note: show what the percentage profit from arbitrage will be)The Treasury bill rate is 6%, and the expected return on the market portfolio is 10%. According to the capital asset pricing model: a. If the market expects a return of 11.0% from stock X, what is its beta? (Do not round intermediate calculations. Round your answer to 2 decimal places.)