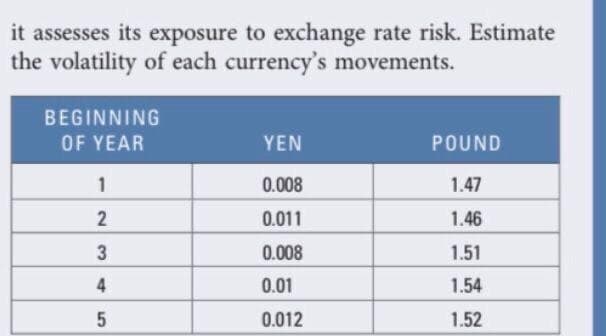

it assesses its exposure to exchange rate risk. Estimate the volatility of each currency's movements. BEGINNING OF YEAR 1 YEN 0.008 0.011 POUND 1.47 1.46

it assesses its exposure to exchange rate risk. Estimate the volatility of each currency's movements. BEGINNING OF YEAR 1 YEN 0.008 0.011 POUND 1.47 1.46

Chapter4: Exchange Rate Determination

Section: Chapter Questions

Problem 30QA

Related questions

Question

Please answer fast I give you upvote.

Transcribed Image Text:it assesses its exposure to exchange rate risk. Estimate

the volatility of each currency's movements.

BEGINNING

OF YEAR

1

2

3

4

5

YEN

0.008

0.011

0.008

0.01

0.012

POUND

1.47

1.46

1.51

1.54

1.52

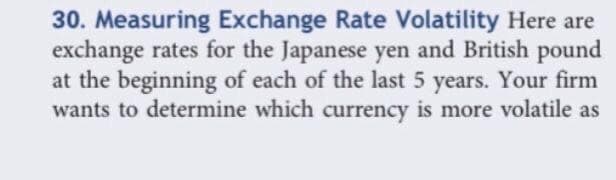

Transcribed Image Text:30. Measuring Exchange Rate Volatility Here are

exchange rates for the Japanese yen and British pound

at the beginning of each of the last 5 years. Your firm

wants to determine which currency is more volatile as

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you