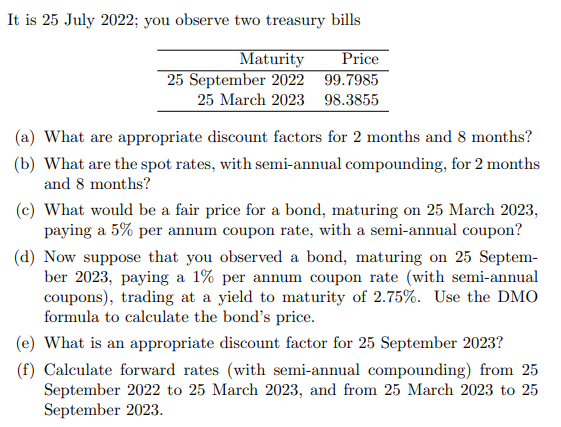

It is 25 July 2022; you observe two treasury bills Maturity Price 25 September 2022 99.7985 25 March 2023 98.3855 (a) What are appropriate discount factors for 2 months and 8 months? (b) What are the spot rates, with semi-annual compounding, for 2 months and 8 months? (c) What would be a fair price for a bond, maturing on 25 March 2023, paying a 5% per annum coupon rate, with a semi-annual coupon? (d) Now suppose that you observed a bond, maturing on 25 Septem- ber 2023, paying a 1% per annum coupon rate (with semi-annual coupons), trading at a yield to maturity of 2.75%. Use the DMO formula to calculate the bond's price. (e) What is an appropriate discount factor for 25 September 2023? (f) Calculate forward rates (with semi-annual compounding) from 25 September 2022 to 25 March 2023, and from 25 March 2023 to 25 September 2023.

It is 25 July 2022; you observe two treasury bills Maturity Price 25 September 2022 99.7985 25 March 2023 98.3855 (a) What are appropriate discount factors for 2 months and 8 months? (b) What are the spot rates, with semi-annual compounding, for 2 months and 8 months? (c) What would be a fair price for a bond, maturing on 25 March 2023, paying a 5% per annum coupon rate, with a semi-annual coupon? (d) Now suppose that you observed a bond, maturing on 25 Septem- ber 2023, paying a 1% per annum coupon rate (with semi-annual coupons), trading at a yield to maturity of 2.75%. Use the DMO formula to calculate the bond's price. (e) What is an appropriate discount factor for 25 September 2023? (f) Calculate forward rates (with semi-annual compounding) from 25 September 2022 to 25 March 2023, and from 25 March 2023 to 25 September 2023.

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 16PROB

Related questions

Question

d please

Transcribed Image Text:It is 25 July 2022; you observe two treasury bills

Maturity

25 September 2022

Price

99.7985

25 March 2023 98.3855

(a) What are appropriate discount factors for 2 months and 8 months?

(b) What are the spot rates, with semi-annual compounding, for 2 months

and 8 months?

(c) What would be a fair price for a bond, maturing on 25 March 2023,

paying a 5% per annum coupon rate, with a semi-annual coupon?

(d) Now suppose that you observed a bond, maturing on 25 Septem-

ber 2023, paying a 1% per annum coupon rate (with semi-annual

coupons), trading at a yield to maturity of 2.75%. Use the DMO

formula to calculate the bond's price.

(e) What is an appropriate discount factor for 25 September 2023?

(f) Calculate forward rates (with semi-annual compounding) from 25

September 2022 to 25 March 2023, and from 25 March 2023 to 25

September 2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning